Blog Categories

SMEs Preparing for the UAE High Season: Get Funded with eFunder

The UAE high season is just around the corner, and businesses across the country are gearing up for a period of intense activity. With increased demand and opportunities, SMEs need to be well-prepared to capitalize on the season's potential. Key Challenges for SMEs During the High Season: Increased Demand: The surge in demand can strain resources and lead to operational challenges. Inventory Management: Ensuring sufficient stock levels to meet increased demand is crucial. Cash Flow Management: Managing cash flow during peak periods can be demanding. How eFunder Can Help eFunder offers a range of financing solutions to help SMEs navigate the challenges of the high season. By providing working capital loans and other financial products, eFunder empowers businesses to: Scale Operations: Invest in additional resources and expand their reach. Manage Cash Flow: Smooth out cash flow fluctuations and meet financial obligations. Seize Opportunities: Capitalize on the increased demand and market opportunities. Don't let financial constraints hinder your business's growth. Get funded with eFunder and make the most of the UAE high season.

Funding Checklist for SMEs in the UAE

Navigating the financial landscape can be challenging for small and medium enterprises (SMEs) in the UAE. To ensure your business secures the necessary funding, it’s essential to have a comprehensive checklist. This guide will help you understand the various SME funding options available, enabling you to make informed decisions for your business growth. Understanding SME Funding Options SME Business Funding Explore various SME funding sources, including banks, financial institutions, and government programs designed to support small businesses. SME Loans for Startups Many financial institutions offer tailored SME loans for startups, providing essential capital to help you establish your business and navigate early challenges. Business Loans for SMEs These loans can be used for various purposes, including expanding operations, purchasing equipment, or managing cash flow. Assess your needs to choose the right loan amount and terms. Working Capital Advance A working capital advance can provide immediate cash flow relief. This option is particularly useful for managing day-to-day operations and unforeseen expenses. Vendor Advance Consider vendor advance options to improve your inventory management. This funding allows you to pay suppliers upfront, securing better pricing and terms while maintaining stock levels. Advance Payment to Vendor Offering advance payments to vendors can strengthen supplier relationships and potentially lead to discounts, enhancing your overall profitability. Key Considerations for Securing Funding Develop a Solid Business Plan A well-structured business plan is crucial for attracting SME funding. Clearly outline your business goals, market analysis, and financial projections to demonstrate viability. Understand Your Financial Needs Determine how much funding you require and for what purpose. This clarity will help you communicate effectively with lenders and identify the best financing options. Review Eligibility Criteria Different funding options have specific eligibility requirements. Ensure you meet these criteria to streamline your application process. Prepare Necessary Documentation Gather essential documents such as financial statements, tax returns, and business licenses. Having these ready will expedite the funding application process. Securing SME funding in the UAE requires careful planning and a clear understanding of your financial needs. By following this funding checklist, you can explore various options, from SME loans for startups to working capital advances, and choose the right financing solutions for your business. With the right funding in place, your SME can thrive and achieve its growth potential.

How to take advantage of the winter peak season in the UAE

As winter approaches, the food and beverage (F&B) industry faces both challenges and opportunities. To thrive this season, here are key strategies for maximizing performance in your restaurant. Streamline Restaurant Inventory Management Winter brings fluctuating demand, making effective restaurant inventory management crucial. Accurately forecast sales trends to minimize waste and ensure you have enough stock. Implement a solid food inventory management system to track ingredients and manage vendor relationships, taking advantage of vendor advances for bulk purchases. Optimize Cash Flow with Financing Options Increased expenses during winter can strain cash flow. Consider financing for restaurants to navigate these challenges. A working capital advance provides instant cash for your restaurant business, enabling you to invest in marketing, hire seasonal staff, or upgrade equipment without compromising your budget. Focus on Customer Experience Create memorable dining experiences this winter with seasonal menus that highlight comfort foods. Promote special events to draw in crowds, and ensure your staff is trained to provide exceptional service. Positive customer experiences lead to repeat business and valuable referrals. Leverage Technology for Efficiency Investing in technology can streamline restaurant inventory management. Use integrated POS systems for real-time sales data to adjust orders and reduce waste. Analytics tools can also help guide menu planning based on customer preferences and seasonal trends. Winter presents a unique opportunity for growth in the F&B industry. By focusing on effective management, optimizing inventory, and utilizing financing options like working capital advances, you can maximize your restaurant’s performance. At eFunder, we’re here to support your success with tailored financial solutions for SMEs, take advantage of the peak season and thrive with eFunder. Contact - sales@efunder.ai

