Restaurant Owners’ Guide to Preparing for Ramadan 2024

While approaching the blessed month of Ramadan restaurateurs are confronted with a peculiar gastronomical dilemma. Such moments provide restaurateurs with the opportunity to serve numerous customers waiting for this occasion.

In this post, we’ll get into some potentially essential strategies these entrepreneurs could employ as preparations take shape for Ramadan 2024 – capitalizing on the benefits provided by such massive events.

Understanding Ramadan

In order to get ready for Ramadan the significance of this month in terms of the Muslim approach should be understood. This month denotes an event of self-control, spiritual growth, and communal harmony. Introduce yourself and your team to the socio-religious aspects that characterize Ramadan to develop a dining setting oriented around inclusion and respect.

Create a special Ramadan menu

Consider creating a unique Ramadan menu which is a combination of traditional and creative recipes. The common iftars food items like dates and refreshing fruit juices are accentuated along with the traditional such as biryani, kebabs, and samosas. Offering variety will make your restaurant appealing to a wide range of tastes.

Adapt operating hours

Since the dining habits are remarkably peculiar during Ramadan, it is advisable to adjust your restaurant’s service times. Extend your overnight activities to accommodate Iftar and Suhoor (pre-dawn meal) timetables. Such a shift could attract customers looking for pleasant and comfortable mealtimes during these specific timeframes.

Promote Healthy Options

Promote the importance of health during Ramadan, and increase choices for healthy food on your list. Serve lighter meals, leafy green mixes, and mixed ripe fruits for people who are very careful about their eating habits during this fasting period.

Marketing and Promotion

Use social media, email bulletins as well as the restaurant’s web page to advertise your Ramadan specials. Consider offering discount packages or deals for groups to join together during Iftar. Engage in discussions with regular diners of your restaurant and create enthusiasm regarding the readiness for this religious observance.

Accommodate large groups

Family and friends congregate in an assortment of numbers for Iftar during Ramadan. Make sure that your eatery has space to hold such gatherings by offering group deals or bookings. While creating a cozy, comfortable environment designed for community meals can enhance your customers’ overall dining experience.

Train your staff

Make sure your team is very well prepared to serve the unique needs of Ramadan. They should be familiar with cultural subtleties, knowledgeable about unusual food sales, and explain that quick but polite service is the priority. It is essential that every employee understands the value of this time and can create an amicable environment.

Collaborate with local communities

Boost local engagement by joining forces with neighborhood mosques, community hubs, or societies. Think about supporting communal happenings or teaming up with regional trendsetters to heighten your diner's prominence during Ramadan.

Conclusion

As a restaurateur gearing up for Ramadan 2024, it demands an insightful mix of respecting cultural diversity, embracing gastronomic imagination, and demonstrating entrepreneurial capacity. By tuning into the essence of Ramadan and fine-tuning your services to match distinct customer requirements during this sacred month can yield not only unforgettable dining moments but also cultivate enduring relationships in your community. The fasting period isn’t merely abstinence; restaurants too have a chance to add vibrancy by contributing joyousness and solidarity symbolic of this hallowed month.

About eFunder

If you are managing an enterprise and require financial support to boost your expansion .efforts, please do not hesitate to reach out to eFunder.ai by completing our inquiry form. We help businesses get access to funds that are essential for their business growth. Join us today: https://efunder.ai/get-started/

