Helping Small and Medium Businesses Unlock Growth

Get funds in 24 hours to invest in your business growth, manage your liquidity and alleviate your financial stress

A leading digital financing platform

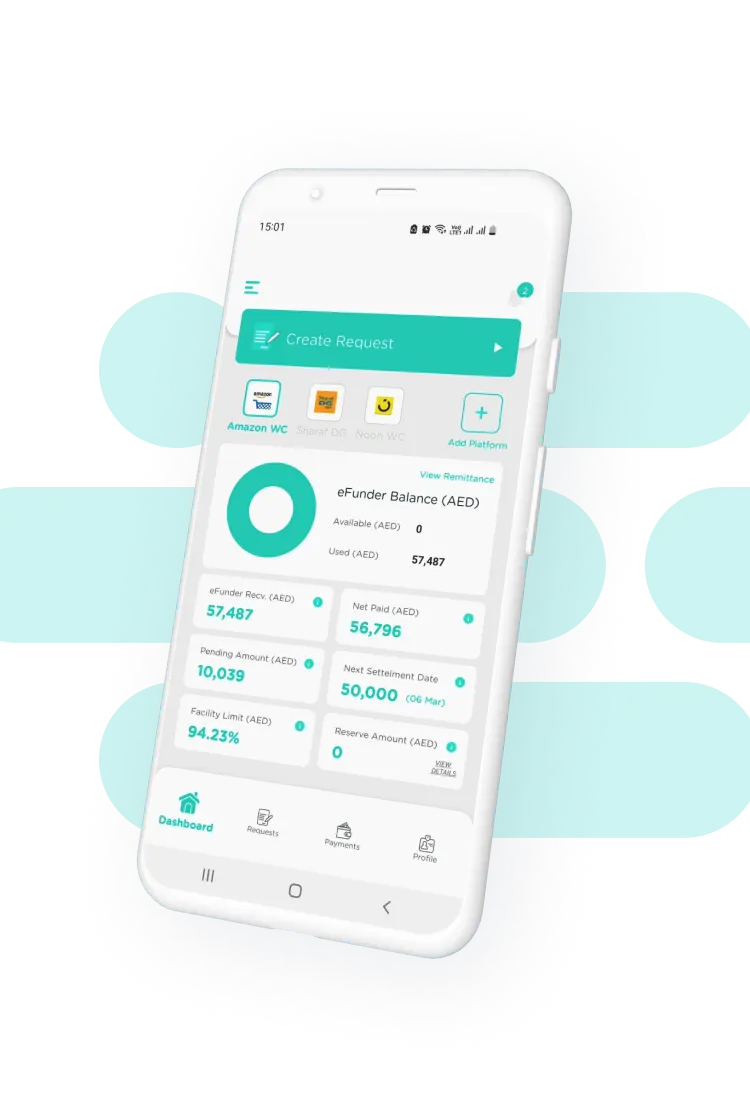

eFunder is a leading digital financing platform that provides small and medium sized businesses with instant cash and consistent cash flow against their receivables. Our secure digital financing platform takes full control of your receivables and helps boost your business growth. Use our funding solutions to boost your business.

Who is it for?

Restaurants

Fulfill your expansion plans using financing that helps stabilize your cash flows

Learn more

Pharmacies & Clinics

Never worry about paying your expenses on time while gearing up for expansion

Learn more

$56m

Cash advanced to date

2-3x

Growth by SMEs achieved with eFunder

25%

Month on month growth in advances

>3,200

Transactions to date

Scale your business with eFunder

As an entrepreneur or the owner of a small business, you might grapple with questions like how to maintain cash flow or how to grow your startup business.

That’s where eFunder’s digital financing solutions can make a big difference to your working capital requirements.

The eFunder Advantage

We provide the capital you need, exactly when you need it. Here is why eFunder is the best when you are considering your financing needs.

Instant cash

Get instant same day payments

Consistent cashflow

Obtain fast and easy access to working capital in a timely manner

Quick onboarding

Quick and hassle-free onboarding process

Transparent

Committed to be your trusted financing partner of choice

Digital Integrated Process

Process your receivable financing in a paperless manner and limited manual intervention

Flexible Funding

Flexible solutions tailored to your business needs

Quick & Hassle Free Onboarding Process

Here is how you can convert your business’s receivables into working capital financing with eFunder in a few simple steps.

-

Integrate your seller account

1 -

2

Select the invoices or the receivable amount you want an advance against

-

Receive up to 95% of value of receivables in your account within 24 hr

3

3 -

4

Get notified when your customer/client settles the invoice

-

The balance is added to your reserve and can be withdrawn immediately

5

5