How to supercharge your online sales performance?

In our ever-evolving digital age, merely having an online presence is no longer enough. The success of a brand is increasingly reliant on its ability to supercharge its online sales performance. Whether you’re a startup or an established brand, optimizing your online sales strategy can significantly boost your bottom line.

With tools like Stripe, Tap, Tabby, eFunder.ai, and JungleScout.com at your fingertips, here's how you can elevate your sales game.

Understand your audience

Knowing about your audience is the key to success because ultimately you are serving your audience and they should be satisfied with it. It’s a simple math: if you know them better, you serve them better.

Segment your market

Classify your audience based on demographics, preferences, behaviors, and other criteria. Tailored strategies for each segment can drive better conversion rates.

Dive deep into customer behavior

Gain a better understanding of your audience's preferences, buying habits, and feedback.

Personalize your offerings

Customize your products, services, and marketing efforts to resonate more effectively with different segments.

Optimize your payment options

It is important to simplify transactions. Offering multiple, user-friendly payment gateways like Stripe and Tap ensures a smoother transaction process. A simple and secure checkout experience can significantly reduce cart abandonment rates.

Some impeccable tools

Here are some of the most useful tools available to boost your sales performance.

Stripe

Stripe is a well-known company that is highly regarded in the worldwide business sector. It provides a dependable and effective payment processing platform that empowers online businesses to provide secure and user-friendly payment options.

Stripe supports various payment methods, including credit cards, debit cards, ACH payments, and different international choices. Furthermore, with the same it incorporates the analytics tool known as Jungle Scout for eCommerce website owners to understand their sales reports and analyze their profit productions.

Stripe provides a wide variety of financing options, which is a noteworthy feature. This specific ability allows merchants to offer their customers the choice of paying in manageable installments, thereby increasing their ability to make purchases. By giving customers more flexibility, businesses can significantly increase their conversion rates and improve the average order value, leading to better sales performance.

Tap

Another significant contender in the eCommerce payment processing industry is Tap. It is highly respected for delivering a smooth and safe purchasing process for customers visiting your online store. With its ability to accommodate various payment options, Tap is an outstanding selection for global eCommerce enterprises.

Tabby

Introducing payment solutions like "Buy Now, Pay Later" with Tabby can attract a wider audience, including those hesitant about upfront payments. This solution easily integrates into your website and checkout system, enabling customers to buy products and pay for them in convenient installments.

The option of "purchase now, pay later" is especially attractive to customers who may not have the complete amount of money right away but are still enthusiastic about making a purchase. By providing this flexibility, you can draw in more customers and greatly increase your sales performance.

Leverage advanced tools for market research

There are some advanced tools that can help you understand the market so that you can build foolproof business strategies.

Junglescout.com

Before launching new products, use Junglescout.com. This platform helps brands identify trends, understand competition, and determine the potential of products in the online marketplace.

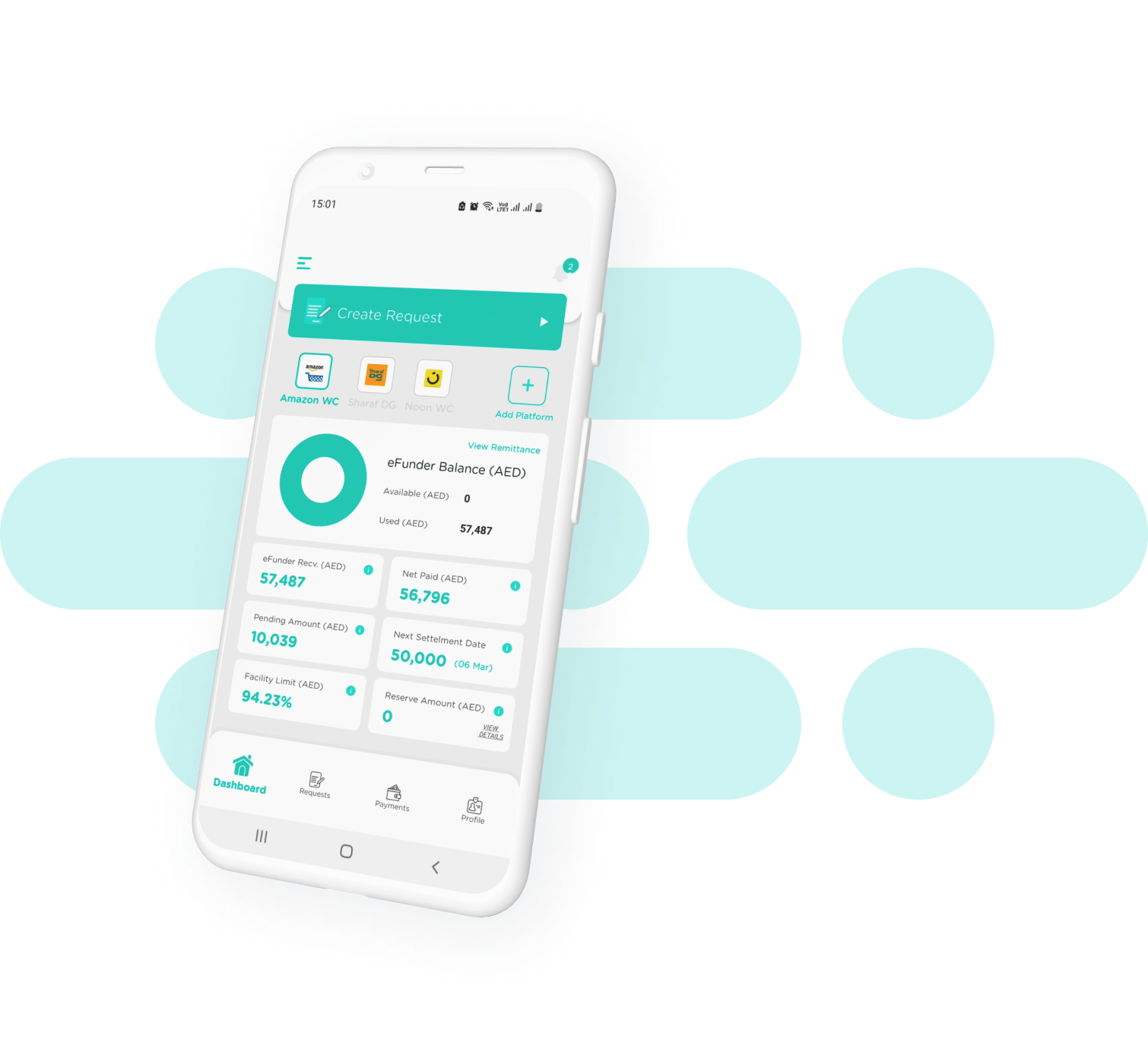

eFunder.ai

eFunder.ai is a leading digital financial platform specifically created to assist eCommerce enterprises that are small or medium-sized to assist them with instant cash and consistent cash flow proportionate to their receivables. Its distinguishing feature lies in its ability to offer financing and working capital solutions, supplying funds to eCommerce businesses. With this financial support, businesses can make investments in expansion and inventory without the need to wait for revenue accumulation. This helps boost the sales of eCommerce websites

In addition, eFunder.ai offers advanced payment gateway functionalities, ensuring smooth integration with your online business platform. This characteristic ensures safe and effective transactions, simplifying the payment procedure and enhancing the financial liquidity of your company.

Engage customers with high-quality content

Customer engagement cannot be ignored in developing businesses. The more you interact with clients the more trust you build for your brand or company.

Educational Webinars & Live Demos: Hosting webinars and using platforms like eFunder.ai to create and distribute valuable content can drive significant engagement.

User Stories & Testimonials: Share stories of real users. Potential customers often trust peer reviews and testimonials more than brand advertisements.

Email Marketing: Collaborate with platforms Mailchimp or Elastic Email that integrate seamlessly with Stripe or Tap, ensuring a cohesive retargeting strategy across all touchpoints.

