Featured Articles

Blog Categories

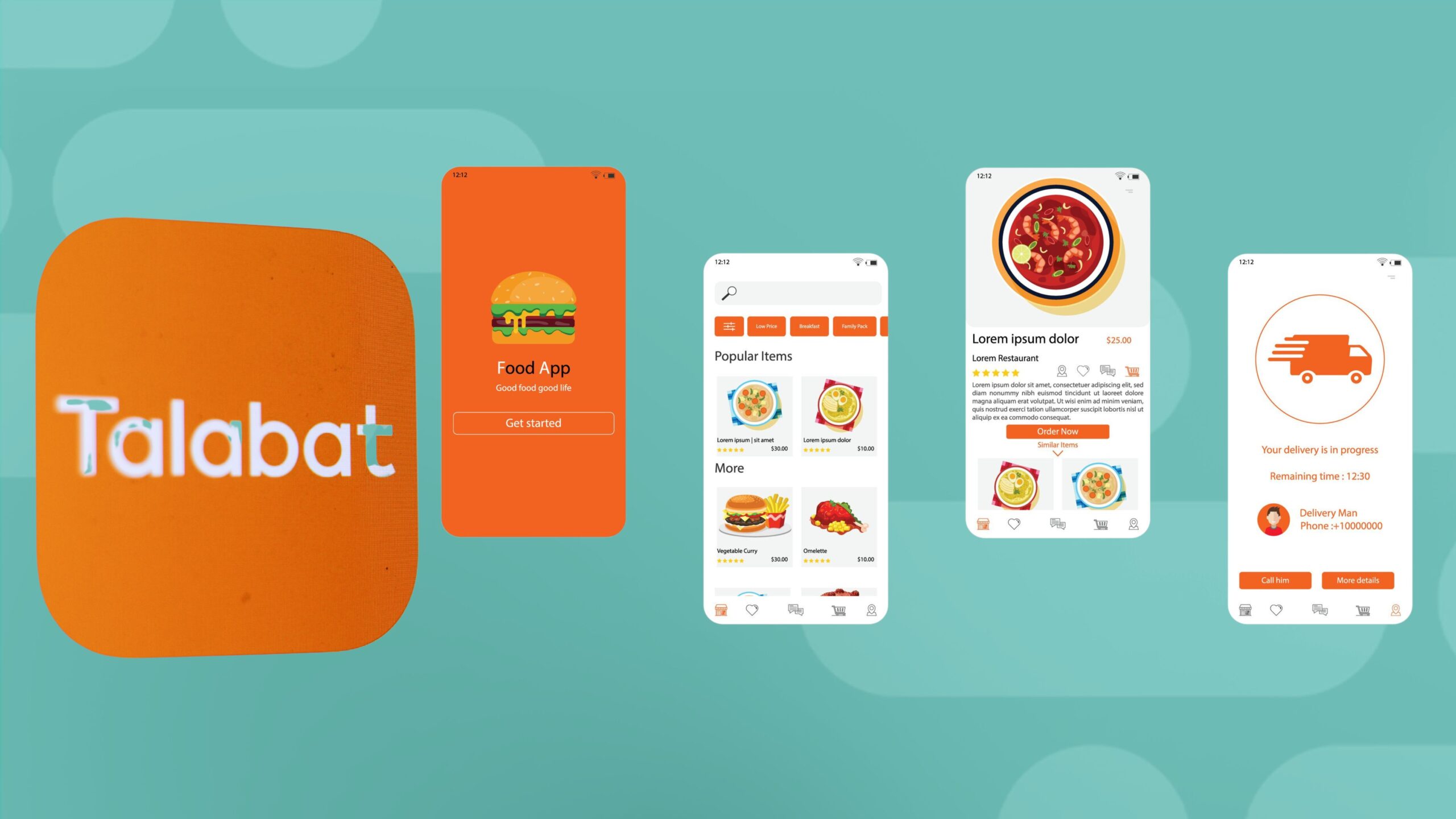

A Step-by-Step guide to starting your own restaurant on Talabat

IntroductionCommencing your culinary venture via Talabat is a thrilling pursuit that guarantees promising prospects. Talabat has established itself as the preferred avenue for food delivery and dining services, catering to a vast audience and fostering expansion opportunities.In this guide, we will go through a step-by-step process to walk you through the procedure of starting your restaurant on Talabat.Step 1: Business PlanIn order to initiate your restaurant venture, it is imperative to develop a sturdy business plan as the foundation. This comprises defining your restaurant's concept, target clientele, culinary offerings, pricing tactics, and unique selling propositions compared to competitors. A comprehensive blueprint of this nature not only brings clarity to your vision but also proves vital in securing financial assistance.Step 2: Necessary Obligations to fulfillAcquaint yourself with Talabat's criteria and benchmarks that necessitate fulfillment to enlist your restaurant on its platform. It is of utmost importance to comply with lawful and operational preconditions in order to avoid any hindrances during the initial phase. This constitutes the second step of the procedure.Step 3: Examination of CostingIn order to launch your restaurant, it is essential to carefully examine the initial costs involved in the process. These expenses include but are not limited to rent, equipment, employee salaries and benefits, licensing fees, marketing expenditures, and other associated costs. Conducting a thorough assessment of these expenses will provide you with an accurate estimation of the total funds required for starting your restaurant.Step 4: EnrolmentIn order to establish a reputable presence on Talabat, it is advised to follow below Steps of the process. The initial step involves enrolling yourself and your restaurant onto the Talabat platform and subsequently initiating the registration procedure. It is essential that all vital information regarding your restaurant such as its name, location, menu items, captivating images, and contact details are provided accurately during the registration process. Go to the Talabat Partner website https://ae.partner.talabat.com/s/ and click on the " Get Started " button. Fill out the online form with your restaurant's information, including its name, address, phone number, and website. Upload a copy of your restaurant's trade license and other required documents. Create a password for your account. Click on the "Submit" button to complete your registration.Once your registration is approved, you will be able to log in to your Talabat Partner account and start adding your food items to the platform. To do this: Go to the "Menu" section of your account and click on the "Add New Item" button. Enter the name, description, and price of your food item. Upload a photo of your food item. Select the categories that your food item belongs to. Click on the "Save" button to add your food item to the menu. You can also use your Talabat Partner account to manage your orders, track your sales, and view your analytics.Additional tips for registering on a Talabat restaurant account: • Make sure that your restaurant's information is accurate and complete.• Upload high-quality photos of your food items.• Select the right categories for your food items.• Set competitive prices for your food items.