How to Improve Your Cash Flow Management as a Small Business Owner in the UAE

Cash flow is the lifeblood of any business, especially for small businesses operating in the UAE. Effective cash flow management is essential for ensuring your business's financial health, sustainability, and growth. By understanding and implementing sound cash flow strategies, you can optimize your operations, meet your financial obligations, and seize new opportunities. Key Strategies for Improved Cash Flow Management Create and Stick to a Budget: Develop a detailed budget that outlines your income, expenses, and cash flow projections. Regularly monitor your budget and make adjustments as needed to ensure you stay on track. Track Your Cash Flow: Keep accurate records of your income and expenses. Use accounting software or spreadsheets to track your cash inflows and outflows, allowing you to identify areas where you can improve your cash flow. Collect Payments Promptly: Implement efficient invoicing and payment collection procedures. Send invoices promptly and follow up with customers to ensure timely payments. Consider offering discounts for early payments to incentivize customers to pay on time. Manage Your Inventory Effectively: Avoid overstocking inventory, as excess inventory can tie up your cash. Implement inventory management systems to optimize stock levels and minimize unnecessary costs. Negotiate with Suppliers: Explore opportunities to negotiate better payment terms with your suppliers. Consider asking for longer payment terms or discounts for early payments. Explore Financing Options: If you're facing cash flow challenges, consider exploring financing options eFunder's services, such as invoice financing, working capital advances, and vendor advance programs. These options can provide the necessary funds to bridge cash flow gaps and support your business growth. Monitor Your Accounts Receivable: Keep a close eye on your accounts receivable to ensure that customers are paying their invoices on time. If you have outstanding invoices, take proactive steps to collect the payments. Reduce Unnecessary Expenses: Review your expenses regularly and identify areas where you can cut costs. Consider negotiating better deals with suppliers, reducing waste, or finding more efficient ways to operate your business. By implementing these strategies, you can significantly improve your cash flow management and enhance the overall financial health of your small business in the UAE. Remember, effective cash flow management is an ongoing process that requires consistent attention and proactive measures.

Building a Strong Financial Foundation: Essential Tips for Your Business

Laying the Groundwork for Success A solid financial foundation is crucial for the long-term success of any business. Whether you're just starting out or looking to expand your operations, understanding your sources of business finance and effectively managing your business financing is essential. Key Tips for Building a Strong Financial Foundation: Create a Comprehensive Business Plan A well-crafted business plan outlines your financial goals, projections, and strategies. This document serves as a roadmap for securing lending for business and making informed financial decisions. It should include detailed financial projections, market analysis, and a clear explanation of your business model. Understand Your Financing Needs Assess your business's specific financial requirements. Determine whether you need business funding for capital expenditures (e.g., purchasing equipment or property), working capital (e.g., covering day-to-day expenses), or debt repayment. This understanding will help you identify the most suitable financing options. Explore Different Funding Options: Explore various sources of funding available to businesses, including: Lending for Business: Consider business lending options such as bank loans, lines of credit, and SBA loans. These options involve borrowing money and repaying it with interest. Equity Financing: Explore equity financing through venture capital, angel investors, or crowdfunding. In this case, you sell ownership stakes in your business in exchange for capital. Alternative Financing: Consider alternative sources like invoice factoring, merchant cash advances, or equipment financing. These options offer unique financing structures to meet specific business needs. Manage Your Cash Flow: Effective cash flow management is essential for a healthy business. Monitor your income and expenses closely, and implement strategies to improve your cash flow. This includes creating a cash flow forecast, managing accounts receivable and payable efficiently, and minimizing unnecessary expenses. Build a Credit History: A strong credit history can improve your chances of securing lending for business at favorable terms. Pay your bills on time and avoid excessive debt. Building a positive credit history takes time, so start early and maintain good credit practices. Seek Professional Advice: Consult with financial experts, such as accountants or financial advisors, to get personalized guidance on your business financing needs. They can help you understand your financial situation, develop a financial strategy, and navigate the complexities of business lending and other funding options. By following these tips, you can build a solid financial foundation for your business. Understanding your sources of business finance and effectively managing your business financing will help you achieve your goals and navigate the challenges of the business landscape. Remember, a strong financial foundation is essential for long-term success and growth.