Related Articles

The Lifeblood of eCommerce: Mastering Cash Flow Management

Cash is king for any business, especially for eCommerce companies operating on digital platforms. Without diligent oversight and strategic cash flow management, even promising online retailers can quickly fall into financial disarray. Fortunately, the very nature of eCommerce provides greater visibility into cash changing hands compared to traditional brick-and-mortar stores. With the right cash management strategies, eCommerce businesses can unlock greater stability, smarter spending, and ampler resources for capturing growth opportunities. Follow these essential tips to master the art and science of managing your eCommerce cash flow. Choose the optimal business banking for online sellers Your business bank accounts provide the foundation for managing cash inflows and outflows. Yet, many eCommerce entrepreneurs use the same personal checking account as early startups. This exposes the business to undue risk and fails to take advantage of specialized services for online sellers. To upgrade your banking, research national and regional banks and credit unions offering tailored products for eCommerce. You will want to secure: A dedicated business checking account in your company's name An integrated merchant account for accepting credit card payments Fraud protection and transaction monitoring Minimal account fees and requirements A separate merchant account through your payment processor gives quick access to credit card funds. If your primary bank experiences issues, having a backup merchant account prevents disruption to your cash flow. Consider spreading your accounts across two banks or institutions. This diversifies risk should any single provider face outages. You gain flexibility and control over cash with the right business banking mix. Centralize financial data in ecommerce accounting software Business bank accounts provide cash access points while accounting software delivers overarching visibility and control. The right accounting platform centralizes all financial transactions from sales to expenses, inventory costs, payroll, taxes, and profit. Choose software with robust functionality tailored to eCommerce, including: Multi-channel sales data aggregation Automated inventory cost tracking Customer invoice and payment management Revenue analytics and reports Cash flow forecasting Bank and credit card reconciliation Having all accounting data flow through connected software provides transparency into the real-time status of available cash. This enables smarter decisions aligned with the financial position. Optimize inventory to balance cash needs Carrying excess inventory unnecessarily ties up cash that could be used for other business purposes. Employ proven inventory management techniques to align your in-stock products with actual consumer demand. Using past sales data, forecast demand for each product. Then implement tactics like: Dropshipping low-volume items Just-in-time manufacturing to reduce stockpiling Lean, just-in-time purchasing based on lead times and demand First-in, first-out (FIFO) management to reduce obsolete stock The ultimate goal of optimized inventory management is to match supply with consumer demand so you don't get stuck holding obsolete, aging products that tie up cash reserves and warehouse space. Data-driven inventory optimization provides visibility into what, when, and how much to stock so you can meet order fulfillment needs while freeing up cash to fund growth initiatives. Forecast cash flow needs for greater control Access to historical data on your eCommerce business's sales volumes, profit margins, expenses, and other financial KPIs empowers you to forecast future cash flow needs accurately. While you can estimate future cash requirements manually, utilizing financial modeling software for automated, data-driven forecasts is better. When software can digest your historical data trends, it can then project scenarios for: Cash requirements during peak sales periods so you can have extra reserves available. Slow sales months when you may decide to pay down debt or redirect marketing spend. Potential cash shortfalls well in advance so you can adjust spending or secure financing. Quarters with excess cash that could be invested in growth initiatives. The biggest benefit of forecasting is it removes the guesswork from cash flow planning. You gain visibility into your cash position months or quarters ahead of time, allowing you to proactively tweak operations, financing, and investments to ensure cash flow aligns with strategic objectives. Speed up customer payments for faster cash flow Even profitable eCommerce companies can experience cash crunches if customer payments drag out too far. Implement best practices to accelerate customer payment collection: The faster you can collect customer payments, the faster you can reinvest funds into inventory, marketing, hiring, and other areas. Employ these accounts receivable best practices to improve payment collection speed: Offer discounts for early or on-time payments to incentivize customers to pay within your terms. Use accounting software to send automated invoice reminders when payments are due. Accept credit card payments and direct bank payments like ACH to get funds deposited quickly. Leverage escrow services to secure payment for very large orders before fulfillment. Quickly deposit checks via mobile deposit so they clear faster. The goals are to reduce the number of unpaid invoices dragging on 30, 60, or 90+ days and to shorten the payment collection cycle. For eCommerce, best practice is to collect most payments within 7, 14, or 30 days. The less time funds are stuck in accounts receivable, the smoother your cash flow will be. Allocate excess cash to growth initiatives Occasional cash reserves exceeding your expense needs provide an opportunity for growth. Work with advisors to determine strategic uses like: - Paying down high-interest debt - Investing in technology, equipment, or facilities - Expanding marketing programs, outreach, and advertising - Hiring initiatives to upgrade talent or expand teams - Building an emergency fund as a contingency Though tempting to spend excess cash, consult your accountant to find the wisest allocations. This ensures excess cash gets employed to improve the bottom line. Conclusion Managing cash flow is among the most vital activities for eCommerce managers. While not flashy or exciting, building competency in overseeing cash inflows and outflows determines your financial staying power. Follow the above tips to implement data-driven systems, processes, tools, and policies for mastering cash. Gain the visibility and control needed to invest cash smartly, cover costs confidently, and seize growth opportunities as they arise. With robust cash flow management, your eCommerce venture can thrive well into the future. eFunder.ai – Your companion in finance aid eFunder.ai is a leading digital financing platform that enables small and medium-sized businesses to have instant cash and consistent cash flow against their receivables. eFunder.ai helps boost business growth by taking full control of your receivables. Whether you are a vendor, marketplace seller, restaurant owner, or part of another industry, eFunder.ai offers funding solutions to stabilize cash flows and support expansion plans. With millions in cash advanced to date and a commitment to transparency and hassle-free onboarding, eFunder.ai is a trusted financing partner for entrepreneurs and business owners.