Conclusion

To enhance your online sales performance on independent eCommerce websites, it is recommended that you incorporate sophisticated tools and functionalities like Stripe, Tap, eFunder.ai, and Tabby. These tools offer financing choices, deferred payment plans, and advanced payment gateway capabilities that cater to a wide range of customers, enhance conversion rates, and elevate the overall shopping experience.

By staying at the forefront of these state-of-the-art technologies, you can guarantee the success of your eCommerce business in a progressively competitive marketplace.

About eFunder.ai

eFunder.ai is the most promising digital financing solutions partner for SMEs. With us, enterprises enjoy financial freedom because we get them instant working capital and can clear all payments. By partnering with us, you focus utterly on your business expansion and other essential tasks. Leave all financial hassles on us and your business can sail through the market successfully.

Related Articles

Scaling Your Restaurant with Delivery Aggregators: How to Keep Cash Flow Smooth

Restaurants operate in a fast-paced, highly competitive environment where efficient supply chain management is absolutely paramount. From sourcing fresh ingredients to managing inventory and ensuring timely delivery, every link in the chain plays a crucial role. Working Captial for restaurants can play a key role in optimizing this complex process. Securing restaurant financing UAE can be challenging, but eFunder offers tailored SME financing for restaurants through our user-friendly eFunder UAE platform. The aroma of success in the restaurant business is often accompanied by the hum of delivery bikes and the ping of online orders. If you're leveraging delivery aggregators alongside your Point of Sale (POS) system, you're tapping into a powerful revenue stream. However, this dynamic landscape can also introduce unique cash flow challenges. Let's explore how to keep your restaurant's finances as smooth as your signature sauce. The Dual-Channel Challenge: POS and Delivery Aggregators Restaurants that operate both a physical dining space and utilize delivery aggregators experience a blend of traditional and digital revenue streams. While this diversification can boost sales, it also complicates cash flow management. Here's why: Delayed Payouts: Delivery aggregators typically have longer payment cycles than your POS system. This delay can create a gap between your daily expenses and incoming revenue. Variable Order Volumes: Demand on delivery platforms can fluctuate significantly, leading to unpredictable cash flow. Increased Operational Costs: Managing online orders requires additional packaging, delivery logistics, and commission fees, impacting your working capital. Working Capital: The Backbone of Your Restaurant's Growth In the dynamic dual-channel environment of restaurants utilizing both POS systems and delivery aggregators, robust working capital is absolutely essential. It provides the financial foundation to cover daily operational expenses, ensuring you can consistently pay for ingredients, staff salaries, and utilities, regardless of the variable payout schedules from aggregators. Furthermore, it empowers you to strategically invest in inventory, allowing you to stock up on popular items to meet the demands of both dine-in and online customers. With sufficient working capital, you can also expand your reach by investing in targeted marketing and promotions, attracting a wider customer base across both platforms. Finally, it provides the necessary buffer to effectively manage seasonal fluctuations, enabling you to prepare for peak seasons and navigate slower periods without experiencing financial strain. This is where eFunder steps in as your trusted partner, offering tailored financing solutions to ensure your restaurant maintains smooth cash flow and continues to thrive. eFunder understands the unique challenges faced by restaurants in the UAE. We offer tailored financing solutions to help you maintain a healthy cash flow and scale your business: Working Capital Financing: Bridge the gap between aggregator payouts and daily expenses with flexible working capital solutions. Access the funds you need to keep your operations running smoothly. Why Choose eFunder? Fast and Flexible: Our streamlined application process ensures you get the funds you need quickly. Tailored Solutions: We understand the nuances of the restaurant industry and offer customized financing options. Transparent and Reliable: We prioritize clear communication and build long-term relationships with our clients. Tips for Optimizing Cash Flow: Forecast Demand: Analyze sales data from both your POS and delivery platforms to predict demand and manage inventory accordingly. Negotiate Payment Terms: Explore options for faster payouts with your delivery aggregators. Implement Efficient Inventory Management: Minimize waste and optimize stock levels to reduce costs. Leverage Technology: Utilize POS systems and accounting software to track sales, expenses, and cash flow in real-time. Contact uhttps://efunder.ai/contact-us/s today to learn how we can help you keep your cash flow as smooth as your culinary creations.

Understanding the Impact of UAE’s New Tax Regulations on SMEs

The introduction of new UAE tax regulations 2025 and subsequent updates have significant implications for SMEs operating within the country. Small business tax compliance UAE is now more critical than ever, and penalties for non-compliance can be substantial. Understanding VAT regulations UAE and their specific impact on your business operations is crucial for effective financial planning for SMEs. Staying informed about changes to the regulations is essential for long-term success. The tax impact on SMEs can be complex, and navigating these changes often requires expert guidance. From understanding VAT implications to managing corporate tax, careful planning is essential. One area to consider is tax-efficient financing UAE. eFunder offers digital financing and invoice financing for small business solutions that can help SMEs manage their cash flow effectively while simultaneously meeting their tax obligations. Our financing for small business options can free up valuable working capital, allowing businesses to focus on growth initiatives and ensure they have the resources needed for compliance. Contact us today to learn more about how eFunder can help you navigate the evolving tax landscape and optimize your financial strategy.

How Flexible Financing Options Are Helping SMEs Navigate Market Uncertainty

The current market landscape is characterized by volatility and uncertainty, making it exceptionally challenging for SME financing UAE. Geopolitical events, fluctuating commodity prices, and evolving consumer preferences can create unpredictable conditions. Traditional business loans for SMEs can be difficult to secure in such an environment, as lenders become more risk-averse, leaving many businesses struggling to manage their SME financial support. However, innovative financial solutions like invoice financing UAE are providing a much-needed lifeline. Small business funding is absolutely essential for navigating these turbulent times. While business working capital loans can provide a financial buffer, they often come with rigid terms, lengthy application processes, and substantial collateral requirements. Invoice financing companies like eFunder offer a different, more agile approach. We specialize in digital financing and invoice financing for small business, providing quick access to cash tied up in unpaid invoices. This allows SMEs to improve their business working capital position, seize time-sensitive opportunities, invest in marketing or new equipment, and weather unexpected market fluctuations. eFunder's invoice financing solutions are designed to be flexible, adapting to the unique needs of each business, and allowing them to scale up or down as needed.

The Impact of Vendor Advances on Supplier Relationships

In today's competitive business landscape, strong supplier relationships are more critical than ever. They are the backbone of a resilient supply chain and a key ingredient for sustained success. One financial tool that can significantly impact these relationships, for better or worse, is the vendor advance. But how exactly do these advances affect suppliers, particularly small and medium-sized enterprises (SMEs)? Let's get into the details. Vendor advances can be a lifeline for suppliers, especially when they're grappling with cash flow challenges. Imagine a small manufacturer who has just completed a large order but is waiting for payment. A vendor advance provides immediate access to funds tied up in pending invoices, significantly improving their SME financing UAE situation. This injection of cash can be a game-changer, allowing suppliers to invest in growth, fulfill larger orders without delay, maintain consistent operations, and even hire new staff. This is particularly beneficial in the UAE, where access to traditional supplier credit UAE can be a hurdle for smaller businesses. Traditional lending often involves lengthy applications, strict criteria, and collateral requirements, which many SMEs struggle to meet. However, the devil is in the details. The specific terms of a vendor advance are absolutely critical. Unfavorable terms, such as high interest rates or rigid repayment schedules, can put a strain on supplier relationships and create resentment. This is where eFunder comes in. We offer flexible invoice financing solutions that empower suppliers without jeopardizing their relationships with buyers. eFunder understands the unique challenges faced by SMEs in the UAE and is recognized as one of the best invoice financing companies in the region. We offer financing for SMEs with flexible financing options designed to improve cash flow, strengthen partnerships, and foster long-term growth. Our process is simple, transparent, and designed to get you the funds you need quickly.

