Featured Articles

Blog Categories

Restaurant Owner’s Guide to New Year Preparation

With the close of the year and New Year's Eve approaching, restaurant owners should prepare for one of the biggest events in the restaurant business – the New Year's feast. At the stroke of midnight, people will be looking for an appropriate eating place to usher in the new year with delicacies, good friends, and a jubilant mood. This manual will help your restaurant fully prepare to host a memorable New Year’s Eve party. With the closing days in the year remaining, the anticipation for the New Year starts getting exciting. Restaurant owners must prepare themselves for some of the most exciting events in hospitality, especially ones with a lot of revenue-generating potential. At midnight, people will seek an attractive place to start a New Year with nice food, company, and entertainment. Below is the detailed guideline that will prepare your restaurant for memorable New Year's Eve celebrations. Develop an alluring menu Create a compelling menu for New Year’s Eve to attract your customers. Create an element of sophistication by blending your renowned dishes with innovative creations. Consider offering tasting menus, wine pairings or theme-based cocktails. Get people excited about your menu by emphasizing it on your website and many social media accounts. Come up with an appealing cuisine for New Year which will attract their target customers. Mix your famous cuisines with new masterpieces that give elegance and grandeur to the event. Think of offering tasting menus, wine matches or thematic drinks. Make sure that you emphasize your menu on your website, as well as other social media channels to create some buzz beforehand. Arrange captivating entertainment You can upgrade all your New Year’s parties with live musical performances, professional DJs or just a real-time countdown. Invest in entertainment that is relevant to your target market and also set a good mood, generally. Such entertainment will attract people to prolong their stay and experience fullness in the festivities. Marketing and promotions Start your marketing and promotions early by undertaking full marketing of your New Year’s party on different platforms. Arouse expectations using social media, email marketing, and your restaurant’s official website. Interact with your customers and encourage them to book early. It’s time to take advantage of the prospects in Internet advertising for wider coverage. You can use Mailchimp to send marketing emails to potential or recurring customers, to let them know about the event so that they mark it in their calendars. On the other hand, you can also make creative posts from Canva to help you get attracted with influencer marketing as well. Offer exclusive packages Offer unique, specialized New Year’s packages with a specific target audience in mind. They include luxury dining, champagne toast, fun party favours, and a lot more. These options are exclusive and by providing them, you will boost the revenue of each client while at the same time making your patrons feel recognized. Effective staffing and scheduling Staffing is appropriate for the smooth running of services during this busy night. It is necessary to carefully prepare the schedule in advance and give additional training to employees to be able to cope with the increased load. It could also involve the use of temporary workers to fill in for any shortfalls and take care of more tasks. To help you do the same seamlessly you can utilize tools like Restaurant 365 or Zoomshift. Promoting safety and responsible Service Safety is of utmost importance during New Year's Eve festivities, as alcohol consumption tends to be prevalent. It is imperative to prioritize safety by ensuring that your staff is knowledgeable in responsible alcohol service. Additionally, it would be wise to explore transportation alternatives such as collaborating with local taxi services or ride-sharing companies. This will guarantee that your guests reach their homes safely. Efficient reservation system For a ticketed event to welcome the New Year at a dining hall, ensure you put your ticket reservation process in order such that it is simple and efficient. Inform your guests of what to expect, including the price, inclusions, and limits. You can effectively use Touchbistro or Lightspeed to take bookings in a seamless manner. Managing your Financing Monitor your financials as New Year can get very busy for restaurants both for your physical footfalls and for online sales as families spend quality time together through family dinners or with friends without the hassle of cooking. Seek out support from restaurant financing platforms like eFunder and create your account today to maintain your cash balance without any worries as you enter the New Year. Conclusion The organization of a perfect New Year’s Eve party is not merely a ceremony marking fresh beginnings. On the contrary, it entails constructing an outstanding experience that will be imprinted in the minds of customers and keep them coming back for decades. Taking care of thoughtful preparation with interesting decorations performing efficient market, security and goodwill will turn out to be a successful evening. This will be followed by the successful year to come. Start now, getting ready to amaze on an exuberant New Year’s Day at your restaurant. About eFunder.ai If you're managing an enterprise and require financial support to boost your expansion efforts, please do not hesitate to reach out to eFunder.ai by completing our inquiry form. We help a business get access to funds that are essential for their business growth.

How to supercharge your online sales performance?