Scaling Up with Confidence: How eFunder Supports Growth-Stage Businesses

The transition from a successful startup to a thriving established business is an exciting yet challenging phase. Growth-stage businesses often face unique hurdles as they scale operations. Inventory management, cash flow management, and marketing expansion are just a few examples. This is where eFunder steps in, providing the digital financing solutions you need to scale up with confidence. Challenges Faced by Growing Businesses: Inventory Management: Meeting increased demand often requires larger inventory purchases. However, managing cash flow for inventory management systems and bulk stock can be tricky. Cash Flow Management: Rapid growth can strain your cash flow. Managing cash flow effectively becomes crucial to meet operational expenses and seize new opportunities. Marketing Expansion: Reaching a wider audience often involves digital marketing campaigns and strategic investments. But these require upfront costs that can disrupt cash flow. eFunder's Solutions for Scaling Up: eFunder offers a variety of financing solutions specifically designed to address the needs of growth-stage businesses: Vendor Advance: This solution helps you secure funding to pay for inventory upfront, allowing you to take advantage of bulk purchase discounts and meet customer demand without straining your cash flow. Learn More - https://efunder.ai/vendor-advance/ Working Capital Advance: This flexible solution provides immediate access to a portion of your future receivables, giving you the cash flow management boost needed to cover operational expenses, invest in marketing initiatives, and fuel your growth strategy. Learn more -https://efunder.ai/working-capital/ Also Read - Cash Flow Freedom: How eFunder Empowers Businesses to Take Control of their Finances Investing in Your Growth Journey By partnering with eFunder, you gain access to the financial tools and resources needed to overcome the hurdles of scaling up. Our digital financing platform empowers you to make strategic investments in inventory, marketing, and other key areas, propelling your business towards its full potential. Focus on the Future With eFunder by your side, you can navigate the growth stage with confidence, focusing on achieving your long-term vision and building a successful future for your business. Also Read - The Future of Digital Financing in the UAE: Trends and Opportunities

Cash Flow Freedom: How eFunder Empowers Businesses to Take Control of their Finances

Imagine a world where you're not constantly chasing invoices, worrying about late payments, or scrambling to cover unexpected expenses. This, my friends, is the dream of cash flow freedom. It's a state where businesses have a clear picture of their cash flow, the lifeblood of any organization. With cash flow freedom, businesses can invest in growth, navigate challenges, and ultimately achieve financial stability. What is Cash Flow Freedom? Cash flow freedom is the ability to manage your cash flow effectively, ensuring a steady stream of incoming cash to cover ongoing expenses and fuel future endeavors. It's more than just having enough money; it's about cash flow management that empowers you to make informed financial decisions, build a buffer against unforeseen circumstances, and ultimately, unlock your business's full potential. Also Read - Unlocking Cashflows with eFunder: A Comprehensive Guide to Invoice Financing for SMEs Common Obstacles to Business Financial Freedom The road to cash flow freedom isn't always smooth. Many businesses face common challenges that disrupt their financial equilibrium: Late Payments: Customers who pay late can leave a significant gap in your cash flow. This can be especially problematic for businesses with tight margins. Seasonality : Some industries experience periods of high and low activity. During slow times, cash flow can dwindle, hindering your ability to meet obligations. Unexpected Expenses : Equipment breakdowns, repairs, or emergencies can throw your budget off track, impacting your cash flow. Taking Charge: The Importance of Cash Flow Management Effective cash flow management is the key to overcoming these obstacles and achieving cash flow freedom. Here's how it empowers your business: Improved Decision-Making : Having a clear understanding of your cash flow allows you to make informed financial decisions, like managing operating cash flow effectively and strategically allocating resources. Enhanced Stability: Cash flow freedom acts as a financial safety net, protecting your business from unexpected disruptions and ensuring you can meet your financial commitments. Growth Opportunities: With a steady stream of available cash, you can invest in new equipment, explore new markets, and seize opportunities that drive business growth. Empowering Businesses: eFunder's Role in Cash Flow Management At eFunder, we understand the critical role cash flow management plays in business success. We provide a comprehensive range of solutions and strategies tailored to empower Marketplace Seller, Vendor, Restaurant Business, Pharmacy or Clinic. Our tailored services help you take control of your finances and achieve the freedom and flexibility of robust cash flow management. Also Read - How to Get Quick Access To Steady Cash Flow With eFunder.ai Strategic Solutions: How eFunder Helps Businesses Manage Cash Flow eFunder provides innovative financial tools and services to help you manage your cash flow effectively: Invoice Financing : Unlock the value tied up in your outstanding invoices and receive immediate cash, boosting your cash flow for operational needs. Accounts Receivable Financing : Gain access to a line of credit based on your outstanding invoices, improving your cash flow flexibility and ability to manage ongoing expenses. Cash Flow Forecasting Assistance : Our team can help you develop accurate cash flow forecasts, allowing you to anticipate future needs and make informed financial decisions. Also Read: What are the requirements to get funding from eFunder.ai? Embracing Financial Freedom: Partnering with eFunder for Success Cash flow freedom is not a luxury; it's a necessity for business success. By partnering with eFunder, you gain access to the tools, cash flow funding options, and expert guidance you need to take control of your finances and achieve your business goals.Explore eFunder's Cash Flow Solutions today and take the first step towards cash flow freedom and financial empowerment for your business