Choosing the Right Invoice Financing Partner in the UAE: A Guide for Businesses

Selecting the right invoice financing partner is crucial for businesses operating in the dynamic UAE market. The right partner can provide the necessary capital to fuel growth, improve cash flow, and unlock new opportunities. However, with numerous options available, choosing the right partner can be challenging. Here are key factors to consider when making your decision: Reputation: Choose a reputable and established company with a proven track record in the UAE market. Look for a partner with a strong financial standing and a history of successful partnerships with businesses like yours. Experience in the UAE Market: Partner with a company that possesses in-depth knowledge of the UAE business landscape, its unique challenges, and regulatory requirements. Flexibility of Terms: Ensure the financing solution offers flexible terms that align with your specific business needs. Look for options that provide flexibility in terms of advance rates, repayment schedules, and other key parameters. Technology and Innovation: Choose a partner that leverages cutting-edge technology to streamline the application process, provide real-time access to information, and offer a seamless user experience. Customer Service: Select a partner with exceptional customer service and a dedicated support team readily available to assist you. Look for a partner that prioritizes open communication, addresses your concerns promptly, and provides ongoing guidance and support. Why Choose eFunder? eFunder stands out as a preferred partner for businesses in the UAE due to its unique strengths: Deep UAE Expertise: We have a deep understanding of the UAE business environment, its unique challenges, and the specific needs of businesses operating within this dynamic market. Tailored Solutions: We don't believe in a one-size-fits-all approach. Our team works closely with you to understand your specific business needs and tailor our financing solutions accordingly. Fast and Efficient: Experience our quick and hassle-free application process. We leverage technology to streamline the application process, allowing you to receive funding rapidly and put it to work immediately. Transparent Pricing: We believe in complete transparency. Our pricing is transparent and competitive, with no hidden fees. You'll always have a clear understanding of the costs associated with our financing solutions. Exceptional Customer Support: Our dedicated team is available to assist you at every step of the way. We prioritize open communication and are always ready to address your questions and concerns promptly. Cutting-Edge Technology: We leverage the latest technology to provide a seamless and user-friendly experience. Our online platform allows you to track your applications, manage your account, and access key information with ease.

Invoice Financing for Startups: Fueling Growth from Day One

Startups face a unique set of challenges, particularly when it comes to securing funding. Securing traditional loans can be a lengthy and often unsuccessful process, leaving startups with limited access to the capital they need to grow. This is where invoice financing can be a game-changer. Overcoming Funding Gaps: Bridging the Chasm Between Costs and Revenue Startups often incur significant upfront costs in areas like marketing, research and development, and hiring. However, revenue generation can take time. This creates a crucial funding gap that can hinder growth. Invoice financing bridges this gap by providing immediate access to funds tied up in outstanding invoices. Accelerating Growth: Investing in Key Areas With access to early-stage capital, startups can: Invest in Marketing and Sales: Launch targeted marketing campaigns, expand sales teams, and accelerate customer acquisition. Fuel Research and Development: Fund innovative product development, enhance existing offerings, and stay ahead of the competition. Expand their Team: Hire talented employees, build a strong team, and scale operations efficiently. Capitalize on Emerging Opportunities: Seize unexpected opportunities that arise in the dynamic startup ecosystem. Early Access to Capital: A significant advantage for business owners. By utilizing invoice financing solutions like eFunder, businesses can significantly reduce their credit cycle. Instead of waiting for traditional payment terms, which often extend from 30 to 90 days, businesses can instantly convert approved invoices into cash. This immediate access to funds empowers businesses to seize opportunities, invest in growth, and maintain a healthy cash flow, ultimately driving greater success. Invoice financing provides startups with significantly faster access to capital compared to traditional loan applications. The application process is typically streamlined and efficient, allowing startups to receive funding quickly and put it to work immediately. This speed can be crucial for startups operating in fast-paced and competitive markets. eFunder's Solutions for Startups: Tailored Support for Growth At eFunder, we understand the unique challenges faced by startups. We offer tailored solutions to help them thrive: Flexible Repayment Terms: We recognize that every startup has a different cash flow cycle. That's why we offer flexible repayment options to suit your specific needs and ensure you can comfortably manage your cash flow. Dedicated Support: Our team provides dedicated support to startups throughout the entire process. We guide you through the application process, answer your questions, and offer valuable insights to help you make informed decisions.

Invoice Financing and Your Credit Score: What You Need to Know

Many businesses are hesitant to explore invoice financing due to concerns about its potential impact on their credit score. While it's natural to be cautious when it comes to weighing financing options, understanding the nuances can help you make informed decisions. Limited Impact on Credit Score Responsible invoice financing generally has a minimal impact on your credit score. Unlike traditional loans that involve a formal credit check and can directly impact your credit history, invoice financing primarily focuses on the creditworthiness of your customers. With eFunder invoice financing you don’t have to worry about the impact on your credit score. Improved Cash Flow: A Credit Score Booster In fact, invoice financing can actually improve your creditworthiness in the long run. By providing immediate access to funds tied up in outstanding invoices, it significantly improves your cash flow. This improved cash flow enables you to: Meet Financial Obligations on Time: Pay suppliers, rent, and other expenses promptly, demonstrating responsible financial behavior to credit bureaus. Reduce Reliance on Debt: Minimize the need for high-interest loans, which can negatively impact your debt-to-income ratio and credit score. Invest in Growth: Utilize the freed-up capital for business expansion, marketing, and other growth initiatives, leading to increased revenue and improved creditworthiness. Maintaining a Healthy Credit Profile with eFunder At eFunder, we prioritize responsible lending practices and work closely with our clients to maintain healthy credit profiles. We: Conduct Thorough Due Diligence: We carefully assess the creditworthiness of your customers to minimize risk and ensure the sustainability of the financing arrangement. Provide Transparent Reporting: We offer clear and transparent reporting on your invoice financing activity, allowing you to track your progress and make informed financial decisions. Offer Guidance and Support: Our team is available to provide guidance on responsible financial management practices and address any concerns you may have regarding your credit score

The Easiest Way to Get Started with Invoice Financing

Starting with invoice financing doesn't have to be daunting. eFunder makes the process incredibly simple. Here's a quick guide: Quick and Hassle-Free Onboarding: Sign up for an eFunder account in just minutes. Our streamlined process requires only six quick and easy steps. Integrate Your Seller Account: Easily connect your Buyer procurement ERP system or provide past invoices and purchase orders for seamless integration. We partner with select non-ERP entities for streamlined onboarding. Select Your Receivables: Choose the specific invoices or the total amount of receivables you want to receive an advance against. Receive Funds Quickly: Get up to 95% of the value of your selected invoices deposited directly into your bank account within 24 hours. Automatic Updates: Receive notifications when your customers pay their invoices. Select Buyer Ecosystems: under Large Corporates, Government Entities or Banks/Financial Required Documentation: We understand that providing documentation can feel overwhelming. At eFunder, we've minimized the requirements to make the process as smooth as possible. Typically, you'll need basic business information and some recent invoices. Ease of Use: Our online platform is designed with user-friendliness in mind. The application process is intuitive and easy to navigate, even for those who aren't tech-savvy. Addressing Common Concerns: Credit Score Impact: efunder invoice financing has zero impact on your credit score. Responsible use of invoice financing, such as with efunder, does not negatively impact your credit score. Data Security: We prioritize data security and employ robust measures to protect your sensitive information.

The Future of E-commerce Business in Dubai: A Lucrative Opportunity

Dubai's e-commerce market is booming, with projections suggesting a significant growth to 17 billion USD by 2025. This presents a golden opportunity for businesses to tap into the region's burgeoning online market. Key Factors Driving E-commerce Growth in Dubai: Growing Middle-Class Population: A rising middle class with increasing disposable income is fueling e-commerce growth. Government Support: The UAE government's initiatives to promote e-commerce have created a favorable business environment. Advanced Logistics Infrastructure: A robust logistics network facilitates efficient delivery of goods. To capitalize on this opportunity, e-commerce businesses in Dubai should: Optimize Online Stores: Ensure a seamless shopping experience with user-friendly websites and mobile apps. Leverage Social Media: Utilize social media platforms to connect with customers and promote products. Invest in Digital Marketing: Implement effective digital marketing strategies to attract and retain customers. Secure Adequate Funding: Access business finance and working capital to fuel growth. By staying ahead of the curve and leveraging the power of e-commerce, businesses in Dubai can position themselves for long-term success.