• Offer special promotions and discounts to attract customers.Once your Talabat restaurant account is up and running, you can start selling food items to customers in your area. Talabat will take a commission on each order that you receive, but this is a great way to reach a wider audience and boost your sales. Step 5: Enhance visibilityThe sixth step involves enhancing your restaurant's visibility. Allow eFunder to address your financial requirements while you focus on advertising your establishment. Avail yourself of Talabat's marketing resources and techniques to attract customers. Utilize various social media channels to engage with your audience, introduce tempting promotions, and highlight the distinctive features of your restaurant in order to stand out in a highly competitive market.Step 6: Build a customer baseIn order to build a loyal customer base and improve the reputation of your restaurant, it is crucial to prioritize delivering exceptional service as soon as orders start coming in through Talabat. Maintaining consistency in terms of quality, timely deliveries, and creating pleasant customer experiences are all key factors that contribute towards achieving this goal.Step 7: ExpandStep eight of the business plan involves repaying the borrowed funds from eFunder and broadening your restaurant's scope. It is crucial to pay back the loan promptly as it establishes your business's trustworthiness and sets the stage for potential partnerships.Step 8: Partner with eFunderStep 8 entails establishing a collaborative alliance with eFunder to obtain financing for your restaurant. They specialize in providing expeditious financial assistance by using unsettled invoices. This particular stage is crucial for small and medium enterprises seeking to mitigate the economic burden associated with delayed customer payments. To conclude, pursuing the Talabat route for your restaurant business presents considerable opportunities. Nevertheless, aspiring business owners often encounter obstacles in obtaining sufficient funds for a seamless launch. eFunder specializes in expeditiously disbursing funds against pending invoices, affording a customized solution designed to aid SMEs seeking financial backing for growth purposes. FAQ Why choose Talabat for starting a restaurant?Talabat offers a vast user base and growth potential in the food industry. How important is a business plan for launching a restaurant on Talabat?A business plan is vital for clarity and securing financial support, outlining your concept, target audience, menu, pricing, and uniqueness. What criteria must you meet to list your restaurant on Talabat?Comply with Talabat's legal and operational requirements to avoid initial obstacles. How does eFunder.ai assist restaurant owners financially on Talabat?eFunder.ai provides quick financial help using unpaid invoices, easing cash flow challenges. How can you enhance your restaurant's visibility and reputation on Talabat?Focus on marketing, utilize Talabat's resources, engage on social media, offer promotions, and ensure consistent high-quality service.About eFunder.aiIf you're managing an online retail enterprise and require financial support to boost your expansion efforts, please do not hesitate to reach out to us by completing our inquiry form. If you are aware of anyone else who could benefit from our assistance, kindly direct them to us through an email sent to sales@efunder.ai, and as a gesture of our appreciation, you will be eligible to receive an AED 500 referral reward.