In our ever-evolving digital age, merely having an online presence is no longer enough. The success of a brand is increasingly reliant on its ability to supercharge its online sales performance. Whether you’re a startup or an established brand, optimizing your online sales strategy can significantly boost your bottom line. With tools like Stripe, Tap, Tabby, eFunder.ai, and JungleScout.com at your fingertips, here's how you can elevate your sales game. Understand your audience Knowing about your audience is the key to success because ultimately you are serving your audience and they should be satisfied with it. It’s a simple math: if you know them better, you serve them better. Segment your market Classify your audience based on demographics, preferences, behaviors, and other criteria. Tailored strategies for each segment can drive better conversion rates. Dive deep into customer behavior Gain a better understanding of your audience's preferences, buying habits, and feedback. Personalize your offerings Customize your products, services, and marketing efforts to resonate more effectively with different segments. Optimize your payment options It is important to simplify transactions. Offering multiple, user-friendly payment gateways like Stripe and Tap ensures a smoother transaction process. A simple and secure checkout experience can significantly reduce cart abandonment rates. Some impeccable tools Here are some of the most useful tools available to boost your sales performance. Stripe Stripe is a well-known company that is highly regarded in the worldwide business sector. It provides a dependable and effective payment processing platform that empowers online businesses to provide secure and user-friendly payment options. Stripe supports various payment methods, including credit cards, debit cards, ACH payments, and different international choices. Furthermore, with the same it incorporates the analytics tool known as Jungle Scout for eCommerce website owners to understand their sales reports and analyze their profit productions. Stripe provides a wide variety of financing options, which is a noteworthy feature. This specific ability allows merchants to offer their customers the choice of paying in manageable installments, thereby increasing their ability to make purchases. By giving customers more flexibility, businesses can significantly increase their conversion rates and improve the average order value, leading to better sales performance. Tap Another significant contender in the eCommerce payment processing industry is Tap. It is highly respected for delivering a smooth and safe purchasing process for customers visiting your online store. With its ability to accommodate various payment options, Tap is an outstanding selection for global eCommerce enterprises. Tabby Introducing payment solutions like "Buy Now, Pay Later" with Tabby can attract a wider audience, including those hesitant about upfront payments. This solution easily integrates into your website and checkout system, enabling customers to buy products and pay for them in convenient installments. The option of "purchase now, pay later" is especially attractive to customers who may not have the complete amount of money right away but are still enthusiastic about making a purchase. By providing this flexibility, you can draw in more customers and greatly increase your sales performance. Leverage advanced tools for market research There are some advanced tools that can help you understand the market so that you can build foolproof business strategies. Junglescout.com Before launching new products, use Junglescout.com. This platform helps brands identify trends, understand competition, and determine the potential of products in the online marketplace. eFunder.ai eFunder.ai is a leading digital financial platform specifically created to assist eCommerce enterprises that are small or medium-sized to assist them with instant cash and consistent cash flow proportionate to their receivables. Its distinguishing feature lies in its ability to offer financing and working capital solutions, supplying funds to eCommerce businesses. With this financial support, businesses can make investments in expansion and inventory without the need to wait for revenue accumulation. This helps boost the sales of eCommerce websites In addition, eFunder.ai offers advanced payment gateway functionalities, ensuring smooth integration with your online business platform. This characteristic ensures safe and effective transactions, simplifying the payment procedure and enhancing the financial liquidity of your company. Engage customers with high-quality content Customer engagement cannot be ignored in developing businesses. The more you interact with clients the more trust you build for your brand or company. Educational Webinars & Live Demos: Hosting webinars and using platforms like eFunder.ai to create and distribute valuable content can drive significant engagement. User Stories & Testimonials: Share stories of real users. Potential customers often trust peer reviews and testimonials more than brand advertisements. Email Marketing: Collaborate with platforms Mailchimp or Elastic Email that integrate seamlessly with Stripe or Tap, ensuring a cohesive retargeting strategy across all touchpoints. Conclusion To enhance your online sales performance on independent eCommerce websites, it is recommended that you incorporate sophisticated tools and functionalities like Stripe, Tap, eFunder.ai, and Tabby. These tools offer financing choices, deferred payment plans, and advanced payment gateway capabilities that cater to a wide range of customers, enhance conversion rates, and elevate the overall shopping experience. By staying at the forefront of these state-of-the-art technologies, you can guarantee the success of your eCommerce business in a progressively competitive marketplace. About eFunder.ai eFunder.ai is the most promising digital financing solutions partner for SMEs. With us, enterprises enjoy financial freedom because we get them instant working capital and can clear all payments. By partnering with us, you focus utterly on your business expansion and other essential tasks. Leave all financial hassles on us and your business can sail through the market successfully.