Financial Planning for SMEs in 2024

As we step into 2024, SMEs are gently pushed towards the crossroads of opportunities and challenges. This year will witness newer shifts and developments in the technological and economic landscape provoking small and medium-sized enterprises to embrace proactive plans and strategies to assure steady growth. In this short guide, we will dive into the financial planning for SMEs in 2024 and how to produce multi-dimensional annual scenarios. Past mistakes – a lesson to learn Everybody makes a mistake, and your enterprise is no exception. Learning from past mistakes to make foolproof financial strategies will ensure that you are on the right track and that you will not repeat the same grave mistakes. Here are a few tips to evaluate your flaws from the last year. Retrospection: identify and acknowledge the mistakes you made in the last year. Root causes and their consequences in financial loopholes should be analyzed thoroughly. Documentation: keeping a record of issues and concerns from the past years that resulted in financial loss will be a guidebook to build a foolproof strategy this year. Cultivating a culture of knowledge-sharing ensures that mistakes from the past are disseminated throughout the organizational structure. Adaptability: recognizing that your business landscape is ever-changing, you may need to accept the fact that what financial plan worked in the past year may not be valid this year. Financial planning for SMEs The financial planning should set a clear and actional goal. Such goals are taken as resolutions that not only go with the overall company’s vision but also address specific concerns essential for sustainable growth and resilience. Here are some of the factors to mind: Identify financial goal Considering all channels of income and expenses will help you set your financial goal for SMEs in 2024. For instance, revenues may come from DTC and Amazon through new customer acquisition, and returning customer revenue can be separated from wholesale revenue. Likewise, expenses could have segregated sections such as value prop budgeting, activity-based budgeting, incremental budgeting, and so on. Target revenue growth Encompass both short- and long-term objectives to set a clear outline for your revenue growth target for the year. The holistic approach would get you a complete picture of your financial ambitions. You may then break down these revenue targets into products or services and segment through customers or geographical sections. Strategize cost management You may implement some measures to monitor and manage the costs of operations and overheads. This helps you assure fiscal stability in economic uncertainties. You may adopt some cost-efficient planning; nevertheless, SMEs need to pay utmost attention that cutting down the cost should not affect customer satisfaction or experience. Financial health check for SMEs in 2024 The year 2024 will come with its own challenges of fast-paced technological change and volatile consumer demands. Hence, for SMEs, it is essential to establish and maintain stringent financial health checks. Here are some of the essential factors to mind while doing the check: Comprehensive fiscal analysis: get deeper into balance sheets, income statements, and cash flow records to figure out the financial ratio showcasing liquidity, profitability, and solvency. Liability and debt assessment: SMEs need to review their debts and liabilities along with checking the terms and amounts of existing borrowings. Interest rates and schedules of repayment may help build a clearer picture. Optimize inventory management: Preventing overstocking and stockouts is quite essential to have foolproof finance planning for SMEs. Evaluating and adjusting inventory management will help you achieve it. Tax planning: You must review current tax liabilities and make sure they fall in compliance with local tax regulations. Explore opportunities while mitigating tax liabilities without compromising on legal ethics. Technology integration: Technology evolves every hour, and your financial goal should include this factor. If SMEs deal with sensitive data or you want to expand your customer base, the latest technology solutions such as cloud computing, and mobile app development integrating contemporary technologies like IoT, Blockchain, AR/VR, and AI should be considered a fruitful investment. Work automation through robotic process automation, chatbots, and virtual assistants is the need of the hour. Cyber security, financial planning and analysis (FP&A) tools are worth investing in. Ready to execute a financial plan? Having a multi-dimensional approach in calculating and evaluating the balance sheet and learning from the mistakes made in the past year, you can execute the new finance plan for SMEs in 2024. You need to get all key stakeholders in place and discuss the feasibility of the finance plan for 2024. Whether you are more concerned with maximum cash or do you want steady growth to build the foundation for your SME for years to come? You need to discuss every facet of the finance plan for 2024 before implementing it in real life. eFunder.ai as a great helping hand If you're considering financing needs for your business, eFunder.ai's digital solutions can make a significant difference in meeting your working capital requirements. Their advantages include instant same-day payments, consistent cash flow, quick onboarding, transparent processes, and flexible funding tailored to your business needs. Thus, eFunder.ai comes as a helping hand to your SME in planning finance for 2024. Whether you want funds to initiate a new line of products or want to zero your debt, eFunder.ai can do it all for you.