Steps on How to Apply for an eCommerce Trade License in UAE

In the ever-expanding realm of digital business, eCommerce has become an integral part of the global economic fabric. The United Arab Emirates (UAE) has positioned itself as a welcoming hub for eCommerce entrepreneurs, but to successfully navigate the business landscape, one needs to understand the process of securing an eCommerce Trade License. In this guide, we break down the steps you need to take to apply for your eCommerce Trade License in the UAE. Why You Need an eCommerce Trade License in UAE To conduct business legally in the UAE, a Trade License is a must-have. This license signifies that your business operations have been reviewed and approved by the relevant authorities. For eCommerce businesses, a specialized license known as the eCommerce Trade License is required. This ensures you comply with all legalities, giving your business credibility and trustworthiness in the eyes of customers and partners. Understanding Different Jurisdictions Before beginning your application, it's crucial to understand the two main jurisdictions in UAE: Mainland and Free Zone. The difference between them lies in the types of activities allowed, ownership rules, and the nature of the market they cater to. Determining the most suitable jurisdiction for your business is a critical first step. Step 1: Choose Your Business Activity The first official step in the process is choosing your business activity. For an eCommerce business, this typically falls under "Retail Sale via Mail Order Houses or Internet." However, depending on your specific services or products, the activity could be classified differently. Step 2: Select a Legal Structure The legal structure of your business affects many aspects of your operation, from the number of shareholders to liability and tax obligations. In the UAE, eCommerce businesses can be structured as a Sole Proprietorship, a Limited Liability Company (LLC), or various other types of partnerships. Step 3: Pick a Trade Name A unique and relevant trade name gives your business a distinct identity. The UAE has specific rules for trade names, so ensure your chosen name complies with these guidelines. Step 4: Apply for Initial Approval Once you've decided on the above elements, you can apply for initial approval from the Department of Economic Development (DED) or the relevant Free Zone Authority. This is essentially an application to ensure your business meets all necessary criteria. Step 5: Prepare Required Documents The UAE authorities require several documents for license applications, such as passport copies, business plan, application form, and more. It's vital to prepare and check these carefully to avoid any potential delays or rejections. a) Passport Copies You'll need to provide copies of the passports of all business owners and shareholders. This serves as an identity verification measure, ensuring all relevant parties are documented and accounted for in the process. b) Visa Copies If the shareholders or owners are residents of the UAE, copies of their visas are also required. This allows the authorities to verify their residency status. c) NOC from the Sponsor If a UAE resident is sponsoring your eCommerce business, you'll need to provide a No Objection Certificate (NOC) from the sponsor. This document signifies the sponsor's agreement to support your business venture. d) Application Form A completed application form is crucial. It's imperative to fill out all required fields accurately to avoid unnecessary delays or complications. e) Business Plan The business plan outlines your proposed business's strategic, operational, and financial aspects. It demonstrates your preparedness and your business's viability. f) Initial Approval Receipt After obtaining the initial approval for your business activities, you will receive an initial approval receipt. This document shows that your proposed business activity has been vetted and accepted. g) Trade Name Reservation Certificate Once you've selected and registered your trade name, you'll receive a Trade Name Reservation Certificate. This certificate shows that the chosen name is unique and reserved for your business. h) Lease Agreement If you're leasing a physical location (even a small office for administrative tasks), you'll need to provide the lease agreement. The authorities use this to confirm the business address. i) Memorandum and Articles of Association (MOA and AOA) These are legal documents outlining your business's operating rules. The Memorandum of Association (MOA) and Articles of Association (AOA) are particularly relevant if you're setting up an LLC or other partnership business. Step 6: Pay Fees and Obtain License After getting initial approval and preparing all documents, you'll need to pay the necessary fees. Once these are settled, your eCommerce Trade License will be issued. The fees vary depending on jurisdiction, legal structure, and other factors. Step 7: Open a Bank Account With your license in hand, the next step is to open a corporate bank account. This is necessary for managing your business finances and transactions. The requirements for opening an account differ from bank to bank. Step 8: Get Necessary eCommerce Permits Although you have your eCommerce Trade License, there might be other permits and approvals required, depending on your specific business activity. Ensure you've got all necessary permissions to avoid any legal complications. Step 9: Launch Your eCommerce Business Finally, with all the licenses, permits, and accounts in place, you're ready to launch your eCommerce business. It's time to start selling and making a name for your brand in the vibrant UAE market. Setting up an eCommerce business in the UAE involves several detailed steps, but with the right guidance and preparation, it's an achievable goal. The eCommerce Trade License is the cornerstone of your operation, signifying your business's compliance with UAE laws and enhancing your reputation among consumers and partners. By following this step-by-step guide, you can navigate the process with confidence, setting the foundation for your eCommerce venture's success in the UAE's dynamic digital marketplace. Should you require any more details, don't hesitate to contact us at sales@efunder.ai. We offer financial support for eCommerce businesses looking to enhance their growth, so if this is you, we encourage you to complete our form and get in touch. If you happen to know others who might benefit from our services, please refer them to us by emailing sales@efunder.ai. As a sign of our appreciation, you'll receive an AED 500 bonus for every successful referral.