Maximizing Revenue Vs Profits Vs Cashflows

Efficient management of revenue, profits, and cash flows in the business realm can be likened to a highly intricate financial choreography. It is incumbent upon entrepreneurs to comprehend the nuances, disparities, and recommended methods for handling these fundamental components. The purpose of this blog is to elucidate on the concepts of revenue, profits, and cash flows but before the same let us understand the basic nuances of the same. Understanding revenue Revenue can be viewed as the echoing sounds that reverberate throughout an enterprise. It represents the total accumulation of earnings generated by merchandise or services, hence a powerful monetary force that establishes the foundation for a synchronized performance. Nevertheless, it is important to note that revenue only reflects the inflow prior to expenses being acknowledged. Understanding profits Profits, as per standard business belief, are the remaining income derived by deducting all costs involved in the production process such as materials, salaries of employees, taxes and other miscellaneous expenses from the total revenue generated. A careful examination of this measure can offer significant understanding into your organization's distribution of resources and overall financial progress. Understanding cashflow Cash flows exhibit the transfer of funds into and out of your enterprise during a specified time frame. This encompasses revenue, expenses, financial investments, and loan reimbursements. Observing cash flows facilitates comprehension of your firm's solvency and capacity to manage financial responsibilities. Striking a balance between revenue, profits, and cash flow Achieving equilibrium among revenue, profits, and cash flows is imperative for businesses. Although augmenting revenue is a desirable objective, placing exclusive emphasis on the top line might result in disregarding expenses and impacting overall profitability. Similarly, reducing costs excessively could jeopardize the quality of products or services provided by the company. In addition, steady cash flows play a vital role in carrying out day-to-day operations and coping with unforeseen financial challenges. It is highly recommended to follow specific established protocols for your enterprise, to ensure success while striking the balance between revenue, profits, and cash flow, which are as follows: An essential step involves gaining a thorough understanding of the financial landscape through scrutinizing financial records, closely monitoring expenditures, and examining trends in cash flow on a regular basis. By undertaking this measure, you can ascertain that your business sustains its financial stability. It is advisable to formulate a comprehensive pricing plan that considers the interests of prospective clients, while also factoring in costs and ensuring lucrative profit margins. It would be prudent to remain flexible and receptive to modifying prices in response to shifting market trends. Effective cost control is an indispensable component that propels triumph in the domain of organizational management. To attain this objective, it becomes imperative to recognize the fundamental areas where expenditures can be minimized without jeopardizing the benchmarks of quality. This objective can be accomplished by implementing diverse tactics such as assessing alternatives for cutting costs, bargaining more favorable conditions with vendors, and maximizing resource utilization. Anticipate upcoming cash inflows and outflows through an analysis of previous financial records and evaluation of current industry patterns. Employing this approach enhances readiness for possible obstacles and encourages cautious judgment. Expertly handling working capital is a pivotal corporate tactic that can be achieved through various avenues, including enhancing inventory management, extending payment periods, and expediting the collection of receivables. Upholding fiscal equilibrium and augmenting profitability mandates meticulous monitoring of working capital. The achievement of financial stability is crucial for the survival of any business in the face of unexpected expenses or economic instability. Therefore, it is essential to establish a financial cushion that can be utilized during challenging times to ensure the sustainability of your enterprise. This short but informative guide has shed some light on cash flow, revenue, or profit. Whatever could be your business objective, you need to optimize your business strategies accordingly and work toward the success. About eFunder.ai eFunder.ai is dedicated to delivering digital financing solutions specifically designed to enhance and expand the operations of SMEs. Utilizing the latest in integrated technology, we ensure a smooth and user-friendly experience for our clients. At eFunder.ai, we prioritize transparency, offering platforms that are not only robust but also adaptable and scalable. For further insights into our advancements or to explore digital lending opportunities, reach out to us at sales@efunder.ai.