Restaurant Owners’ Guide to Preparing for Ramadan 2024

While approaching the blessed month of Ramadan restaurateurs are confronted with a peculiar gastronomical dilemma. Such moments provide restaurateurs with the opportunity to serve numerous customers waiting for this occasion. In this post, we’ll get into some potentially essential strategies these entrepreneurs could employ as preparations take shape for Ramadan 2024 – capitalizing on the benefits provided by such massive events. Understanding Ramadan In order to get ready for Ramadan the significance of this month in terms of the Muslim approach should be understood. This month denotes an event of self-control, spiritual growth, and communal harmony. Introduce yourself and your team to the socio-religious aspects that characterize Ramadan to develop a dining setting oriented around inclusion and respect. Create a special Ramadan menu Consider creating a unique Ramadan menu which is a combination of traditional and creative recipes. The common iftars food items like dates and refreshing fruit juices are accentuated along with the traditional such as biryani, kebabs, and samosas. Offering variety will make your restaurant appealing to a wide range of tastes. Adapt operating hours Since the dining habits are remarkably peculiar during Ramadan, it is advisable to adjust your restaurant’s service times. Extend your overnight activities to accommodate Iftar and Suhoor (pre-dawn meal) timetables. Such a shift could attract customers looking for pleasant and comfortable mealtimes during these specific timeframes. Promote Healthy Options Promote the importance of health during Ramadan, and increase choices for healthy food on your list. Serve lighter meals, leafy green mixes, and mixed ripe fruits for people who are very careful about their eating habits during this fasting period. Marketing and Promotion Use social media, email bulletins as well as the restaurant’s web page to advertise your Ramadan specials. Consider offering discount packages or deals for groups to join together during Iftar. Engage in discussions with regular diners of your restaurant and create enthusiasm regarding the readiness for this religious observance. Accommodate large groups Family and friends congregate in an assortment of numbers for Iftar during Ramadan. Make sure that your eatery has space to hold such gatherings by offering group deals or bookings. While creating a cozy, comfortable environment designed for community meals can enhance your customers’ overall dining experience. Train your staff Make sure your team is very well prepared to serve the unique needs of Ramadan. They should be familiar with cultural subtleties, knowledgeable about unusual food sales, and explain that quick but polite service is the priority. It is essential that every employee understands the value of this time and can create an amicable environment. Collaborate with local communities Boost local engagement by joining forces with neighborhood mosques, community hubs, or societies. Think about supporting communal happenings or teaming up with regional trendsetters to heighten your diner's prominence during Ramadan. Conclusion As a restaurateur gearing up for Ramadan 2024, it demands an insightful mix of respecting cultural diversity, embracing gastronomic imagination, and demonstrating entrepreneurial capacity. By tuning into the essence of Ramadan and fine-tuning your services to match distinct customer requirements during this sacred month can yield not only unforgettable dining moments but also cultivate enduring relationships in your community. The fasting period isn’t merely abstinence; restaurants too have a chance to add vibrancy by contributing joyousness and solidarity symbolic of this hallowed month. About eFunder If you are managing an enterprise and require financial support to boost your expansion .efforts, please do not hesitate to reach out to eFunder.ai by completing our inquiry form. We help businesses get access to funds that are essential for their business growth. Join us today: https://efunder.ai/get-started/

A Guide to Preparing Your Online Business for Ramadan 2024

Introduction When the time of Ramadan- one holy month – comes, online business has a golden chance to communicate with many different people and audiences interested. With the rise in digitization of trade, planning a Ramadan launch for eCommerce requires significant thinking and implementation. In this blog post, we will discuss important points that need to be considered if your online business is prepared for the consumer’s requirement of demand during such an eventful time. Understand your audience First, know your audience. Find cultural and religious components of Ramadan as well as behavioral attitudes to your future clients. This cognizance, in turn, will guide your marketing plan and allow you to create relevant content for this season. Optimize your website Make certain that your eCommerce site is user-friendly and built for a smooth shopping process. Test the workability of your website across various devices and browsers so as to target a great number of users. User satisfaction may be improved by introducing wish lists, navigational ease, and prompt checkout mechanisms. Stock up on relevant products Indicate the products that are popular during Ramadan. This can include traditional dishes, seasonal attires, and other items associated with the celebration. Stock up on inventory to meet the rising demand, and also provide unique Ramadan-themed products that will attract more customers. Create special offers and promotions Honor the spirit of Ramadan by offering discounts, promotional offers, and special deals. Similar to products or provide free shipping discounts to attract customers. Tag these promotions clearly on your website as well as across all marketing channels. Implement a content marketing strategy Create a content marketing plan based on the holiday of Ramadan. Focus on the creation of blog posts, social media content, and email campaigns that provide useful information related to your products as well as appeal to an emotional side that is inherent in a particular season. Appeal to your audience by using Ramadan-related content. Enhance customer support It is essential to have effective customer care when there are more customers active. Make sure that your customer support team is prepared to answer queries, attend to grievances, and provide timely help. To consider extending customer support hours to busy periods. Mobile optimization As mobile users are all over the place, make sure your eCommerce platform is optimized for them. A website that is mobile-friendly allows buyers to scroll through it and buy using a smartphone, which matters greatly in the months when they may be traveling. Social responsibility initiatives By linking your brand with social responsibility initiatives, engage the audience. Try running charitable initiatives, helping out local areas, or cooperating with charity organizations. This not only builds a positive brand image but also reflects the values of Ramadan. Conclusion Preparation must be based on a comprehensive approach taking into account the cultural, religious, and social dimensions of Ramadan to facilitate its preparation for business activity online. By comprehending your audience, working on the optimization of your website, and linking up with social responsibility initiatives, you need to engage them. Attempts to conduct charity, helping local neighborhoods, or collaborations with charitable organizations. First of all, this creates a good brand image but also characterizes the values of Ramadan concerning product offerings and advertising promotion. Spirit of Ramadan should be embraced and the online business has to become a banner for premium, ease, quality as well culture conscious. About eFunder If you are managing an enterprise and require financial support to boost your expansion efforts, please do not hesitate to reach out to eFunder.ai by completing our inquiry form. We help businesses get access to funds that are essential for their business growth. These are fine, just make sure there is the call to action links in the posts to visit the website and in the blog itself to fill the eFunder forms. Join us today: https://efunder.ai/get-started/