A Beginner’s Guide to Starting Your Own Amazon Store

Are you ready to tap into the thriving eCommerce market in the UAE? Starting your own business on Amazon UAE is easier than you think. This beginner's guide will walk you through the essential steps to establish and grow your own successful Amazon store in the UAE. Step 1: Register as a Seller To get started, visit sellercentral.amazon.ae and click on "Register Now." This will take you to the registration page where you can create your account and provide the necessary information. Fill in your business details and choose a selling plan that suits your needs. Step 2: Product Listing Once your account is set up, it's time to list your products on Amazon. Take clear product photos that showcase your items in the best possible light. High-quality images are essential for attracting customers and increasing sales. Additionally, write compelling product descriptions that highlight the unique features and benefits of your products. Engaging descriptions will capture the attention of potential buyers and persuade them to make a purchase. Step 3: Set Pricing and Shipping Determining the right pricing strategy is crucial for the success of your Amazon store. Research the market and analyze your competitors to set competitive prices. Use the Amazon seller dashboard to monitor the prices of similar products and adjust yours accordingly. Additionally, choose your shipping options wisely. Decide whether you will handle shipping yourself or opt for Amazon's Fulfillment by Amazon (FBA) service, which takes care of storage, packaging, and shipping for you. Step 4: Promote Your Products Standing out from the competition is essential in the e-commerce world. To promote your products effectively, leverage social media platforms, sponsored ads, and other marketing tools. Build a strong online presence by creating engaging content and interacting with your target audience. Collaborate with influencers in your niche to reach a wider audience and generate more sales. Utilize Amazon's advertising features to increase visibility and drive traffic to your product listings. Step 5: Fulfill Orders and Provide Customer Service Once the orders start rolling in, it's crucial to deliver excellent customer service. Ensure fast and reliable shipping to provide a positive buying experience for your customers. Promptly respond to customer inquiries and reviews, addressing any concerns or issues they may have. Positive feedback and satisfied customers will contribute to the growth and success of your Amazon store. Step 6: Grow Your Business To sustain and expand your business, it's essential to continuously monitor your sales performance and customer feedback. Analyze data and identify trends to make informed decisions. Adjust your pricing, marketing strategies, and product offerings based on customer preferences and market demands. Consider expanding your product catalog to cater to a broader customer base. The key to long-term success is adapting and evolving with the ever-changing e-commerce landscape. You can also leverage financing from eFunder.ai and execute your growth plans without any financial stress – apply with eFunder.ai here (form). Starting your own Amazon store in the UAE offers tremendous opportunities in the thriving eCommerce market. By following the steps outlined in this beginner's guide, you can establish a strong foundation and set yourself up for success. Register as a seller, list your products, set competitive prices, promote effectively, provide excellent customer service, and continuously grow your business. Take advantage of the vast potential offered by Amazon UAE and begin your entrepreneurial journey today. Visit sellercentral.amazon.ae to begin your journey and tap into the vast potential of the e-commerce market in the UAE. Frequently Asked Questions (FAQs) Do I need a trade license to sell on Amazon UAE? Yes, to register as a seller on Amazon UAE, you will need a valid trade license issued by the relevant authorities in the UAE. You may get started as an individual account but as per UAE laws, you would require to obtain an e-Commerce license. Can I sell internationally on Amazon UAE? Yes, you can expand your reach and sell internationally through Amazon's Global Selling program. It allows you to list and sell your products in multiple countries. What are the fees associated with selling on Amazon UAE? Amazon charges various fees, including referral fees, closing fees, and subscription fees based on the selling plan you choose. It's important to understand the fee structure before setting your prices. Is it necessary to use Amazon's Fulfillment by Amazon (FBA) service? No, it's not mandatory to use FBA. You have the option to fulfill orders yourself, but FBA can simplify logistics and provide a better customer experience. How can I optimize my product listings for better visibility? Optimize your product listings by including relevant keywords in the title, bullet points, and description. Use high-quality images and provide accurate product information to improve search rankings. If you need further information, please feel free to reach out to sales@efunder.ai About eFunder.ai If you're operating an eCommerce business and seeking financial assistance to fuel your growth, don't hesitate to get in touch with us by filling out our form. If you know of anyone else who could use our services, refer them to us by sending an email to sales@efunder.ai and you can receive an AED 500 referral bonus as a token of our gratitude.

Can Chat GPT help eCommerce brands change their Business Growth?

Amid the global pandemic, the eCommerce industry has grown significantly and is now playing a much more significant role in our daily routine lives. However, eCommerce firms face intense competition in serving quality and seamless customer experiences. Therefore, developing unique strategies to stand out in the crowded industry is critical. Here's where Chat GPT steps in as a linguistic model. It has the power to revolutionize how eCommerce companies can engage with consumers and expand their businesses by offering superior value and experience to customers. What is Chat GPT? Open AI introduced Chat GPT as a chatbot in November 2022. Generative Pre-trained Transformer is referred to as GPT. Built on top of the GPT-3.5 family of big language models from Open AI, Chat GPT is enhanced using supervised and reinforcement learning approaches. It is a potent, cutting-edge tool for creating a language that chatbots and other conversational AI applications may use. Additionally, according to Open AI, GPT-4 is successful at several "meta-learning" tasks. Several GPT-3 and similar descendants have been created. How can Chat GPT help eCommerce Brands? Personalized client experience The capacity of Chat GPT to offer individualized customer experiences is one of its main benefits. Chat GPT can produce unique responses and recommendations by examining client data and behavior, giving each customer a unique experience. This can aid e-commerce businesses in strengthening their bond with customers and fostering greater client loyalty. Enhanced client services Successful eCommerce depends on providing excellent customer service. Virtual assistants and chatbots that can respond to consumer questions and complaints in real time can be built with Chat GPT. This saves time and resources and guarantees that clients get responses right away, which leads to a high degree of customer satisfaction. Enhanced product discovery Chat GPT can also improve product discovery by making tailored recommendations to clients. Chat GPT can produce recommendations based on a customer's interests, previous purchases, and browsing history by examining user data and behavior. Higher revenues and better client retention may result from this. Automation of sales and marketing tasks. Additionally, Chat GPT can be used to automate sales and marketing procedures. It can be used, for instance, to develop chatbots for lead generation, customer acquisition, upselling, and cross-selling. This guarantees that the sales process is streamlined and effective while saving time and money. Conclusion Finally, Chat GPT can change how eCommerce companies engage with their clients and expand their business. Chat GPT can help eCommerce firms stand out in the competitive market and increase customer satisfaction and retention through the provision of personalized customer experiences and the automation of marketing and sales operations. As technology develops, we may anticipate seeing ever more creative applications of Chat GPT in the eCommerce industry. Seamlessly Grow Your Business with eFunder's Hassle-Free Financing Interface. eFunder.ai offers digital financing options to small and medium-sized businesses (SMEs) to support their expansion and scalability. To provide its consumers with a fluid and trouble-free interface, eFunder.ai uses the most recent integrated technologies. The business takes great satisfaction in its dependable, adaptable, and scalable solutions that give its users complete transparency. For SMEs looking to boost their business goals and achieve financial freedom, eFunder.ai offers uniquely crafted funding solutions that prioritize prudent financial planning. The company's cash flow funding solution is particularly noteworthy for its ability to provide unrivaled financial independence to its users. Suppose you would like to understand eFunder's funding solutions better and explore how they can positively impact your business. In that case, we encourage you to contact eFunder.ai using the provided email address. Our financial experts will be more than happy to assist you in identifying the funding options that align with your business objectives and financial goals. We are committed to providing our clients with tailored and practical financing solutions designed to enhance their business growth and scalability. Don't hesitate to contact us for a seamless and hassle-free experience as you take your business to the next level.