SMEs Preparing for the UAE High Season: Get Funded with eFunder

The UAE high season is just around the corner, and businesses across the country are gearing up for a period of intense activity. With increased demand and opportunities, SMEs need to be well-prepared to capitalize on the season's potential. Key Challenges for SMEs During the High Season: Increased Demand: The surge in demand can strain resources and lead to operational challenges. Inventory Management: Ensuring sufficient stock levels to meet increased demand is crucial. Cash Flow Management: Managing cash flow during peak periods can be demanding. How eFunder Can Help eFunder offers a range of financing solutions to help SMEs navigate the challenges of the high season. By providing working capital loans and other financial products, eFunder empowers businesses to: Scale Operations: Invest in additional resources and expand their reach. Manage Cash Flow: Smooth out cash flow fluctuations and meet financial obligations. Seize Opportunities: Capitalize on the increased demand and market opportunities. Don't let financial constraints hinder your business's growth. Get funded with eFunder and make the most of the UAE high season.

eFunder Connects with Global Leaders at WorldEF 2024

eFunder recently participated in WorldEF 2024 Dubai, a premier global financial event held in Dubai. The event brought together industry leaders, investors, and entrepreneurs to discuss the latest trends and innovations in the financial sector. A Unique Experience eFunder's presence at WorldEF 2024 Dubai provided a unique opportunity to connect with global leaders and explore potential partnerships. The event showcased the company's commitment to driving financial innovation and empowering businesses. Deepak Sekar’s Masterclass: Financing 101 for E-commerce Sellers Deepak Sekar, eFunder's CEO, delivered a captivating masterclass on "Financing 101 for E-commerce Sellers." The session provided valuable insights into the financial strategies that e-commerce businesses can employ to fuel their growth. By attending WorldEF 2024, eFunder reaffirmed its position as a leading provider of business finance and working capital solutions. The company remains dedicated to supporting businesses of all sizes, helping them achieve their full potential.

Thriving in the Gulf E-commerce Market: Best Practices for Amazon Sellers

The Gulf region has emerged as a focal point for global e-commerce expansion. With a growing population of tech-savvy consumers and a robust online infrastructure, the opportunities for Amazon sellers are immense. However, to truly thrive in this competitive market, sellers must adopt a strategic approach and navigate the complexities of the Amazon platform. Understanding the Gulf E-commerce Landscape Before diving into the strategies, it's crucial to understand the unique dynamics of the Gulf e-commerce market. Factors such as cultural nuances, shipping regulations, and local consumer preferences can significantly impact your business. Key Strategies for Amazon Sellers: Optimize Product Listings: Keyword Research: Conduct thorough keyword research to identify relevant terms that potential customers are searching for. Compelling Product Descriptions: Create engaging and informative product descriptions that highlight the unique selling points of your products. High-Quality Images: Use high-resolution images from multiple angles to showcase your products. Build a Strong Brand Presence: Consistent Branding: Maintain a consistent brand identity across all your listings. Customer Reviews: Encourage positive reviews from satisfied customers. Effective Customer Service: Respond promptly to customer inquiries and resolve issues efficiently. Leverage Amazon's Marketing Tools: Amazon Advertising: Utilize Amazon's advertising tools, such as Sponsored Products and Sponsored Brands, to increase visibility. Amazon Coupons: Offer coupons and promotions to attract customers and boost sales. Comply with Amazon's Policies and Regulations: Stay Updated: Keep up-to-date with Amazon's policies and guidelines to avoid account suspensions or penalties. Intellectual Property Protection: Protect your brand and products by registering trademarks and copyrights. By following these best practices and adapting to the evolving landscape of the Gulf e-commerce market, Amazon sellers can position themselves for long-term success.

Funding Checklist for SMEs in the UAE

Navigating the financial landscape can be challenging for small and medium enterprises (SMEs) in the UAE. To ensure your business secures the necessary funding, it’s essential to have a comprehensive checklist. This guide will help you understand the various SME funding options available, enabling you to make informed decisions for your business growth. Understanding SME Funding Options SME Business Funding Explore various SME funding sources, including banks, financial institutions, and government programs designed to support small businesses. SME Loans for Startups Many financial institutions offer tailored SME loans for startups, providing essential capital to help you establish your business and navigate early challenges. Business Loans for SMEs These loans can be used for various purposes, including expanding operations, purchasing equipment, or managing cash flow. Assess your needs to choose the right loan amount and terms. Working Capital Advance A working capital advance can provide immediate cash flow relief. This option is particularly useful for managing day-to-day operations and unforeseen expenses. Vendor Advance Consider vendor advance options to improve your inventory management. This funding allows you to pay suppliers upfront, securing better pricing and terms while maintaining stock levels. Advance Payment to Vendor Offering advance payments to vendors can strengthen supplier relationships and potentially lead to discounts, enhancing your overall profitability. Key Considerations for Securing Funding Develop a Solid Business Plan A well-structured business plan is crucial for attracting SME funding. Clearly outline your business goals, market analysis, and financial projections to demonstrate viability. Understand Your Financial Needs Determine how much funding you require and for what purpose. This clarity will help you communicate effectively with lenders and identify the best financing options. Review Eligibility Criteria Different funding options have specific eligibility requirements. Ensure you meet these criteria to streamline your application process. Prepare Necessary Documentation Gather essential documents such as financial statements, tax returns, and business licenses. Having these ready will expedite the funding application process. Securing SME funding in the UAE requires careful planning and a clear understanding of your financial needs. By following this funding checklist, you can explore various options, from SME loans for startups to working capital advances, and choose the right financing solutions for your business. With the right funding in place, your SME can thrive and achieve its growth potential.

Evergreen Industries for E-commerce Businesses in the UAE: Thrive All Year Round

The UAE’s e-commerce landscape is vibrant and rapidly evolving, presenting numerous opportunities for businesses to flourish year-round. By focusing on evergreen industries, you can build a sustainable e-commerce business that thrives irrespective of seasonal fluctuations. Here are key sectors and strategies for success in the UAE's e-commerce market. Key Evergreen Industries Health and Wellness Products The demand for health supplements, fitness gear, and wellness products is consistently high. With a growing health-conscious population, selling health-related products on platforms like Amazon UAE can yield substantial returns. Beauty and Personal Care The beauty industry is a staple in the UAE, with consumers seeking the latest skincare and cosmetic products. As an Amazon seller in the UAE, you can tap into this lucrative market by offering popular brands and unique products. Home and Kitchen Appliances As more people invest in their living spaces, home and kitchen appliances remain in demand. E-commerce businesses focusing on these products can benefit from consistent sales throughout the year. Fashion and Accessories The fashion industry never goes out of style. By curating a unique selection of clothing and accessories, your e-commerce business can cater to diverse consumer preferences, making it an evergreen sector. Strategies for Success Sell on Amazon UAE Utilizing established platforms like Amazon can help you reach a broader audience. As an Amazon business owner in the UAE, ensure your listings are optimized for visibility and appeal to local consumers. Understand Local Trends Stay informed about e-commerce businesses in the UAE to identify emerging trends. Adapting your product offerings to meet local preferences can give you a competitive edge. Explore E-commerce Financing Options To grow your e-commerce business, consider partnering with ecommerce financing companies. Securing ecommerce seller funding can provide the working capital for e-commerce that you need to expand inventory, improve marketing, and enhance customer service. By focusing on evergreen industries and leveraging platforms like Amazon UAE, e-commerce businesses can thrive all year round. Understanding the local market, staying agile with trends, and securing the necessary funding will position your e-commerce venture for long-term success in the UAE. Embrace the opportunities ahead and watch your business flourish!