How to Set up a Seller’s Noon Account

The prevalence of technology has seamlessly incorporated electronic commerce into our daily routines, utilizing the internet as a gateway to virtual marketplaces. This provides us with the advantages of ease and accessibility, an extensive array of merchandise, and cost-effective pricing. A notable example exemplifying this occurrence is Noon, a recognized Middle Eastern eCommerce brand. When delving into the realm of internet selling, the first undertaking is to establish your Seller Noon account. In this instructional manual, we will act as your guide on this venture by furnishing explicit guidance on how to form your own Noon account and commence selling online. With the same, it is essential to understand that there are certain requirements for sellers to fulfil before setting up an account on Noon which are as follows: The seller’s business should be a locally owner business venture. Further, non-locals with an active local partner or a business owned or managed by a non-local family member with a local husband/wife are also allowed to register as a seller on Noon. Small to medium business owners with annual revenue of less than 350,000 AED are allowed to register. The seller should have an active trade license with any sort of ‘trade’ stated on the documents. The seller should have an active commercial bank account. If you fit in the above categories then follow the next steps to start setting up your seller account on Noon. Step-1: Open the Noon website and Register To begin, it is important to take the initial step of launching your internet browser on the appropriate partner account, click here in order to register as a seller on Noon. Upon arrival at the Noon homepage for partner registration, users will immediately notice a prominent button labeled ‘Sign Up’ or ‘Register’. Select the method that aligns with your preferences and proceed by clicking on it. Step-2: Complete Your Information Regardless of the method you select to sign up, you will be required to provide certain personal information in order to establish your Noon account. Typically, this entails supplying the following details and documents: Name Email address Phone number Trading License/Commercial Registration Residence Visa (for Non-Nationals) Emirates ID VAT Certificate or Non-VAT declaration Bank Details in the form of a cancelled cheque/bank statement/letter on the bank’s letterhead Tax Card (only required for Egypt-based sellers) Step-3: Verification To ensure the precision of your contact details, Noon may request that you authenticate your email address or phone number. In the event that you provided your email, kindly review your inbox for a verification message sent by Noon. Proceed to click on the link enclosed within the email in order to validate your email address. Alternatively, in the event that you have selected your phone number, please remain vigilant for a verification code sent via SMS. Proceed to input the received code into the designated box to complete the verification procedure. Step-4: Contact your relationship manager In order to enhance the individualization of your selling encounter, Noon would be provided a relationship manager who would guide you through your selling experience and onboarding requirements. Once, the same is done, you can start selling online with Noon and discover the world of online selling in one place. Conclusion Creating a Noon account opens the door to a myriad of retail selling options and convenience. With an interface that is easy to navigate, transactions that are secure, and an extensive customer base. By following the instructions provided in this manual, you will be on track to experiencing the advantages of online selling on Noon. Set up your account now! About eFunder.ai If you're managing an online retail enterprise and require financial support to boost your expansion efforts, please do not hesitate to reach out to eFunder.ai by completing our inquiry form. We help a business get access to funds that are essential for their business growth.