Steps to Set Up an eCommerce Business in Saudi Arabia in 2024

Today, Saudi Arabia has grown to become one of the most thriving hubs for eCommerce with a lot of opportunities for an entrepreneur that wants to be there firmly. With the technologically savvy population and authorities who are willing to develop the digital economy, 2024 is going to become one of the favorable years for those seeking their foothold on the eCommerce turf within this region. This will be a guideline for business-critical paths which are vital in the initial stages of a new eCommerce operation in Saudi Arabia leveraging its fast-developing arena. Market Research and Target Audience Analysis Conduct thorough market research and kick-start your digital commerce journey in Saudi Arabia. Know the likes of the local buyers, their culture, and who else is competing for your customers. Identify your niche market and tailor your offerings to meet the specific needs and desires of your target clients. Hence, this preparatory act will form the foundation of an efficient break into the Saudi marketplace. Legal Compliance and Business Registration Knowing the legal requirements for eCommerce projects in Saudi Arabia is important as this will help to comply with the regulatory framework set in place. Registration of a business with the appropriate state authorities, licenses, and permits are obligatory actions. This is a crucial step towards strengthening the trust of customers and governmental agencies in your business’ honesty. Legal formalities: Business name: Reserve a name compliant with Saudi regulations. Commercial register: Obtain an Electronic Commercial Register (ECR) through the Ministry of Investment (MISA). Maroof registration: Register on the "Maroof" platform for online business activities. Licenses: Depending on your business model and activities, you might need additional licenses like the SAGIA investment license. Localize Your eCommerce Platform Alter your eCommerce setup to suit the local users and their needs. It entails using Arabic content, selling it in SARs, and enabling commonly used local payment channels like Mada or Mada Pay. Localizing does not end in language and currency– one should consider customizing product specifics, graphics, and adverts that make sense for a typical Arab customer from Saudi Arabia. Secure Payment Gateways and Logistics Partnerships Incorporate strong and commonly used payment mechanisms suitable for consumers in Saudi Arabia. Develop relationships with reliable transport and logistic companies for smooth supply chain management. It is important because the Saudis value reliability and convenience when making purchasing decisions for consumer satisfaction. Mobile Optimization and App Development In light of the dense abundance of smartphone usage within Saudi Arabia, it's crucial to maximize efficacy and usability for your eCommerce site on mobile platforms. It may also be worth contemplating constructing a specialized mobile application that augments shopping interactions for clients. A well-crafted, easily navigable app could play an influential role in retaining customers and cultivating their devotion. Digital Marketing and Social Media Engagement Devise an effective internet-based advertisement strategy that will help enhance recognition of your brand and consequently increase traffic to your eCommerce website. Use popular social networking sites such as Instagram, Twitter, and Snapchat which have high usage within Saudi Arabia. This includes tailored efforts such as working with influential partners, and special promotional campaigns directed at establishing a strong online presence of the firm. Customer Support and Localization of Services Dedicate resources to competent customer support services that fit into the Saudi context. Offer customer services in Arabic and provide fast responses to issues addressed by clients. Additionally, consider employing local sales, discounts, or events as a means to cultivate a direct link between your company and the general population while fostering the community spirit of your brand. Resources: Ministry of Investment (MISA): https://misa.gov.sa/en/ Maroof platform: http://maroof.com/ Saudi General Investment Authority (SAGIA): https://misa.gov.sa/ar/ General Authority for Small and Medium Enterprises(Monsha'at): http://www.monshaat.gov.sa/ Conclusion Establishing an online trade industry in Saudi Arabia by 2024 brings about myriad possibilities for expansion and triumph. Knowledge of the regional market, compliance with legal regulations, and tailoring your strategy to please the taste of Saudi customers will place your company on a pathway to prosperous advancement within this thriving environment for eCommerce. As you commence this endeavor, remain flexible and incorporate innovation as needed, geared up to leverage positively from the constantly changing dynamism characterizing the commercial scene that is internet-based commerce in Saudi Arabia. About eFunder If you're managing an enterprise and require financial support to boost your expansion efforts, please do not hesitate to reach out to eFunder.ai by completing our inquiry form. We help a business get access to funds that are essential for their business growth.