Navigating the most significant economic hurdles in eCommerce: strategies for brand survival

The eCommerce industry's rapid growth has transformed how businesses operate and communicate with their customers. With the increasing shift towards online shopping, eCommerce businesses have experienced unprecedented growth in recent years. However, this growth has also brought some significant economic hurdles that businesses must navigate to remain competitive. These hurdles can include challenges such as cash flow management, inventory optimization, cost of customer acquisition, fraud prevention, and returns management. To secure their position in the intensely competitive eCommerce industry, businesses must devise solutions to surmount the financial obstacles encountered in their operations. To explore this matter in greater depth, let us delve into the specific challenges businesses face and the strategies they can employ to address these concerns. Cash flow management is one of the biggest obstacles in eCommerce. For eCommerce businesses, cash flow management can be a major challenge. One of the primary issues such companies face is long payment cycles, which can adversely impact their financial liquidity. This can be particularly problematic for small businesses that need more resources. E-commerce companies can employ various strategies to mitigate the risks associated with long payment cycles. For example, offering early payment discounts or negotiating shorter payment terms with suppliers can help businesses to manage their cash flow more effectively. By adopting such measures, eCommerce companies can reduce their exposure to financial risks and maintain a healthy cash flow. Inventory management is another financial challenge for eCommerce. Effective inventory management is a critical aspect of financial management in eCommerce businesses. Companies must balance the cost of maintaining inventory against the risk of stockouts, which can impact customer satisfaction and ultimately lead to a loss of revenue. One way to address this challenge is by leveraging a reliable inventory management system to help businesses optimize their inventory levels and minimize the costs associated with overstocking or stockouts. E-commerce businesses can further reduce their inventory holding costs by adopting a just-in-time inventory strategy. This approach involves ordering inventory only when needed for production or sale, thereby minimizing the amount of capital tied up in inventory. By implementing these inventory management strategies, eCommerce companies can streamline operations, reduce expenses, and enhance their overall financial health. The cost of customer acquisition is another major challenge that eCommerce businesses must face. Online businesses face fierce competition nowadays, and gaining new clients may be expensive. Businesses can lower their customer acquisition costs by using retargeting advertisements, referral marketing initiatives, social media and email marketing campaigns, and referral marketing programs to connect with potential consumers. In eCommerce, fraud is also a huge financial risk; therefore, businesses must take precautions to guard against it. Businesses that operate online are susceptible to fraud, which can lead to large financial losses. Companies can use several procedures to reduce this risk, including two-factor authentication, fraud detection software, and manual order scrutiny. The login process becomes more secure with two-factor authentication, which lowers the possibility of unauthorized access. Businesses can identify suspicious activity and stop fraudulent transactions from happening with the aid of fraud detection software. To avoid processing fraudulent purchases, manual order inspection entails reviewing orders for warning signs like odd shipping or billing addresses. eCommerce companies can protect themselves from potential financial losses caused by fraudulent actions by putting these precautions in place. Finally, handling the costs incurred by returns can be a significant obstacle for eCommerce enterprises. Customers expect a hassle-free returns process, but processing returns can be costly for businesses. Implementing a returns policy that balances customer satisfaction with cost management is essential for eCommerce businesses. In conclusion, navigating the economic obstacles of eCommerce can be challenging, but businesses can adopt strategies to overcome these challenges and ensure their survival in the market. Effective cash flow management, inventory optimization, customer acquisition cost reduction, fraud prevention, and returns management policies can help eCommerce businesses stay competitive and thrive in the ever-evolving online market. Tailored financing solutions for SMEs: Explore eFunder's cutting-edge lending services eFunder.ai strives to provide customized financing solutions specifically designed to help small and medium enterprises (SMEs) expand and expand. By leveraging the latest integrated technology, eFunder.ai delivers customers a seamless and hassle-free lending experience. In addition to this, eFunder.ai takes great pride in ensuring absolute transparency across all its platforms, which are built to be robust, flexible, and scalable. To gain further insight into these innovative lending solutions and to secure financing through digital lending methods, interested parties may contact eFunder.ai via their official website or email sales@efunder.ai.