The Rise of Voice Commerce: How Voice Assistants Are Shaping the Future of E-commerce

As technology continues to evolve, voice commerce is emerging as a transformative force in the e-commerce landscape. With the rise of voice assistants like Alexa and Google Assistant, consumers are embracing voice-activated shopping experiences. Here’s how voice commerce is shaping the future of e-commerce and what it means for your e-commerce business. Understanding Voice Commerce Voice commerce refers to the use of voice commands to make purchases or interact with e-commerce platforms. This trend is rapidly gaining traction, making it essential for businesses to adapt to this new shopping paradigm. Voice commerce allows for seamless transactions, enabling consumers to shop hands-free and receive personalized recommendations. Current Trends in Voice Commerce The voice commerce market is expanding rapidly, with increasing adoption among consumers. Key voice commerce trends include: Enhanced Convenience: Shoppers are gravitating towards the ease of voice commands for quick purchases, making convenience a top priority. Personalization: Voice assistants leverage AI to provide tailored product suggestions, enhancing the overall shopping experience. Integration with Smart Devices: As smart home devices become more prevalent, integrating voice commerce with everyday technology is becoming a standard practice. Preparing for the Future of E-commerce To stay competitive, e-commerce businesses must embrace these evolving trends. Here are some strategies to consider: Optimize for Voice Search: Ensure your e-commerce platform is voice-search friendly. Use conversational keywords and phrases that customers are likely to speak. Invest in Voice Technology: Explore options for integrating voice commerce capabilities into your e-commerce platform. This investment can set you apart in a crowded market. Monitor Consumer Behavior: Keep an eye on voice commerce trends to better understand how customers are engaging with voice technology. Funding Your Voice Commerce Strategy For e-commerce businesses looking to capitalize on voice commerce, securing adequate funding is crucial. Whether you’re exploring e-commerce startup loans or seeking ecommerce funding, having financial resources will enable you to invest in technology and marketing strategies that align with future trends. The rise of voice commerce is reshaping the e-commerce landscape, presenting both opportunities and challenges. By understanding voice commerce trends and investing in the right technology, your e-commerce business can thrive in this dynamic environment. Embrace the future of e-commerce and position yourself for success as voice shopping becomes increasingly mainstream.

How to take advantage of the winter peak season in the UAE

As winter approaches, the food and beverage (F&B) industry faces both challenges and opportunities. To thrive this season, here are key strategies for maximizing performance in your restaurant. Streamline Restaurant Inventory Management Winter brings fluctuating demand, making effective restaurant inventory management crucial. Accurately forecast sales trends to minimize waste and ensure you have enough stock. Implement a solid food inventory management system to track ingredients and manage vendor relationships, taking advantage of vendor advances for bulk purchases. Optimize Cash Flow with Financing Options Increased expenses during winter can strain cash flow. Consider financing for restaurants to navigate these challenges. A working capital advance provides instant cash for your restaurant business, enabling you to invest in marketing, hire seasonal staff, or upgrade equipment without compromising your budget. Focus on Customer Experience Create memorable dining experiences this winter with seasonal menus that highlight comfort foods. Promote special events to draw in crowds, and ensure your staff is trained to provide exceptional service. Positive customer experiences lead to repeat business and valuable referrals. Leverage Technology for Efficiency Investing in technology can streamline restaurant inventory management. Use integrated POS systems for real-time sales data to adjust orders and reduce waste. Analytics tools can also help guide menu planning based on customer preferences and seasonal trends. Winter presents a unique opportunity for growth in the F&B industry. By focusing on effective management, optimizing inventory, and utilizing financing options like working capital advances, you can maximize your restaurant’s performance. At eFunder, we’re here to support your success with tailored financial solutions for SMEs, take advantage of the peak season and thrive with eFunder. Contact - sales@efunder.ai

Improving Your Business Credit Score: Practical Tips and Strategies

A strong business credit score is essential for accessing financing, securing favorable terms, and building trust with suppliers and customers. Here are some practical tips to help you improve your business credit score: 1. Monitor Your Business Credit Report: Regularly review your business credit report to identify any errors or discrepancies. You can obtain your business credit report from bureaus like Dun & Bradstreet and Experian. 2. Pay Bills on Time: Consistent and timely payments are a crucial factor in building a good credit score. Make sure to pay all your bills, including taxes, rent, and supplier invoices, on time. 3. Establish a Positive Payment History: Build a positive payment history by making regular payments on your business loans and credit lines. This shows lenders that you are reliable and responsible. 4. Limit New Credit Applications: Applying for new credit can temporarily lower your credit score. Avoid applying for unnecessary credit unless it's absolutely necessary. 5. Maintain a Low Debt-to-Credit Ratio: Keep your debt-to-credit ratio low by managing your credit lines responsibly and avoiding excessive debt. 6. Use Business Credit Cards: Using business credit cards responsibly can help build your business credit score. However, make sure to pay your balances in full each month to avoid interest charges. 7. Build Business Relationships: Establish positive relationships with suppliers, vendors, and other businesses. Strong relationships can improve your creditworthiness. 8. Consider Business Credit Monitoring: Use a business credit monitoring service to track your credit score and identify any potential issues. 9. Explore Financing Options: If you need additional funding, consider exploring options like business finance and Mall business loans. By following these tips and strategies, you can effectively improve your business credit score and access the financing you need to grow your business.

Your Roadmap to Business Success By Setting SMART Goals

Setting SMART goals is the key to taking your business to the next level. This proven framework will help you define clear, achievable objectives and guide your business toward success. Key Benefits of Setting SMART Goals: Gain clarity and focus: Avoid confusion and stay focused on what matters most. Boost morale and accountability: Create a sense of purpose and motivation among your team. Make informed decisions: Align your actions with your long-term objectives. Enhance performance: Track your progress and identify areas for improvement. How to Set SMART Goals: Specific: Clearly define your goals, avoiding vague or ambiguous statements. Measurable: Set quantifiable objectives that can be tracked and measured. Achievable: Ensure your goals are realistic and attainable given your resources and constraints. Relevant: Align your goals with your overall business strategy and objectives. Time-bound: Set deadlines for achieving your goals to create a sense of urgency and accountability. The Role of eFunder eFunder can play a crucial role in helping you achieve your SMART goals by providing the necessary working capital. With our advance cash and advance financial solutions, you can access the funding you need to invest in your business. Key Benefits of Using eFunder: Fast and Efficient: Our streamlined application process and quick approval times ensure you get the funding you need when you need it. Flexible Terms: We offer flexible repayment options to suit your business needs. Competitive Rates: Our competitive interest rates make it affordable to access the capital you require. Dedicated Support: Our team of experts is committed to providing personalized support and guidance throughout the process. By setting SMART goals and leveraging the power of eFunder, you can position your business for success in today's competitive market.

Choosing the Right Online Payment Gateway for Your UAE Business

In today's digital age, a reliable and efficient online payment gateway is essential for the success of any e-commerce business. With a wide range of options available, selecting the best payment gateway for your UAE-based business can be challenging. This guide will help you navigate the process and make an informed decision. Key Factors to Consider: Compatibility: Ensure the payment gateway seamlessly integrates with your e-commerce platform and other business systems. Security: Prioritize payment gateways that offer robust security measures to protect your customers' sensitive data. Transaction Fees: Compare transaction fees and other charges to identify cost-effective options. Payment Methods: Consider the range of payment methods supported by the gateway, including credit cards, debit cards, digital wallets, and local payment options. Global Reach: If you plan to expand your business internationally, choose a payment gateway that supports multiple currencies and payment methods. Customer Support: Evaluate the quality and responsiveness of the payment gateway's customer support services. Payment Gateways in the UAE Partnered with eFunder: Tap: Tap provides seamless and secure payment processing, making transactions quick and hassle-free. Stripe: Stripe is a global leader in online payments, known for its developer-friendly platform and robust security. MamoPay: MamoPay simplifies payments with its user-friendly interface and efficient transaction processing. Tabby: Tabby offers flexible payment solutions, allowing customers to buy now and pay later with ease. Additional Considerations: Seller Financing: Explore financing options to support your e-commerce business, including inventory management, marketing, and growth. E-commerce Platforms: Consider the payment gateway options offered by your chosen e-commerce platform. By carefully evaluating these factors and considering your specific business needs, you can select the most suitable online payment gateway to enhance your e-commerce operations and drive sales in the UAE market.