Online Business Growth Ideas and Trends to look out for in 2024

Introduction In the advent of 2024, proprietors of online marketplaces encounter exceptional prospects for company enhancement in an ever-changing virtual environment. In this fast-paced digital age staying apace is key to achieving victories. The moment has arrived now to probe into predicted developments and innovative concepts projected to boost online business growth during this year while sharing practical tips businesses can utilize these trends. AI-Powered Customer Experiences In 2024, companies will exploit Artificial Intelligence (AI) to transform customer interactions radically. There's a growing trend among enterprises towards employing AI for enhancing user experiences via tailored recommendations, chatbots, and forward-looking analytics. The utilization of AI enables task automation, comprehensive insights into clients' behaviors, and the delivery of customized solutions—these result in superior consumer satisfaction levels alongside higher conversion figures. An impressive statistic reveals that about 91% of consumers show an increased propensity toward purchasing from brands dishing out personalized encounters (Accenture). E-Commerce and Online businesses are well poised to take advantage of these AI based tools to enhance their customer experiences and communications. Pro Tip: Incorporating tools powered through artificial intelligence into your website or within your clientele care platforms can offer a bespoke experience combined with simplified processes which ultimately escalates client involvement considerably Sustainability in eCommerce As awareness of environmental responsibility increases, buyers are putting heightened value on sustainable ways. Internet-based or Online businesses that adopt green policies like utilizing recycled packaging and encouraging eco-friendly sourcing have the potential to lure an expanding clientele. Incorporating sustainability into your company's identity can foster trust and dedication among consumers aware of their surroundings' well-being. Projections indicate that the global market for sustainable packaging will hit $244.9 billion by 2028 (Grand View Research). In 2024, web-enabled enterprises will make a shift towards ecological protection with an emphasis on friendly practices along their supply chain. Pro tip: Assess your business operations including supplier Interfaces to identify areas where you could introduce ecologically responsible initiatives in practice; transparently promote these efforts aligning them with conscientious customers. Livestream Shopping Experiences Live stream shopping has surged in popularity and this inclination is predicted to rocket sky-high by 2024. This participatory version of online business allows companies to interact with their patrons on an instantaneous basis, exhibit wares, and clear doubts. By employing live streams, digital businesses have the power to engender urgency sensation amongst customers and persuade engagement, resulting in immediate purchases. Pro tip: Tinker around with broadcasting real-time product releases; revealing what goes on behind the scenes. Also, consider question-answer interactive sessions as these can forge a genuine bond between you and your audience which aids in cultivating trust and loyalty. Blockchain for Enhanced Security and Transparency In an age where safeguarding information is significant, it's anticipated that blockchain technology will be integral to upholding secure exchanges and clear supply chains. Deploying this kind of intricate tech in web-based ventures can foster confidence among clients by offering a checkable and unmodifiable archive of dealings. Pro tip: Look into options for using the power of blockchain solutions as a method to intensify safety measures on digital transactions while securing client data - thereby setting your venture apart as one seen with dependability within the electronic sphere. Augmented Reality (AR) for Virtual Shopping Experiences Are you aware that the Augmented Reality sector is projected to skyrocket to $366.1 billion by 2025, as per Grand View Research? By 2024, industries flawlessly implementing AR and VR will likely establish an innovative benchmark for immersive retailing environments. There's a wave of revolution ahead in online marketing scenarios with AR facilitating virtual trials before actually purchasing products. This technology aims at decrucifying customers' shopping journey virtually while diminishing doubts & amplifies trust towards their acquisition choices. Pro tip: To craft an engaging buying experience merge augmented reality features within your digital platform be it a website or mobile application enabling users to visualize clothing items accessories or even furniture before making a decision. Conclusion As we delve into the future of online business in 2024, embracing these trends and ideas can propel your business to new heights. Whether through AI-powered interactions, sustainable practices, livestream shopping, blockchain security, or augmented reality experiences, staying innovative is key to maintaining a competitive edge. By aligning your business with these trends, you not only cater to evolving consumer preferences but also set the stage for sustained growth and success in the digital marketplace. About eFunder If you're managing an enterprise and require financial support to boost your expansion efforts, please do not hesitate to reach out to eFunder.ai by completing our inquiry form. We help a business get access to funds that are essential for their business growth. Join us today: https://efunder.ai/get-started/