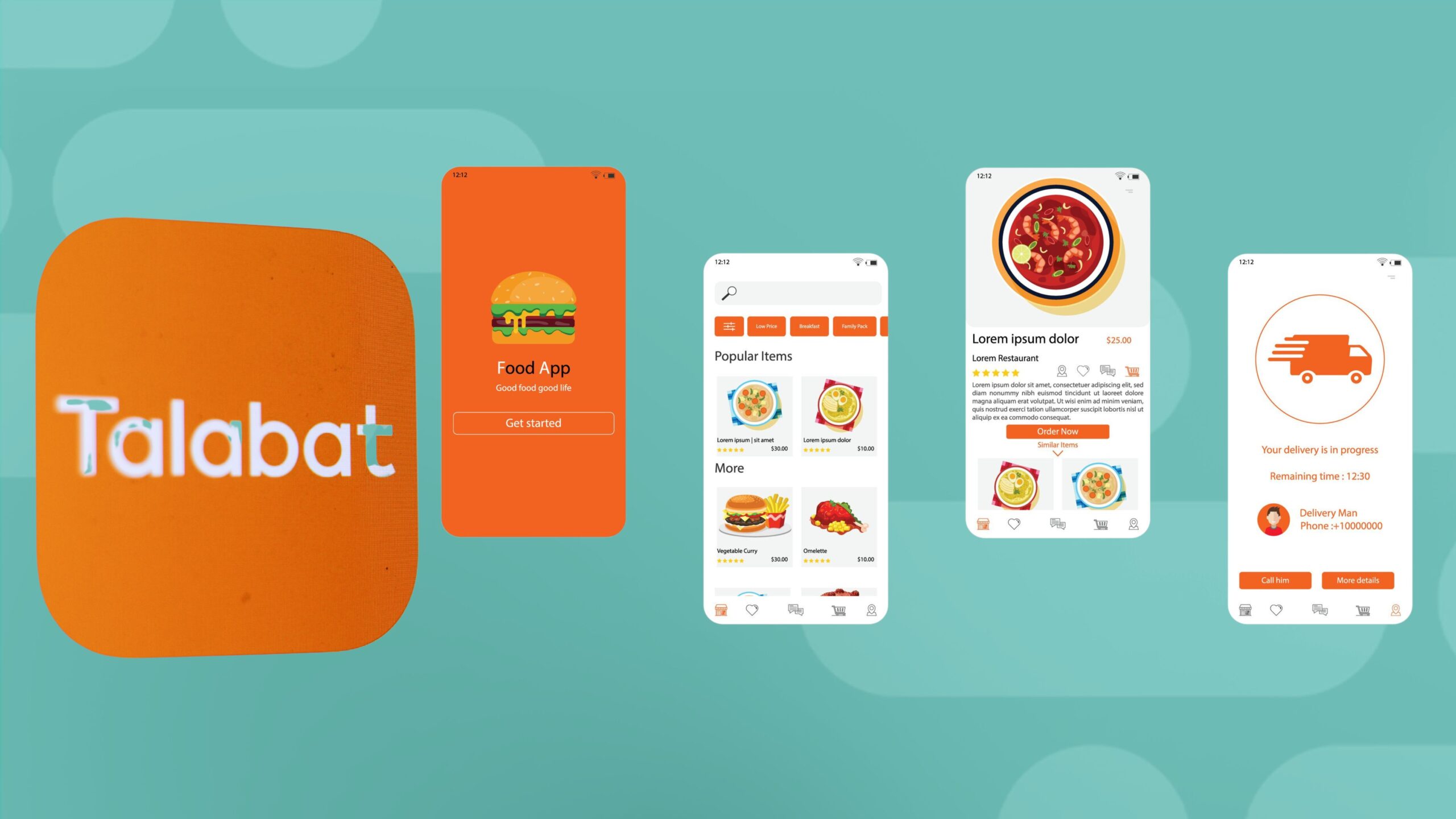

A Step-by-Step guide to starting your own restaurant on Talabat

IntroductionCommencing your culinary venture via Talabat is a thrilling pursuit that guarantees promising prospects. Talabat has established itself as the preferred avenue for food delivery and dining services, catering to a vast audience and fostering expansion opportunities.In this guide, we will go through a step-by-step process to walk you through the procedure of starting your restaurant on Talabat.Step 1: Business PlanIn order to initiate your restaurant venture, it is imperative to develop a sturdy business plan as the foundation. This comprises defining your restaurant's concept, target clientele, culinary offerings, pricing tactics, and unique selling propositions compared to competitors. A comprehensive blueprint of this nature not only brings clarity to your vision but also proves vital in securing financial assistance.Step 2: Necessary Obligations to fulfillAcquaint yourself with Talabat's criteria and benchmarks that necessitate fulfillment to enlist your restaurant on its platform. It is of utmost importance to comply with lawful and operational preconditions in order to avoid any hindrances during the initial phase. This constitutes the second step of the procedure.Step 3: Examination of CostingIn order to launch your restaurant, it is essential to carefully examine the initial costs involved in the process. These expenses include but are not limited to rent, equipment, employee salaries and benefits, licensing fees, marketing expenditures, and other associated costs. Conducting a thorough assessment of these expenses will provide you with an accurate estimation of the total funds required for starting your restaurant.Step 4: EnrolmentIn order to establish a reputable presence on Talabat, it is advised to follow below Steps of the process. The initial step involves enrolling yourself and your restaurant onto the Talabat platform and subsequently initiating the registration procedure. It is essential that all vital information regarding your restaurant such as its name, location, menu items, captivating images, and contact details are provided accurately during the registration process. Go to the Talabat Partner website https://ae.partner.talabat.com/s/ and click on the " Get Started " button. Fill out the online form with your restaurant's information, including its name, address, phone number, and website. Upload a copy of your restaurant's trade license and other required documents. Create a password for your account. Click on the "Submit" button to complete your registration.Once your registration is approved, you will be able to log in to your Talabat Partner account and start adding your food items to the platform. To do this: Go to the "Menu" section of your account and click on the "Add New Item" button. Enter the name, description, and price of your food item. Upload a photo of your food item. Select the categories that your food item belongs to. Click on the "Save" button to add your food item to the menu. You can also use your Talabat Partner account to manage your orders, track your sales, and view your analytics.Additional tips for registering on a Talabat restaurant account: • Make sure that your restaurant's information is accurate and complete.• Upload high-quality photos of your food items.• Select the right categories for your food items.• Set competitive prices for your food items.• Offer special promotions and discounts to attract customers.Once your Talabat restaurant account is up and running, you can start selling food items to customers in your area. Talabat will take a commission on each order that you receive, but this is a great way to reach a wider audience and boost your sales. Step 5: Enhance visibilityThe sixth step involves enhancing your restaurant's visibility. Allow eFunder to address your financial requirements while you focus on advertising your establishment. Avail yourself of Talabat's marketing resources and techniques to attract customers. Utilize various social media channels to engage with your audience, introduce tempting promotions, and highlight the distinctive features of your restaurant in order to stand out in a highly competitive market.Step 6: Build a customer baseIn order to build a loyal customer base and improve the reputation of your restaurant, it is crucial to prioritize delivering exceptional service as soon as orders start coming in through Talabat. Maintaining consistency in terms of quality, timely deliveries, and creating pleasant customer experiences are all key factors that contribute towards achieving this goal.Step 7: ExpandStep eight of the business plan involves repaying the borrowed funds from eFunder and broadening your restaurant's scope. It is crucial to pay back the loan promptly as it establishes your business's trustworthiness and sets the stage for potential partnerships.Step 8: Partner with eFunderStep 8 entails establishing a collaborative alliance with eFunder to obtain financing for your restaurant. They specialize in providing expeditious financial assistance by using unsettled invoices. This particular stage is crucial for small and medium enterprises seeking to mitigate the economic burden associated with delayed customer payments. To conclude, pursuing the Talabat route for your restaurant business presents considerable opportunities. Nevertheless, aspiring business owners often encounter obstacles in obtaining sufficient funds for a seamless launch. eFunder specializes in expeditiously disbursing funds against pending invoices, affording a customized solution designed to aid SMEs seeking financial backing for growth purposes. FAQ Why choose Talabat for starting a restaurant?Talabat offers a vast user base and growth potential in the food industry. How important is a business plan for launching a restaurant on Talabat?A business plan is vital for clarity and securing financial support, outlining your concept, target audience, menu, pricing, and uniqueness. What criteria must you meet to list your restaurant on Talabat?Comply with Talabat's legal and operational requirements to avoid initial obstacles. How does eFunder.ai assist restaurant owners financially on Talabat?eFunder.ai provides quick financial help using unpaid invoices, easing cash flow challenges. How can you enhance your restaurant's visibility and reputation on Talabat?Focus on marketing, utilize Talabat's resources, engage on social media, offer promotions, and ensure consistent high-quality service.About eFunder.aiIf you're managing an online retail enterprise and require financial support to boost your expansion efforts, please do not hesitate to reach out to us by completing our inquiry form. If you are aware of anyone else who could benefit from our assistance, kindly direct them to us through an email sent to sales@efunder.ai, and as a gesture of our appreciation, you will be eligible to receive an AED 500 referral reward.