TikTok Shop’s Rise: Will It Come to the UAE?

The world of e-commerce is constantly evolving, with new platforms and trends emerging all the time. One of the hottest topics in recent months is TikTok Shop, a feature within the popular social media app that allows users to discover and purchase products directly from creators. TikTok Shop has seen explosive growth in markets like China and Southeast Asia, quickly becoming a major player in the e-commerce landscape. This begs the question: Will TikTok Shop come to the UAE? There's no official confirmation yet, but the potential is undeniable. Here's why the UAE could be a fertile ground for TikTok Shop: High Social Media Engagement: The UAE boasts a highly engaged social media population, with TikTok being a major player. Integrating shopping seamlessly into this platform could be a game-changer for both sellers and consumers. Influencer Marketing Powerhouse: The UAE influencer scene thrives on platforms like TikTok. Leveraging this existing ecosystem could be a powerful marketing tool for TikTok Shop. E-commerce Growth: The UAE's e-commerce market is experiencing rapid growth, with a tech-savvy and mobile-first consumer base. TikTok Shop could cater to this growing demand. However, entering a new market with established players like Amazon and Noon comes with challenges. Competition: E-commerce giants already have a strong foothold in the UAE market. User Adoption: Will users readily adopt a new e-commerce platform within TikTok? So, what are the options for UAE-based e-commerce businesses? Stay Ahead of the Curve: Keep an eye on TikTok Shop's developments and explore potential opportunities. Focus on Multi-Channel Strategies: Don't rely solely on one platform. Maximize your presence on existing platforms and diversify your e-commerce strategy. Secure Seller Funding: Optimize your operations and growth with financial support from platforms like eFunder. Seller finance solutions can help with inventory management, marketing efforts, and scaling your online business. While the future of TikTok Shop in the UAE remains uncertain, it's a trend e-commerce businesses should be aware of. By adapting to the changing landscape and utilizing the right resources like seller funding, you can stay ahead of the curve and thrive in the competitive world of e-commerce.

Women in Business: Female-Led Enterprises in the UAE

The United Arab Emirates has witnessed a remarkable rise in the number of women entrepreneurs in recent years, contributing significantly to the nation's economic growth. These women in business have demonstrated exceptional leadership, innovation, and resilience, inspiring countless others to pursue their entrepreneurial dreams. One such inspiring figure is Jumana Al Darwish (@jumanaaldarwish), a visionary leader in the sustainable fashion industry. Her brand, R’eem, is renowned for its eco-friendly and ethically sourced designs, challenging traditional norms and promoting a more sustainable future. Jumana's commitment to social responsibility and her innovative approach to business have made her a role model for aspiring women entrepreneurs in the UAE. Latifa Bin-Haider (@latifabinhaider), is a successful entrepreneur in the technology sector. As the founder of Latifa Ventures, she has invested in numerous startups and provided mentorship to young entrepreneurs. Latifa's passion for technology and her dedication to empowering women in business have solidified her position as a leading figure in the UAE's entrepreneurial ecosystem. Noor Sweid is a prominent women entrepreneur and the Founder and Managing Partner at Global Ventures. Her firm has invested in a wide range of startups across various industries, demonstrating her expertise and vision in the venture capital space. Noor's contributions to the UAE's entrepreneurial ecosystem have made her a respected figure among investors and entrepreneurs alike. Randa Ayoubi is the co-founder and CEO of Rubicon Group Holding (RGH), a global entertainment and production company known for creating innovative entertainment and interactive educational content. RGH operates with hundreds of employees across offices in Amman, Los Angeles, Manila, and Dubai. Founded by Ayoubi in 2004, she also serves as Chairperson of the Red Sea Institute for Cinematic Art and is a Board Member of the Children’s Museum of Jordan. Ayoubi has been recognized as Business Woman of the Year by CEO Middle East Awards and ranked among the most influential women in the Middle East by The Economist (2007) and Arabian Business (2010). Sarah Hamouda, a 38-year-old British-Egyptian entrepreneur, founded Fix Dessert Chocolatier in 2021. Based in Dubai, Fix quickly gained global recognition for its innovative pistachio-filled chocolate bars. Initially inspired by Hamouda's pregnancy cravings, the business rapidly grew from modest daily orders to 500 orders a day.Despite limited production capacity, Fix’s $20, 200-gram bars sell out within minutes on Deliveroo due to high demand. The brand has expanded from a home operation to a team of 10, though demand still often exceeds supply. Hamouda is proud of the global impact her creations have made, and with international expansion in sight, she sees a bright future for Fix Dessert Chocolatier. These are just a few examples of the many remarkable women entrepreneurs who are shaping the business landscape in the UAE. Their success stories demonstrate the potential for women-owned businesses to thrive in the region and contribute to its economic development. We offer a range of financial solutions, instant funding, and working capital advances, to help you achieve your goals.Contact sales@efunder.ai today to learn more about how eFunder can help you turn your entrepreneurial dreams into reality.

Efficient eCommerce Fulfillment in the GCC/UAE

The UAE has emerged as a thriving hub for e-commerce in the GCC region. Its strategic location, coupled with a favorable business environment, has fueled the growth of the e-commerce market in the UAE. The UAE ecommerce market size has expanded significantly in recent years, driven by factors such as a growing population, increased internet penetration, and a shift towards online shopping. Efficient fulfillment is a critical aspect of a successful e-commerce business. It involves managing inventory, order processing, packaging, and shipping to ensure timely delivery of products to customers. In the GCC region, strategic location plays a crucial role in optimizing e-commerce fulfillment. The UAE's central position in the region provides easy access to major markets, reducing shipping times and costs. eFunder understands the importance of efficient e-commerce fulfillment and offers financing for ecommerce business to help businesses optimize their operations. With eFunder, you can access ecommerce funding to invest in inventory management systems, warehouse facilities, and transportation infrastructure. We offer flexible financing options tailored to the needs of your ecommerce startup. Key benefits of efficient e-commerce fulfillment in the GCC/UAE: Reduced shipping times: The UAE's strategic location allows for faster delivery to regional markets. Lower shipping costs: Proximity to major markets can help reduce transportation expenses. Improved customer satisfaction: Timely delivery and efficient fulfillment contribute to positive customer experiences. Increased sales: Effective fulfillment can lead to higher customer satisfaction and repeat business. eFunder is committed to supporting the growth of e-commerce businesses in the GCC region. By providing ecommerce funding and resources, we help businesses achieve their goals and succeed in the competitive market.