The Ultimate Guide to Amazon Financing Options

As an e-commerce seller, you might know that highs and lows in sales are unpredictable yet recurring and can affect the cash flow of your business operations. The same holds true for Amazon retail business as well. Having instant and reliable access to funding options can help you address the cash flow issues and grow your Amazon business. However, finding the right amazon financing options is far from easy. Banks and traditional financial institutions have strict criteria that may favour well-established enterprises or brick-and-mortar stores, but it could hold the fast-moving online businesses back from their growth. Why Do Amazon Sellers Need Funding? Whether you are running a store on Amazon, noon or any other eCommerce platform, you might need capital for various purposes. Some of the common reasons include the following: Business Growth: As your sales start growing, so does your need for an ever-increasing amount of working capital to cater to customer demands. This involves investing more into stocking up inventory, storage costs, allocating marketing budgets and hiring new staff if required. Paradoxically, you will experience trouble with your cash flow only after your Amazon business starts growing. Many business owners find securing funding to manage and scale their operations challenging compared to starting a business from scratch. Hence, working with a reputed and reliable funding solutions provider is essential for Amazon vendors and sellers. Daily Expenses: Running an e-commerce store may seem like an inexpensive endeavour, but nothing could be further from the truth. There are various costs associated with running an online business, which include maintaining Amazon vendor central, digital marketing, 3rd-party platform payments, transactional charges, security measures, shipping, returns and refunds and more. Even when your Amazon store is profitable and thriving, you need financial assistance to manage everyday expenses. That is why it is important to partner with a reliable financial service provider to get amazon working capital financing solutions to meet its short-term obligations. Why Do Amazon Businesses Struggle To Get A Working Capital Loan? Securing a business loan from banks is difficult for small and medium-sized enterprises, especially online businesses. Outdated legacy systems and processes of traditional banking and finance system jeopardize the development of SMEs. Lack of a conventional business plan, failure to provide good collateral, and absence of tax history or similar documentation are some of the main reasons banks do not give funding support to e-commerce businesses. If securing a bank loan can be next to impossible for Amazon business, where could you get funding assistance? eFunder.ai is your answer. Offering the most flexible and fastest funding solutions to new and existing Amazon or noon sellers, we ensure to help you channel the working capital to achieve your business objective effectively. We are just one of the many options businesses can rely on for amazon working capital financing. Read on to discover five alternative types of funding solutions available to Amazon businesses so that you can make a pick according to your needs. Peer-To-Peer Loans (P2P) P2P lending, a relatively new approach in borrowing and lending, is an online system that connects potential borrowers directly with individual investors for funding or loans. Instead of going through the time-consuming lending process of banks or credit unions, peer-to-peer lending uses an online system which acts as an intermediary between investor and borrower. In the P2P lending process, business owners can post their funding requirements on the lending platform. Lenders registered with the platform would check the loan listing request, decide whether to fund it and bid on it. As a borrower, you could secure funding from the highest bidder at competitive interest rates. P2P lending is a perfect option for all Amazon businesses as it tends to be quick and convenient and comes with attractive interest rates. Amazon Lending Amazon lending is a funding program where Amazon offers direct loans to its sellers. If you have an Amazon vendor central or a seller account, you can apply to get funding for your business at a rate lower than credit cards. Amazon's lending program is simple, has a fast turnaround time, and the fund gets deposited to the Amazon seller's account quickly when approved. However, e-commerce business owners should have a solid sales history of at least 12 months, excellent customer service metrics and sales volume to qualify for Amazon's lending program. Merchant Cash Advances A merchant cash advance (MCA) is a popular type of business funding suited explicitly for SMEs that accepts card payments from their customers. The lender provides the business with a cash advance against your sales and receivable card transactions. As an Amazon seller or e-commerce business owner, you have the option to get funding based on your future sales transactions through MCAs. The lender meets the repayments, deducting a percentage of each sale processed through a card terminal until the loan is paid off. Amazon Financing Options From eFunder.ai At eFunder.ai, we offer faster, safer and easier ways to fund your Amazon business through our financing solutions. Qualified sellers with an Amazon business can register with eFunder.ai and apply for our amazon working capital loans. Our team will review the eligibility criteria and instantly transfer the funds to the account after approval. Reach out to eFunder.ai today, and let us show you how easy it's to get started.