Maximizing Revenue Vs Profits Vs Cashflows

Efficient management of revenue, profits, and cash flows in the business realm can be likened to a highly intricate financial choreography. It is incumbent upon entrepreneurs to comprehend the nuances, disparities, and recommended methods for handling these fundamental components. The purpose of this blog is to elucidate on the concepts of revenue, profits, and cash flows but before the same let us understand the basic nuances of the same. Understanding revenue Revenue can be viewed as the echoing sounds that reverberate throughout an enterprise. It represents the total accumulation of earnings generated by merchandise or services, hence a powerful monetary force that establishes the foundation for a synchronized performance. Nevertheless, it is important to note that revenue only reflects the inflow prior to expenses being acknowledged. Understanding profits Profits, as per standard business belief, are the remaining income derived by deducting all costs involved in the production process such as materials, salaries of employees, taxes and other miscellaneous expenses from the total revenue generated. A careful examination of this measure can offer significant understanding into your organization's distribution of resources and overall financial progress. Understanding cashflow Cash flows exhibit the transfer of funds into and out of your enterprise during a specified time frame. This encompasses revenue, expenses, financial investments, and loan reimbursements. Observing cash flows facilitates comprehension of your firm's solvency and capacity to manage financial responsibilities. Striking a balance between revenue, profits, and cash flow Achieving equilibrium among revenue, profits, and cash flows is imperative for businesses. Although augmenting revenue is a desirable objective, placing exclusive emphasis on the top line might result in disregarding expenses and impacting overall profitability. Similarly, reducing costs excessively could jeopardize the quality of products or services provided by the company. In addition, steady cash flows play a vital role in carrying out day-to-day operations and coping with unforeseen financial challenges. It is highly recommended to follow specific established protocols for your enterprise, to ensure success while striking the balance between revenue, profits, and cash flow, which are as follows: An essential step involves gaining a thorough understanding of the financial landscape through scrutinizing financial records, closely monitoring expenditures, and examining trends in cash flow on a regular basis. By undertaking this measure, you can ascertain that your business sustains its financial stability. It is advisable to formulate a comprehensive pricing plan that considers the interests of prospective clients, while also factoring in costs and ensuring lucrative profit margins. It would be prudent to remain flexible and receptive to modifying prices in response to shifting market trends. Effective cost control is an indispensable component that propels triumph in the domain of organizational management. To attain this objective, it becomes imperative to recognize the fundamental areas where expenditures can be minimized without jeopardizing the benchmarks of quality. This objective can be accomplished by implementing diverse tactics such as assessing alternatives for cutting costs, bargaining more favorable conditions with vendors, and maximizing resource utilization. Anticipate upcoming cash inflows and outflows through an analysis of previous financial records and evaluation of current industry patterns. Employing this approach enhances readiness for possible obstacles and encourages cautious judgment. Expertly handling working capital is a pivotal corporate tactic that can be achieved through various avenues, including enhancing inventory management, extending payment periods, and expediting the collection of receivables. Upholding fiscal equilibrium and augmenting profitability mandates meticulous monitoring of working capital. The achievement of financial stability is crucial for the survival of any business in the face of unexpected expenses or economic instability. Therefore, it is essential to establish a financial cushion that can be utilized during challenging times to ensure the sustainability of your enterprise. This short but informative guide has shed some light on cash flow, revenue, or profit. Whatever could be your business objective, you need to optimize your business strategies accordingly and work toward the success. About eFunder.ai eFunder.ai is dedicated to delivering digital financing solutions specifically designed to enhance and expand the operations of SMEs. Utilizing the latest in integrated technology, we ensure a smooth and user-friendly experience for our clients. At eFunder.ai, we prioritize transparency, offering platforms that are not only robust but also adaptable and scalable. For further insights into our advancements or to explore digital lending opportunities, reach out to us at sales@efunder.ai.

How Data Analytics and Transparency can Leverage Growth?