Tips for eCommerce Sellers to Prepare for the New Year

The conclusion of the year denotes a chance for merchants in the eCommerce industry, irrespective of whether they run their own web store or vend on Amazon, to get ready for the advantageous possibilities that the upcoming year offers. The objective of this piece is to furnish valuable details on necessary enhancements, user-friendly tools, and helpful guidance to aid you in optimizing your accomplishments in the constantly evolving realm of online retail. Revitalize your product listings In order to commence the New Year with a profitable outlook, it is imperative to undertake a thorough assessment of your commodities listings. Ensure that your product portrayals, imagery, and charges are up-to-date. Similarly, consider highlighting any distinct promotions, price markdowns, or product packages intended to attract acquainted customers. Address the management of inventory It is imperative to thoroughly examine your stock to guarantee adequate readiness for the possible increase in customer demand that may occur both during the festive season and at the onset of the New Year. It is advisable to contemplate carrying out a comprehensive assessment of your inventory towards the end of the year in order to detect any products that require replenishment or removal. Enhance the quality of your website or online eCommerce store When managing an eCommerce platform, it is crucial to enhance the appearance of your website. It is imperative to guarantee that it is user-friendly, adaptable to various devices, and capable of accommodating higher volumes of visitors. For individuals selling on platforms like Amazon, it is advisable to improve the content and visuals of your product listings by incorporating appropriate keywords and top-notch images in order to amplify your online presence. Social media engagement Utilize the influence of social media to showcase your promotional offers for the New Year and establish a connection with your target audience. Create compelling content that effectively captures the essence of New Year's celebrations and contemplate the option of running social media advertisements to broaden your outreach. Present New Year's specials To entice customers during the New Year, captivate their attention with exceptional deals and promotions. These offerings can encompass extraordinary packages, enticing discounts, or exclusive loyalty rewards that serve as an added incentive for customers to remain loyal to your brand. By providing these exclusive benefits, you are not only attracting new customers but also strengthening relationships with existing ones. Revise and enhance your shipping and fulfillment approach Given the growing number of individuals engaging in online shopping, it is imperative to establish a dependable strategy for shipping and fulfillment. It is advisable to contemplate providing expedited shipping alternatives for customers who make last-minute purchases and evaluating your shipping expenses in order to maintain competitiveness. Take up funding for the betterment of business As eCommerce enterprises progress, there is an ongoing requirement for financial resources to enhance the effectiveness and productivity of these businesses. Additionally, it is crucial for eCommerce merchants to actively engage in monitoring their business analytics and finances during the holiday season in order to offer superior products and services to customers who are generating excitement through their purchases. To fulfill these needs, sellers should contemplate utilizing platforms such as eFunder.ai to promptly obtain the necessary funding that will assist in fortifying their business operations. Click here to create your eFunder account today! Conclusion The preparation for the upcoming year as an eCommerce merchant involves various aspects that demand a blend of enhancements, resources, and approaches. Through effective organization, refining your product listings, utilizing data insights, and delivering exceptional customer service, you can position your eCommerce business for success in the approaching year. Embrace the possibilities that the New Year offers and witness the growth and success of your online shops or eCommerce stores like Amazon and Noon; so, there you have a way to a prosperous and gratifying year ahead! About eFunder.ai If you're managing an enterprise and require financial support to boost your expansion efforts, please do not hesitate to reach out to eFunder.ai. by completing our inquiry form. We help a business get access to funds that are essential for their business growth.