Eliminate Gaps in the Working Capital Cycles With eFunder.ai

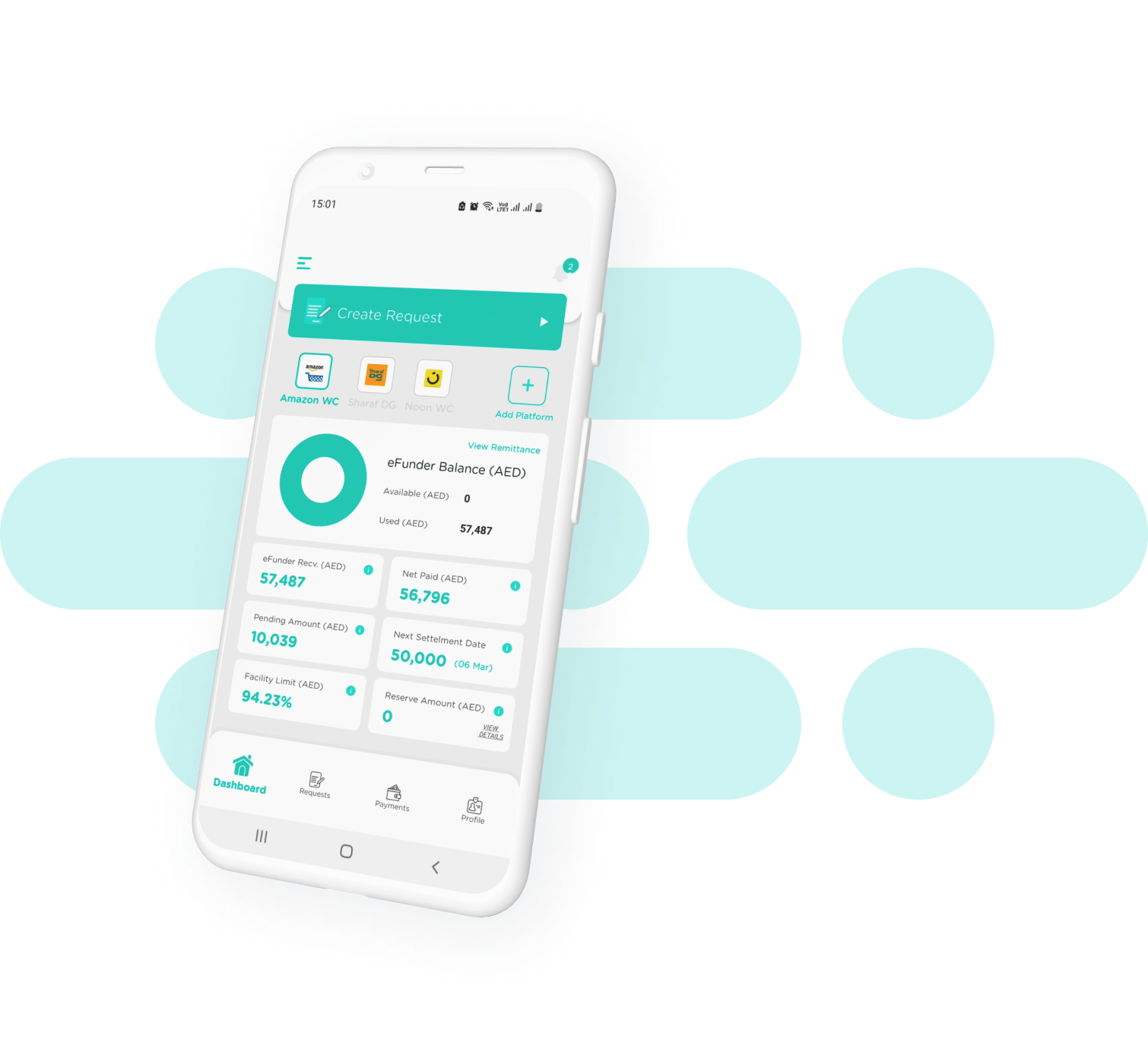

Small and medium-sized businesses (SMEs) are the lifeblood of the modern economy, accounting for the majority of all firms and jobs worldwide. However, SMEs are generally plagued by difficulties with financing as they lack access to savings and credit. This threatens the growth of SMEs as well as the economy. Digital finance, as a new financial industry, has emerged as a game changer in the SME space by filling the funding gaps and carving out increased revenues. Considered a deep integration of technology and financial services, digital finance helps to alleviate financing constraints on firms as well as to lift them out of financial distress, thus helping to increase their willingness to innovate. As a start-up entrepreneur or a small business owner, you may be struggling with maintaining cash flow to manage the daily operational costs. It is time you took advantage of eFunder’s digital working capital financing solutions to boost your business expansion plans. Benefit from instant cash and consistent cash flows to meet your expenses and fuel growth plans by converting your business’s receivables into working capital financing with eFunder.ai. Scale your business with eFunder.ai At eFunder.ai, we aim to support SMEs with their financial burdens via digital working capital financing to eliminate the gaps in working capital cycles. As UAE’s leading digital financing platform, we provide SMEs from various industries and segments with instant and consistent cash flow against their receivables. With eFunder.ai, you no longer need to worry about customers or vendors clearing pending payments. By taking complete control of your receivables, our secure digital financing platform helps boost your business growth and allows you to reach your full potential using our smart working capital solutions: Smoothen supply chain operations by supporting your business growth with quick access to working capital Be assured of sufficient funding with access to convenient cash flow within 24 hours of your onboarding Lock in the next 30 days of sales upfront and make stress-free and timely payment decisions Withdraw the money as soon as recoveries are made without waiting to complete past repayments Benefit From Our Working Capital Advance Solutions Recent research says that the widespread adoption and utilisation of digital financing solutions could increase the GDPs of all emerging economies by 6 %. This additional GDP will likewise assist to create up to 95 million new jobs across all the sectors of the economy. Widely used digital funding and working capital financing has the power to transform the economic prospects of billions of people and inject new dynamism into the eCommerce businesses that today are held back for lack of credit. There is no doubt that unexpected