In the current age of digital advancement, enterprises that fall under the category of small and medium-sized businesses (SMBs) are exploring novel ways to grow their business and ensure its longevity. Business owners and entrepreneurs who aspire for sustainable expansion can rely on various inventive methodologies that utilize data analytics and transparency to revamp how businesses thrive, develop, and shape their future results. In this article, we will delve deeper into the aspect of how data analytics and transparency can leverage growth for various sorts of businesses. Understanding Data Analytics Data analytics is not merely a trendy term but a strategic methodology that endows enterprises with the ability to make well-informed decisions, refine operations and unveil concealed opportunities. Fundamentally, data analytics entails an organized analysis of unprocessed data to expose patterns, trends, and revelations that can facilitate strategic planning. It converts the act of decision-making into an empirical science thereby enabling businesses to react promptly and precisely to fluctuations in the market and customer conduct. The Types of Data That Foster Business Growth It is imperative for informed growth strategies that businesses utilize the copious amounts of data generated daily. Several essential types of data that facilitate business expansion are: Customer-behaviour data: Analysing customer behavior data can prove to be a beneficial factor in enhancing products and devising targeted marketing strategies. Understanding how customers engage with a business's offerings can provide valuable insights, which enable effective improvements and precise targeting efforts. Market trends data: Utilizing market trend information is imperative for businesses to adjust their offerings based on fluctuations in customer demand. This adaptability is necessary for sustaining the pertinence of your business. Operational Data: This type of data analytics is all about operational deficiencies that are streamlined in a business to attain better cost savings with optimum productivity. Financial data: Financial analytics holds immense value in guiding a business towards the allocation of budget to make prompt and prudent investment decisions while keeping in mind the potential risks of the same. Transparency and eFunder.ai: A transformative partnership By providing online sellers with real-time and transparent access to receivables data, eFunder establishes a mutually beneficial partnership that facilitates business expansion. Here are some of the reasons why eFunder.ai fosters transparency with data analytics: Trusted financing partner: As an esteemed financial institution, eFunder.ai has gained the recognition of a dependable financing partner that prioritizes transparency and informed decision-making. It has shown its commitment to different organizations by fostering long-lasting connections with clients. Paperless efficiency: eFunder's as a financial institution optimizes its operational efficiency with the implementation of paperless procedures and the incorporation of data analytics in its financial operations. Prompt onboarding: The eFunder.ai platform boasts a beneficial onboarding system that expeditiously facilitates a swift incorporation process. This well-organized system deducts all unnecessary bureaucratic procedures that allow businesses to promptly get on their journey toward expansion. Empowering business owners to scale with confidence Small business owners and individuals who undertake entrepreneurial ventures are frequently confronted with obstacles when it comes to sustaining steady progress. Nevertheless, eFunder.ai emerges as a significant strategic partnership by harnessing cutting-edge data analytics and transparent methodologies which enable the facilitation of expandable business operations. Instant cash: The expeditious provision of funds through same-day payments can provide prompt financial resources, addressing concerns regarding the availability of cash and maintaining operational stability. Consistent cash flow: Sustained liquidity is a vital necessity for enterprises to ensure stable cash flow and capitalize on expansion prospects without any hindrance. Such an objective can be accomplished by utilizing eFunder. Harnessing the power of data and transparency for growth The goal of eFunder.ai is based upon the convergence of transparency and data analytics to empower businesses. Through the provision of immediate access to cash and reliable cash flow linked with receivables, eFunder.ai aids growth-oriented initiatives by transforming challenges into opportunities. About eFunder eFunder.ai, an eminent digital financing platform exclusively committed to providing SMBs with quick access to funds and maintaining a stable cash flow by securing their receivables. The noteworthy factor behind eFunder's triumph is its impeccable integration of data analytics and transparency, two fundamental aspects that have the capability of bringing a revolution in how businesses expand and succeed in today's cut-throat environment. If you are an eCommerce business seeking financial support to boost your growth, we invite you to fill out our form and contact us at sales@efunder.ai. Know others who could benefit from our services? Refer them to us, and as a token of our gratitude, you'll receive an AED 500 bonus for each successful referral.

What are the requirements to get funding from eFunder.ai?

In the swiftly evolving domain of corporate finance, novel and inventive techniques are surfacing to support entrepreneurs in acquiring the financial backing they require to prosper. Amongst the notable players in this field is eFunder.ai. However, what are the key prerequisites for securing funding from this avant-garde platform? This piece delves into the essential criteria that enterprises must satisfy to gain access to funding from eFunder.ai, and analyses how this platform is remodeling the terrain of business financing. Getting to know eFunder.ai eFunder.ai has positioned itself as a pioneer in the intersection of finance and technology, leveraging data-backed analysis to facilitate prompt and effortless funding for enterprises. Such an approach diverges considerably from the traditional funding avenues since eFunder.ai places a premium on dispensing quick and hassle-free capital that facilitates business growth. Essential prerequisites for approval of funding Enterprises intending to obtain financial funding options from eFunder.ai are obliged to satisfy particular prerequisites that align with the platform's dedication to fostering expansion and mitigating hazards. The fundamental criteria which businesses must fulfill to secure funding from eFunder.ai are as follows: Company background: eFunder.ai provides monetary aid exclusively to companies that display robust and consistent performance in their online business activities for a period of three to six months, depending upon the nature of their customer base. This criterion ensures the continuous and dependable generation of online revenue by the company. Authorization: To carry out an exhaustive assessment of a company's financial condition, eFunder.ai requires authorization to retrieve pertinent data related to the purchasing networks that are being scrutinized for funding. This data aids in assessing the firm's credit standing as well as its ability to repay any borrowed funds. Early payment agreement: Businesses that meet the criteria must consent to the conditions set forth in eFunder.ai's Early Payment Agreement, which outlines the responsibilities and liabilities of all parties involved in the financing transaction. Digital banking account formation: It is expected that organizations establish a distinct digital banking account to accept present and upcoming payments from Internet-based platforms. This plan simplifies repayment efforts while ensuring the accurate allocation of funds. Security authentication: In order to improve security measures, eFunder.ai has instituted a mandatory security authentication procedure. The aim is to minimize potential risks associated with funding arrangements. KYC and AML requirements: As with all reputable financial institutions, eFunder.ai also necessitates Know Your Customer (KYC) and Anti-Money Laundering (AML) documentation be provided as evidence of business legitimacy and prevention against potential financial misconduct. The mandatory process involves items such as Trade Licenses, Tax Registration certificates, and identification proofs for relevant enterprises. It serves as an assurance of trustworthiness while guarding against any possible unlawful behavior. Benefits of eFunder.ai eFunder.ai with it brings various advantages that contribute to the growth of an organization, the following are some of the benefits it offers: The technology-driven approach of eFunder.ai expedites the approval as well as application process in a seamless manner making it easier for businesses to get funds quickly. There are various repayment options to choose for the repayment of the amount, these options are moreover adaptable to a business’s cash flow. This feature makes it manageable for businesses to return the money timely and also sustain themselves in the long run. eFunder.ai has a reliable cash flow system where businesses can invest in growing initiatives such as launching marketing campaigns, expanding operations, developing new products, etc. About eFunder.ai Securing funds with a secure process is every growing business’s dream and eFunder.ai with its prompt funding programs is providing an efficient and innovative solution to them in order to thrive in a competitive market. By leveraging the benefits of the platform businesses can unlock various possibilities of exponential growth and prosperity. We provide financial support to eCommerce and SME businesses aiming to accelerate growth. If this applies to you, please fill out our form to connect with us. If you know others who might find our services useful, feel free to refer them to us at sales@efunder.ai. For each successful referral, we'll thank you with an AED 500 bonus. Should you have any questions or need assistance, please feel free to contact us at any time. We're always available to provide you with the necessary information and support.