How to Start Preparing Your eCommerce Business for Q4 with eFunder.ai

The busiest and revenue-generating days of any online retailer's calendar are upon us. Undeniably, there is a lot to think and plan about going into this year's final quarter - Q4. If you run a product-based e-commerce business, Q4 is anticipated to be the most hectic yet lucrative sales season. Creating A Strategy For The Holiday Season Your plan to come victorious over the holiday shopping season should start early. Having enough time to plan and prepare is the best thing you can do for your business to engage your audiences and maximize revenue opportunities. Whether you are running a restaurant, online boutique or an Amazon store, it is essential to know how to strategize and execute. Keep in mind that preparing yourself for the upcoming quarter mainly includes setting up goals, using the right tools, and excellent execution. Here are some actions you can begin implementing for your e-commerce business now for the much-awaited Q4 sales. 1. Establish Your Calendar Developing a powerful and strategic plan for your e-commerce business entails utilizing all the key dates of the fourth quarter. The final quarter of the year is packed with events and holidays, which opens up a lot of sales and revenue opportunities for your online business. So, it is crucial to know when these holidays are and plan your activities around them. A well-organized and detailed business calendar can be your greatest asset as it would help roll out ad campaigns, manage inventory and engage with customers. Below is a list of key dates in Q4 2022 that every e-commerce business owner should be aware of: Halloween (31 October) Single's Day (11 November) Black Friday (25 November) Cyber Monday (28 November) UAE National Day (2 December) Christmas (25 December) Being aware of the upcoming events and holidays would help you plan and manage the business operations in advance, ensuring optimal engagement and reach. 2. Manage Inventory Levels The most important factor while preparing your e-commerce business for Q4 sales is to get your inventory systematized as early as possible to avoid a last-minute crisis. A successful Q4 could mean a massive spike in traffic and a flood of sales to your e-commerce store. Then you will need a steady inventory flow to keep up with the demand and ensure a seamless customer experience. You can start by mapping out your existing inventory levels and tracking what will be available during the holiday sales season. However, many small and medium-sized businesses may need help with the financing part of stocking up inventory. That is where e-commerce financing companies like eFunder.ai step in. Fast and flexible e-commerce invoice financing solutions from eFunder.ai are ideal for online businesses that need to purchase materials or stock up their inventory. Take a look at your previous year's sales report or the top-selling products this year to predict the sales growth during the whole holiday period. Once you have a clear idea of your sales projection and required stock levels, you can start filling up the inventory. If your business relies on sourcing raw materials or products from third-party suppliers, make it a point to speak with them and plan your stock deliveries in advance. 3. Define Your Order Fulfillment Strategy In addition to the inventory planning, you also need to consider the order fulfilment process, which includes shipping, returns, exchanges and refund. The most popular options for e-commerce businesses include in-house order fulfilment or outsourcing it to third-party logistics providers. Always keep the order placement, shipping and returns as easy and convenient as possible to ensure a positive experience for your customers. 4. Optimize Your Product Listings The next step in preparing your e-commerce business for the final quarter is to optimize and boost your listings. Examine and assess your website to make sure you are targeting the right keywords. Moreover, you need to update your product categories, descriptions and photos with the most relevant and latest information. Having the best e-commerce strategy for Q4 won't do your business any good if your website crashes from traffic spikes. And pages with longer load times could detract your visitors and cause them to switch to a competitor's site. In order to avoid these risks, conduct several tests and audits of your online store to check the performance and health of your website. 5. Prepare Your Marketing Campaign Promotional advertising and marketing are critical during the holidays, and if properly strategized and executed, they can increase your traffic, conversions and sales exponentially. As the busiest season takes off, make sure you already have your promotional and marketing campaigns planned, optimized and ready to go. Determine your pricing strategies, deals, vouchers, cross-selling and up-selling techniques to plan your sales days. This would help craft an effective campaign that will drive engagement and convert new and returning visitors. You can make the best use of promotion tools, coupon codes, social media ads, personalized packaging and more to achieve optimal growth and success in Q4. If you are struggling to secure funding for stocking up your inventory, kick start the promotional campaigns or organizing everything for the Q4 sales, eFunder's financing for eCommerce sellers can help. eFunder.ai gets you access to flexible financing solutions quickly so you can plan your sales accordingly and avoid a crunch at the end of the year. So, start planning now and get funded to make the most of every sales opportunity to finish 2022 out strong.

Level up Your eCommerce Store for Huge Black Friday Wins with eFunder.ai

The busiest and the most profitable time for retailers has arrived. The last quarter of the year, also known as the Golden Quarter, is just around the corner. With the sales peak starting before Halloween and ending right after Christmas or New Year, retailers must prepare themselves for success by investing time and effort. Black Friday events, or White / Friday as they call it in the Middle East and North Africa (MENA) region, are growing in popularity. This year, the famous shopping event by Amazon falls on 25th November. The much-touted sales event, first launched by Souq – now Amazon - as a three-day online-only event, has now evolved into a shopping extravaganza of the fourth quarter. Spanning all the major and micro moments, the black Friday sales are all set out to turn into a three-month-long shopping spree. According to the reports by Forbes, the total online spending worldwide during Thanksgiving and Black Friday in 2021 amounted to $14 billion. So, with the right marketing plan and strategy, the time, money and efforts you invest towards preparing your eCommerce business for Black Friday sales would be worth your while. As a small and medium-sized enterprise, you might be wondering how to compete with the retail giants and leverage the sales potential of Q4. The best way is to plan ahead and find creative ways to maximize your plan's impact. With an unsettled economic climate, dynamic demands and changing consumer demands, navigating the Black Friday Cyber Monday sales may seem challenging. That is why we have compiled a checklist to help you hit the ground running, avoid last-minute surprises, implement your marketing strategy, and make this holiday shopping season your best. Start Your Black Friday Sales Planning Before Q4 The Black Friday sales season happens over the course of four major phases, starting around 11 weeks before D-day. With online shoppers starting their search earlier and contemplating whether to buy online or locally, make it a point to communicate your exclusive deals and offers as early as possible. While Cyber Week, Single's Day and Black Friday aren't until nearly the end of the fourth quarter, the marketing efforts need to be implemented in October. If you want your eCommerce business sales to succeed during Q4, starting your planning early and building a sound strategy is essential. Having a well-defined strategy ensures nothing slips through the cracks during the busiest time of the year and gives you a specific timeline on what to do and when to do it. Determine Your Deals And Offers Whether you are running a restaurant, an Amazon store or a Noon store, it is important to plan your sales for the upcoming season. And the first thing you need to do is determine your discounts and offers. It would be best if you could find creative ways to promote your products or services so that customers can visit your store and make purchases. A classic way to structure your sales is to feature attractive discounts on high-selling items to draw people in and then upsell them on other products. Launching flash sales for a limited time or quantity is also a great option to grab audience attention and drive traffic. Make sure to plan your discounts, deals and offers by including your top-selling products and services. Optimize Your Website Preparing your eCommerce business for Black Friday sales is all about ensuring efficiency. And this is specifically true for your website, where the loading speed and user experience can make or break your customer's shopping experience and your conversion rate. Traffic spikes often come with a downside - it causes websites to slow down and ultimately crash. So, you will want to check your website's load capacity and ensure your web infrastructure is well-equipped to handle the high traffic volume. Providing an easy and fast checkout experience is another crucial factor to consider. If you want to boost your online traffic and maximize Q4 sales, you need to meet your customer expectations by offering a quick and seamless checkout process. Make sure your web presence is easy to navigate, interact with and buy from. With the big opportunity to reap sales and profit during the Black Friday and Cyber Monday sales, optimizing the customer experience of your web presence should be a priority. Plan and Prepare Your Inventory Now that you have a clear idea about the upcoming season deals and discounts, it is important to stock up your inventory. The only thing worse than having unsold stock is not having enough to meet the customer's demands. Running out of stock during Black Friday sales could be detrimental to your business. Imagine putting all the effort and time into preparing for the biggest sales, only to run out of inventory just when your customers start placing orders. Failing to meet your customer needs not only makes you lose on sales but also affects your brand reputation. Choosing and ordering the products you want to promote for the Black Friday sales should be done as early as possible, especially if your business is dependent on sourcing materials from third-party vendors or suppliers. You could make use of forecasting tools and inventory management applications to predict product demands and identify which merchandise you want to stock up for upcoming sales. Figure Out Your Funding Solutions The last quarter of the year is the perfect opportunity to promote your business and drive new revenue streams. But in order to put the marketing and sales plans into action, you need to fund your business. Stocking up the inventory, implementing the marketing strategies and advertising the offers - anything and everything requires financing. This is where eFunder.ai steps in with its wide range of marketplace sellers financing solutions. With its financing solutions for online businesses, eFunder.ai helps small and medium-sized businesses scale their operations and expand their reach. Planning, preparation and starting ahead are the key factors to a successful seasonal sale. At eFunder.ai, we help businesses with working capital funding solutions to manage finances in and out of seasonal sales. Want to learn more about how our financing solutions can help you achieve your Q4 sales target? Get in touch with us, and our team of experts would be more than glad to help you out.