How to Improve Your Cash Flow Management as a Small Business Owner in the UAE

Cash flow is the lifeblood of any business, especially for small businesses operating in the UAE. Effective cash flow management is essential for ensuring your business's financial health, sustainability, and growth. By understanding and implementing sound cash flow strategies, you can optimize your operations, meet your financial obligations, and seize new opportunities. Key Strategies for Improved Cash Flow Management Create and Stick to a Budget: Develop a detailed budget that outlines your income, expenses, and cash flow projections. Regularly monitor your budget and make adjustments as needed to ensure you stay on track. Track Your Cash Flow: Keep accurate records of your income and expenses. Use accounting software or spreadsheets to track your cash inflows and outflows, allowing you to identify areas where you can improve your cash flow. Collect Payments Promptly: Implement efficient invoicing and payment collection procedures. Send invoices promptly and follow up with customers to ensure timely payments. Consider offering discounts for early payments to incentivize customers to pay on time. Manage Your Inventory Effectively: Avoid overstocking inventory, as excess inventory can tie up your cash. Implement inventory management systems to optimize stock levels and minimize unnecessary costs. Negotiate with Suppliers: Explore opportunities to negotiate better payment terms with your suppliers. Consider asking for longer payment terms or discounts for early payments. Explore Financing Options: If you're facing cash flow challenges, consider exploring financing options eFunder's services, such as invoice financing, working capital advances, and vendor advance programs. These options can provide the necessary funds to bridge cash flow gaps and support your business growth. Monitor Your Accounts Receivable: Keep a close eye on your accounts receivable to ensure that customers are paying their invoices on time. If you have outstanding invoices, take proactive steps to collect the payments. Reduce Unnecessary Expenses: Review your expenses regularly and identify areas where you can cut costs. Consider negotiating better deals with suppliers, reducing waste, or finding more efficient ways to operate your business. By implementing these strategies, you can significantly improve your cash flow management and enhance the overall financial health of your small business in the UAE. Remember, effective cash flow management is an ongoing process that requires consistent attention and proactive measures.

International Expansion from UAE: How to use Amazon as Launchpad for global growth

Are you a UAE-based business looking to expand your reach globally? Amazon offer excellent platforms to launch your products into international markets. However, expanding operations can be capital-intensive. This is where eFunder comes in. We provide tailored financing solutions to help you navigate the challenges of global expansion and maximize your growth potential. Leveraging Amazon for Global Reach Wide Customer Base: Amazon has millions of active users worldwide, providing a vast potential customer base for your products. Established Marketplaces: This platform offer a proven infrastructure and ecosystem for sellers, making it easier to set up and manage your online store. Fulfillment Services: Amazon's Fulfillment by Amazon (FBA) and Noon's Fulfillment by Noon (FBN) services can streamline your logistics and delivery operations. eFunder's Financing Solutions for Global Expansion Invoice Financing: If you're facing cash flow challenges due to delayed payments from customers, invoice financing can provide immediate liquidity. Working Capital Advances: Need funds to cover operational expenses or invest in growth initiatives? Working capital advances can help you bridge the gap. Vendor Advance Programs: If you're a supplier to larger businesses, vendor advance programs can provide upfront payments for your invoices, improving your cash flow. Why Choose eFunder? Tailored Solutions: We work closely with you to understand your specific needs and provide customized financing options. Fast and Efficient: Our application process is streamlined, and we offer quick approval withing 48 hours to help you access funds promptly. T&C Apply* Competitive Rates: We provide competitive interest rates and flexible repayment terms. Dedicated Support: Our team of experts is available to guide you through the entire financing process. Start Your Global Expansion Journey with eFunder By leveraging the power of Amazon and Noon and partnering with eFunder, you can confidently expand your business into international markets. Our financing solutions can provide the financial support you need to achieve your global growth goals. Contact sales@efunder.ai today to learn more about how eFunder can help you take your business to the next level.

How to Get Funding/Investment for Your Business with eFunder: 5 Simple Steps

Are you looking to expand your business, launch a new product, or hire additional staff? eFunder is here to help you secure the business financing you need. Our user-friendly platform connects you with a wide range of investors and lenders, making it easier than ever to find the right business funding for your venture. 5 Simple Steps to Get Funding with eFunder: Integrate Your Seller Account: Connect your online marketplace or e-commerce platform to eFunder. This allows us to access your sales data and identify eligible invoices. Select Invoices or Receivable Amount: Choose the invoices or receivable amount you want to receive an advance against. You can select individual invoices or opt for a bulk advance. Receive Up to 95% of Value of Receivables: Within 24 hours, you'll receive up to 95% of the value of the selected receivables directly into your account. This provides you with immediate access to funds. Get Notified When Your Customer/Client Settles the Invoice: You'll be notified as soon as your customer or client settles the invoice. This ensures transparency and keeps you informed about your funding status. Withdraw the Balance: Once the invoice is settled, the remaining balance (after deducting the advance and fees) will be added to your reserve. You can withdraw this balance immediately, providing you with additional flexibility. Why Choose eFunder? Fast and Efficient: Our streamlined process ensures you receive funding quickly, allowing you to seize opportunities and accelerate your business growth. Flexible Options: Choose the invoices or receivable amount that best suits your needs, providing you with tailored financing solutions. Transparent and Reliable: Benefit from our transparent terms and reliable service, ensuring a hassle-free funding experience. Start Your Funding Journey Today Ready to take your business to the next level? Visit eFunder and begin your search for business financing. With our simple process and extensive network of investors, you're just a few steps away from securing the business capital you need to succeed.

Building a Strong Financial Foundation: Essential Tips for Your Business

Laying the Groundwork for Success A solid financial foundation is crucial for the long-term success of any business. Whether you're just starting out or looking to expand your operations, understanding your sources of business finance and effectively managing your business financing is essential. Key Tips for Building a Strong Financial Foundation: Create a Comprehensive Business Plan A well-crafted business plan outlines your financial goals, projections, and strategies. This document serves as a roadmap for securing lending for business and making informed financial decisions. It should include detailed financial projections, market analysis, and a clear explanation of your business model. Understand Your Financing Needs Assess your business's specific financial requirements. Determine whether you need business funding for capital expenditures (e.g., purchasing equipment or property), working capital (e.g., covering day-to-day expenses), or debt repayment. This understanding will help you identify the most suitable financing options. Explore Different Funding Options: Explore various sources of funding available to businesses, including: Lending for Business: Consider business lending options such as bank loans, lines of credit, and SBA loans. These options involve borrowing money and repaying it with interest. Equity Financing: Explore equity financing through venture capital, angel investors, or crowdfunding. In this case, you sell ownership stakes in your business in exchange for capital. Alternative Financing: Consider alternative sources like invoice factoring, merchant cash advances, or equipment financing. These options offer unique financing structures to meet specific business needs. Manage Your Cash Flow: Effective cash flow management is essential for a healthy business. Monitor your income and expenses closely, and implement strategies to improve your cash flow. This includes creating a cash flow forecast, managing accounts receivable and payable efficiently, and minimizing unnecessary expenses. Build a Credit History: A strong credit history can improve your chances of securing lending for business at favorable terms. Pay your bills on time and avoid excessive debt. Building a positive credit history takes time, so start early and maintain good credit practices. Seek Professional Advice: Consult with financial experts, such as accountants or financial advisors, to get personalized guidance on your business financing needs. They can help you understand your financial situation, develop a financial strategy, and navigate the complexities of business lending and other funding options. By following these tips, you can build a solid financial foundation for your business. Understanding your sources of business finance and effectively managing your business financing will help you achieve your goals and navigate the challenges of the business landscape. Remember, a strong financial foundation is essential for long-term success and growth.

Fintech Trends to Watch in 2025 in Dubai

Before we set our sights on 2025, let's reflect on the fintech landscape of 2024. Dubai's fintech landscape has witnessed remarkable growth and innovation in 2024. The year has been marked by a surge in digital lending companies offering a variety of business financing solutions. Lending for business has become more accessible and efficient, with a particular focus on working capital financing and SME finance. Key Trends Shaping the Dubai Fintech Market: Rise of Digital Lending: The adoption of digital lending platforms has accelerated, providing businesses with quicker access to company financing. Focus on SME Finance: Dubai's vibrant SME sector has benefited from tailored SME finance solutions, empowering small and medium-sized enterprises to scale and grow. Innovation in Financing Products: Fintech startups have introduced innovative fintech products to address specific business needs, such as sources of business finance for niche industries. Also Read: Financial Planning for SMEs in 2024 Looking Ahead: What to Expect in 2025 As we step into 2025, Dubai's fintech industry is poised to continue its upward trajectory. Here are some trends to watch: Further Digitization: Expect to see even more fintech companies leveraging advanced AI technologies to streamline business funding processes. Expansion of Alternative Financing: Alternative financing options, such as invoice factoring and peer-to-peer lending, will gain popularity as businesses seek diverse business capital sources. Integration with Traditional Banking: Collaboration between fintech startups and traditional banks will likely deepen, leading to hybrid models that combine the best of both worlds. Dubai's fintech ecosystem has demonstrated its resilience and potential in 2024. With a strong focus on business financing, SME finance, and digital lending, the city is well-positioned to remain a global fintech hub in the years to come. As the industry continues to evolve, businesses can look forward to even more innovative and accessible fintech products to support their growth ambitions.