Steps on How to Apply for an eCommerce Trade License in UAE

In the ever-expanding realm of digital business, eCommerce has become an integral part of the global economic fabric. The United Arab Emirates (UAE) has positioned itself as a welcoming hub for eCommerce entrepreneurs, but to successfully navigate the business landscape, one needs to understand the process of securing an eCommerce Trade License. In this guide, we break down the steps you need to take to apply for your eCommerce Trade License in the UAE. Why You Need an eCommerce Trade License in UAE To conduct business legally in the UAE, a Trade License is a must-have. This license signifies that your business operations have been reviewed and approved by the relevant authorities. For eCommerce businesses, a specialized license known as the eCommerce Trade License is required. This ensures you comply with all legalities, giving your business credibility and trustworthiness in the eyes of customers and partners. Understanding Different Jurisdictions Before beginning your application, it's crucial to understand the two main jurisdictions in UAE: Mainland and Free Zone. The difference between them lies in the types of activities allowed, ownership rules, and the nature of the market they cater to. Determining the most suitable jurisdiction for your business is a critical first step. Step 1: Choose Your Business Activity The first official step in the process is choosing your business activity. For an eCommerce business, this typically falls under "Retail Sale via Mail Order Houses or Internet." However, depending on your specific services or products, the activity could be classified differently. Step 2: Select a Legal Structure The legal structure of your business affects many aspects of your operation, from the number of shareholders to liability and tax obligations. In the UAE, eCommerce businesses can be structured as a Sole Proprietorship, a Limited Liability Company (LLC), or various other types of partnerships. Step 3: Pick a Trade Name A unique and relevant trade name gives your business a distinct identity. The UAE has specific rules for trade names, so ensure your chosen name complies with these guidelines. Step 4: Apply for Initial Approval Once you've decided on the above elements, you can apply for initial approval from the Department of Economic Development (DED) or the relevant Free Zone Authority. This is essentially an application to ensure your business meets all necessary criteria. Step 5: Prepare Required Documents The UAE authorities require several documents for license applications, such as passport copies, business plan, application form, and more. It's vital to prepare and check these carefully to avoid any potential delays or rejections. a) Passport Copies You'll need to provide copies of the passports of all business owners and shareholders. This serves as an identity verification measure, ensuring all relevant parties are documented and accounted for in the process. b) Visa Copies If the shareholders or owners are residents of the UAE, copies of their visas are also required. This allows the authorities to verify their residency status. c) NOC from the Sponsor If a UAE resident is sponsoring your eCommerce business, you'll need to provide a No Objection Certificate (NOC) from the sponsor. This document signifies the sponsor's agreement to support your business venture. d) Application Form A completed application form is crucial. It's imperative to fill out all required fields accurately to avoid unnecessary delays or complications. e) Business Plan The business plan outlines your proposed business's strategic, operational, and financial aspects. It demonstrates your preparedness and your business's viability. f) Initial Approval Receipt After obtaining the initial approval for your business activities, you will receive an initial approval receipt. This document shows that your proposed business activity has been vetted and accepted. g) Trade Name Reservation Certificate Once you've selected and registered your trade name, you'll receive a Trade Name Reservation Certificate. This certificate shows that the chosen name is unique and reserved for your business. h) Lease Agreement If you're leasing a physical location (even a small office for administrative tasks), you'll need to provide the lease agreement. The authorities use this to confirm the business address. i) Memorandum and Articles of Association (MOA and AOA) These are legal documents outlining your business's operating rules. The Memorandum of Association (MOA) and Articles of Association (AOA) are particularly relevant if you're setting up an LLC or other partnership business. Step 6: Pay Fees and Obtain License After getting initial approval and preparing all documents, you'll need to pay the necessary fees. Once these are settled, your eCommerce Trade License will be issued. The fees vary depending on jurisdiction, legal structure, and other factors. Step 7: Open a Bank Account With your license in hand, the next step is to open a corporate bank account. This is necessary for managing your business finances and transactions. The requirements for opening an account differ from bank to bank. Step 8: Get Necessary eCommerce Permits Although you have your eCommerce Trade License, there might be other permits and approvals required, depending on your specific business activity. Ensure you've got all necessary permissions to avoid any legal complications. Step 9: Launch Your eCommerce Business Finally, with all the licenses, permits, and accounts in place, you're ready to launch your eCommerce business. It's time to start selling and making a name for your brand in the vibrant UAE market. Setting up an eCommerce business in the UAE involves several detailed steps, but with the right guidance and preparation, it's an achievable goal. The eCommerce Trade License is the cornerstone of your operation, signifying your business's compliance with UAE laws and enhancing your reputation among consumers and partners. By following this step-by-step guide, you can navigate the process with confidence, setting the foundation for your eCommerce venture's success in the UAE's dynamic digital marketplace. Should you require any more details, don't hesitate to contact us at sales@efunder.ai. We offer financial support for eCommerce businesses looking to enhance their growth, so if this is you, we encourage you to complete our form and get in touch. If you happen to know others who might benefit from our services, please refer them to us by emailing sales@efunder.ai. As a sign of our appreciation, you'll receive an AED 500 bonus for every successful referral.