expenses, increased liabilities, and cash flow disruptions can stagnate or even derail your growth. Not to mention the working capital challenges that are par for the course with any business, the financing options for eCommerce organisations are far fewer than their brick-and-mortar counterparts. Rather than waiting for a generation for incomes to arise, eCommerce business funding provides the organisation with the opportunity to rapidly unlock the economic opportunity and accelerate development. We have digital financing for online sellers and SMEs of all industries who work within the digital procurement ecosystems. We do not provide loans, require complex paperwork or charge you exorbitant interest rates. All our processing fees, terms and conditions, and payment structures are clearly stated at the beginning itself with zero ambiguity. With our working capital solutions, you can enjoy hassle-free access to a steady cash flow to accelerate your business goals. You can be sure to receive the funds you need within 24 hours of your simple and easy onboarding process. This can be very useful to entrepreneurs from various segments within the eCommerce world: Marketplace Sellers We offer flexible digital financing for marketplace sellers and empower them to take their business to the next level with quick cash flow solutions. With eFunder.ai, you can have more control over your outstanding and future receivables and thus grow your business operations accordingly. Restaurants Meet growing customer demands and expansion opportunities to take your restaurant to new levels with eFunder.ai. With our instant cash facilities, you can run your daily operations, invest in new locations and restock inventory without any stress. Onboard with eFunder.ai to ensure a steady influx of funds within 24 hours of signing up and witness your business soar high. Pharmacies & Clinics eFunder.ai Working Capital Solutions can help the healthcare industry unlock a steady cash flow to meet deadlines, commitments, and expansion dreams. Medical facilities need to wait as much as 90 days to receive the funds from insurance carriers. Within 24 hours of onboarding, eFunder.ai can help acquire claims and hold them until they mature and are paid by the insurance carrier after 90 days. The eFunder.ai Advantage With advantages like full transparency of charges and transaction details, quick fund transfer within 24 hours, a dedicated support team and a substantial advance of up to 95% of your expected receivables; we are providing online business funding for SMEs to address working capital and cash flow challenges, and changing the way SMEs can grow. To experience unlimited financial freedom with our unrivalled cash flow funding solutions, get in touch with us today!

Helping Small and Medium Businesses Unlock Growth

Experience financial freedom through our unrivaled cash flow funding solutions.