How to Stay on Top of Your eCommerce Business Goals with eFunder.ai

Having a healthy cash flow is critical for any business, but it is especially important for fledgling small and medium-sized online businesses. eCommerce is a dynamic business space where money moves rapidly, and metrics change daily. A stable positive cash flow allows businesses to pay off debts, pay employees, avoid stockouts, invest in marketing activities and meet other unexpected expenses. 61% of businesses around the world surveyed for Quickbooks' 2019, The State of Small Business Cash Flow report revealed that they have struggled with cash flow. As a matter of fact, it is also a primary reason contributing to a small business's failure. So it is crucial to plan and execute your business cash flow to avoid shortages and disruptions of operations. Irregular cash flows paired with limited cash reserves can create problems for eCommerce businesses. Growing businesses often face this challenge, as they have to rely on credit terms to manage the cash flow and day-to-day expenses. Well, thanks to the advancements in digital space and finance sectors - there are innovative solutions to address the cash flow issues of struggling small and medium-sized eCommerce businesses. Not only these funding solutions are increasingly affordable and easy to access, but they also help businesses to ease any short-term liquidity blockages and avoid disruptions of operations. Invoice financing, a type of short-term financing, has become one of the most popular financing options among various marketplace sellers nowadays. Online businesses look for invoice financing solutions to turn their accounts receivables into cash, particularly in those situations where stretched-out credit terms create a cash crunch. Invoice financing offers a reliable alternative to traditional bank loans or lending systems and ensures many benefits for eCommerce businesses. Quick Access to Funds Most eCommerce business funding solution providers like eFunder.ai allow businesses to access funds within a short time. For instance, eFunder.ai credits the required funds within 24 to 72 hours after its easy onboarding process. Instant access to funds helps businesses meet their emergency cash flow requirements and negate the chances of downtime. Releases Tied Up Capital Invoices are often set with repayment terms of up to 90 days, which makes things simple for the buyers but difficult for marketplace sellers. For instance, if you are running an online store, and your buyers take at least two to three months to release the payments for purchased goods or services, your business is bound to experience a financial crunch sooner or later. Lack of required capital or stagnating cash flow also leads your business to miss out on lucrative market opportunities. With invoice financing solutions, you gain access to the capital amount tied up in those unpaid bills and inject cash flow into your business operations. Hassle-Free Process With Simple Repayment Terms Getting financial solutions for fintech companies is a quick and easy process. You are not required to repay the invoice financiers until you have received payment from your customers. However, you need to look for reputed companies that will extend a significant percentage of your invoice value in exchange for simple, easy-to-meet requirements. This will enable you to obtain funds fast and make repayments. Avoid Debt Accumulation Unlike traditional funding options, invoice financing is not a credit facility; rather, it is an extension of payment terms, which helps to retain a business's cash flow without creating or adding new debt. eCommerce businesses, especially startups, can benefit from invoice financing and eCommerce working capital financing solutions as it lifts the uncertainty regarding the cash flow, eliminates the risk of debt crisis and secures your company's potential to grow and thrive. At eFunder.ai, we help SMEs with innovative and flexible financing solutions to manage their cash flow more efficiently. Moreover, our financing for marketplace sellers aid eCommerce businesses in expanding into new markets, scaling their operations and reaching more customers. To get instant access to working capital advance, get in touch with us today!

Helping Small and Medium Businesses Unlock Growth

Experience financial freedom through our unrivaled cash flow funding solutions.