Freight Cost Recovery: Top Tips and Techniques for SMEs Success

Freight cost recovery can be defined as a method of recovering the costs incurred by a carrier or a shipper for transporting goods from one destination to another. For SMEs, freight cost recovery plays a significant role because the increased freight rates or prices are observed due to several factors such as fuel surcharges, security fees, congestion charges, demand fluctuations, and environmental regulations. It is possible for carriers and shippers to optimize operations and reduce their expenses by implementing effective freight cost recovery strategies and, therefore, ultimately increasing their profits. Some of the common freight cost recovery methods include negotiating contracts, auditing invoices, using technology, and outsourcing services. Nevertheless, here we present concrete tips and techniques for SEM’s success through freight cost recovery. Analyze your freight costs and drivers of expenses Freight costs are significant for many businesses that ship goods across different locations. However, not all freight costs are fixed or unavoidable. By analyzing your freight costs and identifying the main drivers of expenses, you can find ways to reduce them and save money. Some of the factors that affect freight costs are: The distance and destination of the shipment The weight and dimensions of the cargo The mode of transportation (air, sea, rail, or road) The fuel surcharges and taxes The service level and delivery time By collecting and analyzing data on these factors, you can identify the areas where you can optimize your freight costs. Negotiate better rates with your carriers Negotiation always works at any scale. There is no harm in searching for a couple of more freight service providers and getting quotations. You can then compare and negotiate the freight cost by stating others’ prices and services. This shall get you the best deal and a way for freight cost recovery. Consolidate your shipments One way to optimize your logistics and save on freight costs is to consolidate your shipments or use less-than-truckload (LTL) services. This means that you can combine multiple smaller shipments into one larger shipment, or share the truck space with other shippers who have similar destinations. By consolidating your shipments, you can bring down the number of trips and the amount of fuel needed which, in turn, results in less transportation costs and reduced carbon emissions. Optimize your packaging and loading Optimizing your packaging and loading can reduce freight costs by minimizing the space and weight of your cargo. This can lower the fuel consumption and emissions of the transport vehicle and the number of trips required to deliver the goods. A more efficient packaging and loading strategy can also improve the safety and quality of your cargo, reducing the risk of damage or loss. Choose the most suitable mode of transportation Choosing the most suitable mode of transportation for each shipment based on the urgency and value of the goods can reduce freight costs by optimizing the trade-off between speed and expense. It is worth noting that different modes of transportation possess pros and cons in the form of costs, capacity, reliability, and environmental impact. Shippers can save money and improve customer satisfaction by selecting the best mode for each shipment. Plan ahead and avoid rush orders One of the best ways to reduce freight costs is to plan ahead and avoid rush orders or expedited services that incur higher fees. Planning ahead allows you to optimize shipping routes, consolidate shipments, and negotiate better rates with your carriers. You can also avoid paying extra for urgent deliveries, fuel surcharges, and other unexpected expenses. Planning ahead can help you save time, money, and resources in your freight operations. Reduce freight costs, earn more profit Reducing freight costs is a surefire way to shoot your SME’s profits. Freight costs take a major chunk of your overall budget, but then you can save money on each shipment by reducing the above-mentioned techniques and increasing your profit margin. About eFunder.ai Are you a restaurant looking for financing to accelerate your growth? Reach out to us by filling out the form. You can also refer someone who might need our services and avail of AED 500 as a referral bonus.

Helping Small and Medium Businesses Unlock Growth

Experience financial freedom through our unrivaled cash flow funding solutions.