Amazon vs. Noon: Which Marketplace is Right for Your E-commerce Business?

Wondering which e-commerce platform to choose in the UAE’s bustling market? When expanding your e-commerce business into the Middle East and North Africa (MENA) region, Amazon and Noon are two of the most prominent marketplaces to consider. With both platforms rapidly gaining traction among sellers, making the right choice is crucial for your business. Amazon vs. Noon: Choosing the Ideal Platform for Your Business In today’s business world, marketplaces are where the action is. But to really make the most of these platforms, you need more than just a quick look—you’ll want some expert advice to help you get the best results. Amazon: Breaking Down the Powerhouse Amazon is a major player thanks to its huge global reach. With millions of active users around the world, it gives your business amazing visibility and access to a broad audience. This can be a huge advantage if you're looking to grow quickly and tap into international markets. Amazon’s global reach and extensive infrastructure provide unparalleled visibility and access to a broader audience. Its robust financing options offer more flexible and extensive solutions compared to Noon’s regional focus. eFunder is a great choice for Working Capital Financing and invoice financing. It’s perfect for both Amazon and Noon sellers. With eFunder, we fetch the approved invoices online and get funding in 24 hours—fast access to the cash you need. And for working capital we check your historical data on Amazon or Noon and get 4-6 weeks of your future sales upfront which helps SME's with their cashflow. T&C apply* We offer flexible solutions, tailored to fit your needs. Plus, our competitive rates and simple requirements, focusing on your customers’ creditworthiness rather than your own, make it easier to qualify for financing. eFunder’s invoice financing has some great perks over traditional bank loans, including quicker funding, more flexible options, and a hassle-free online application process. Invest in your business's future with eFunder. Our innovative tools and expert guidance will help you maintain a strong credit profile and unlock new opportunities. Also Read: A Step-by-Step Guide for Setting Up Your Amazon Seller Account in UAE Noon: Regional Focus and Targeted Solutions On the other hand, Noon's deep-rooted presence in the MENA region positions it as a formidable competitor for businesses seeking to tap into this market. With a focus on local market dynamics, Noon offers tailored solutions, competitive pricing, fast delivery within the UAE, and specialized financing options that align with the needs of local sellers. These advantages set it apart from global competitors like Amazon, making it a strong choice for businesses targeting the MENA market. Local Focus: Noon understands regional consumer needs, offering a tailored approach for the MENA market. Competitive Pricing: Noon often provides exclusive deals and competitive pricing to attract customers. Fast and Reliable Delivery: Significant investments in logistics ensure prompt delivery across the UAE. Growing Ecosystem: Noon is expanding its services with Noon Food and Noon Daily, providing additional opportunities for sellers. Marketplace Financing: This helps bridge the gap between invoice generation and payment collection, making it easier to manage cash flow. Working Capital Marketplace: Noon’s financing options provide access to working capital, which is crucial for maintaining smooth operations and investing in growth. If you’re looking for alternatives to traditional financing, Noon’s marketplace lending and marketplace loans might be just what you need. These options are tailored to meet the unique needs of marketplace sellers, offering flexible terms and faster access to funds. Plus, Noon’s financing solutions are designed to help with specific cash flow challenges and investment needs. This way, you can get the resources you need to succeed in a competitive market. Also Read: How to Set up a Seller’s Noon Account Choosing between Amazon and Noon really comes down to your business goals and where you want to focus. eFunder is a great choice for Working Capital Financing and invoice financing. It’s perfect for both Amazon and Noon sellers. With eFunder, we fetch the approved invoices online and get funding in 24 hours—fast access to the cash you need. And for working capital we check your historical data on Amazon or Noon and get 4-6 weeks of your future sales upfront which helps SME's with their cash flow. T&C apply* We offer flexible solutions, tailored to fit your needs. Plus, our competitive rates and simple requirements, focusing on your customers’ creditworthiness rather than your own, make it easier to qualify for financing. eFunder’s invoice financing has some great perks over traditional bank loans, including quicker funding, more flexible options, and a hassle-free online application process. Invest in your business's future with eFunder. Our innovative tools and expert guidance will help you maintain a strong credit profile and unlock new opportunities.Also Read: How eFunder.ai is Empowering Marketplace Sellers To Take Their Business To The Next Level

Top Growth Industries for UAE e-commerce SMEs: Conquer the Digital Marketplace

The UAE's e-commerce scene is booming, driven by a tech-savvy population and a growing appetite for online shopping. This presents a golden opportunity for small and medium-sized enterprises (SMEs) to carve their niche in the digital marketplace. But with so many categories to choose from, which industries offer the most fertile ground for e-commerce success? Here, we explore the top growth industries for UAE e-commerce SMEs: 1. Fashion & Beauty: UAE residents are known for their discerning taste and love for all things stylish. This translates to a thriving online fashion and beauty market. Whether you offer trendy apparel, luxurious skincare products, or high-end fragrances, there's a dedicated customer base waiting to be discovered. 2. Electronics & Appliances: Cutting-edge technology is a major draw for UAE consumers. Capitalize on this trend by offering the latest gadgets, smartphones, home appliances, and other electronic devices. Partnering with top brands or offering competitive pricing can set you apart in this dynamic market. 3. Home & Living: With a growing focus on creating stylish and comfortable living spaces, the demand for homeware and décor items is surging. From furniture and bedding to kitchenware and gardening supplies, cater to the desire for a well-curated home environment. 4. Health & Wellness Products: The UAE prioritizes well-being, leading to a rising demand for health and wellness products. Whether it's organic food options, fitness supplements, or natural beauty products, tap into this market segment dedicated to holistic living. Conquering the Digital Marketplace: Finding your niche within these top growth industries is just the first step. To truly thrive in the UAE's e-commerce landscape, consider these crucial aspects: Choosing the Best E-commerce Marketplace: Explore popular platforms like Amazon, Noon, and Sharaf DG, each with its unique advantages and customer base. Building a Strong Online Presence: Create a user-friendly website or mobile app with secure payment gateways and efficient logistics. Optimizing Marketing Strategies: Utilize social media marketing, search engine optimization (SEO), and targeted advertising to reach your ideal customers. Providing Exceptional Customer Service: Build trust and loyalty by offering prompt responses to inquiries, efficient delivery services, and hassle-free returns. Fueling Your E-commerce Journey with eFunder: Launching and scaling an e-commerce business requires a robust financial foundation. eFunder, your one-stop shop for financing solutions, can be your partner in success: Business Funding Solutions: Access a variety of funding options like small business loans, investment opportunities, or working capital financing tailored to your specific needs. Company Financing & Investment for Business: Connect with investors and explore funding options best suited for your growth goals. Working Capital Lenders: Secure the working capital needed to manage inventory, marketing campaigns, and day-to-day operations. Don't just survive - thrive! With a strategic approach, a focus on the right industries, and the financial support of eFunder, your UAE e-commerce SME can soar in the competitive digital marketplace. Now that you've explored these top growth areas, the question remains: which industry speaks to your entrepreneurial spirit? Take the first step today and unlock the immense potential of the UAE's e-commerce landscape!

A Step-by-Step Guide for Setting Up Your Amazon Seller Account in UAE