Restaurant Owner’s Guide to New Year Preparation

With the close of the year and New Year's Eve approaching, restaurant owners should prepare for one of the biggest events in the restaurant business – the New Year's feast. At the stroke of midnight, people will be looking for an appropriate eating place to usher in the new year with delicacies, good friends, and a jubilant mood. This manual will help your restaurant fully prepare to host a memorable New Year’s Eve party. With the closing days in the year remaining, the anticipation for the New Year starts getting exciting. Restaurant owners must prepare themselves for some of the most exciting events in hospitality, especially ones with a lot of revenue-generating potential. At midnight, people will seek an attractive place to start a New Year with nice food, company, and entertainment. Below is the detailed guideline that will prepare your restaurant for memorable New Year's Eve celebrations. Develop an alluring menu Create a compelling menu for New Year’s Eve to attract your customers. Create an element of sophistication by blending your renowned dishes with innovative creations. Consider offering tasting menus, wine pairings or theme-based cocktails. Get people excited about your menu by emphasizing it on your website and many social media accounts. Come up with an appealing cuisine for New Year which will attract their target customers. Mix your famous cuisines with new masterpieces that give elegance and grandeur to the event. Think of offering tasting menus, wine matches or thematic drinks. Make sure that you emphasize your menu on your website, as well as other social media channels to create some buzz beforehand. Arrange captivating entertainment You can upgrade all your New Year’s parties with live musical performances, professional DJs or just a real-time countdown. Invest in entertainment that is relevant to your target market and also set a good mood, generally. Such entertainment will attract people to prolong their stay and experience fullness in the festivities. Marketing and promotions Start your marketing and promotions early by undertaking full marketing of your New Year’s party on different platforms. Arouse expectations using social media, email marketing, and your restaurant’s official website. Interact with your customers and encourage them to book early. It’s time to take advantage of the prospects in Internet advertising for wider coverage. You can use Mailchimp to send marketing emails to potential or recurring customers, to let them know about the event so that they mark it in their calendars. On the other hand, you can also make creative posts from Canva to help you get attracted with influencer marketing as well. Offer exclusive packages Offer unique, specialized New Year’s packages with a specific target audience in mind. They include luxury dining, champagne toast, fun party favours, and a lot more. These options are exclusive and by providing them, you will boost the revenue of each client while at the same time making your patrons feel recognized. Effective staffing and scheduling Staffing is appropriate for the smooth running of services during this busy night. It is necessary to carefully prepare the schedule in advance and give additional training to employees to be able to cope with the increased load. It could also involve the use of temporary workers to fill in for any shortfalls and take care of more tasks. To help you do the same seamlessly you can utilize tools like Restaurant 365 or Zoomshift. Promoting safety and responsible Service Safety is of utmost importance during New Year's Eve festivities, as alcohol consumption tends to be prevalent. It is imperative to prioritize safety by ensuring that your staff is knowledgeable in responsible alcohol service. Additionally, it would be wise to explore transportation alternatives such as collaborating with local taxi services or ride-sharing companies. This will guarantee that your guests reach their homes safely. Efficient reservation system For a ticketed event to welcome the New Year at a dining hall, ensure you put your ticket reservation process in order such that it is simple and efficient. Inform your guests of what to expect, including the price, inclusions, and limits. You can effectively use Touchbistro or Lightspeed to take bookings in a seamless manner. Managing your Financing Monitor your financials as New Year can get very busy for restaurants both for your physical footfalls and for online sales as families spend quality time together through family dinners or with friends without the hassle of cooking. Seek out support from restaurant financing platforms like eFunder and create your account today to maintain your cash balance without any worries as you enter the New Year. Conclusion The organization of a perfect New Year’s Eve party is not merely a ceremony marking fresh beginnings. On the contrary, it entails constructing an outstanding experience that will be imprinted in the minds of customers and keep them coming back for decades. Taking care of thoughtful preparation with interesting decorations performing efficient market, security and goodwill will turn out to be a successful evening. This will be followed by the successful year to come. Start now, getting ready to amaze on an exuberant New Year’s Day at your restaurant. About eFunder.ai If you're managing an enterprise and require financial support to boost your expansion efforts, please do not hesitate to reach out to eFunder.ai by completing our inquiry form. We help a business get access to funds that are essential for their business growth.

How to supercharge your online sales performance?

In our ever-evolving digital age, merely having an online presence is no longer enough. The success of a brand is increasingly reliant on its ability to supercharge its online sales performance. Whether you’re a startup or an established brand, optimizing your online sales strategy can significantly boost your bottom line. With tools like Stripe, Tap, Tabby, eFunder.ai, and JungleScout.com at your fingertips, here's how you can elevate your sales game. Understand your audience Knowing about your audience is the key to success because ultimately you are serving your audience and they should be satisfied with it. It’s a simple math: if you know them better, you serve them better. Segment your market Classify your audience based on demographics, preferences, behaviors, and other criteria. Tailored strategies for each segment can drive better conversion rates. Dive deep into customer behavior Gain a better understanding of your audience's preferences, buying habits, and feedback. Personalize your offerings Customize your products, services, and marketing efforts to resonate more effectively with different segments. Optimize your payment options It is important to simplify transactions. Offering multiple, user-friendly payment gateways like Stripe and Tap ensures a smoother transaction process. A simple and secure checkout experience can significantly reduce cart abandonment rates. Some impeccable tools Here are some of the most useful tools available to boost your sales performance. Stripe Stripe is a well-known company that is highly regarded in the worldwide business sector. It provides a dependable and effective payment processing platform that empowers online businesses to provide secure and user-friendly payment options. Stripe supports various payment methods, including credit cards, debit cards, ACH payments, and different international choices. Furthermore, with the same it incorporates the analytics tool known as Jungle Scout for eCommerce website owners to understand their sales reports and analyze their profit productions. Stripe provides a wide variety of financing options, which is a noteworthy feature. This specific ability allows merchants to offer their customers the choice of paying in manageable installments, thereby increasing their ability to make purchases. By giving customers more flexibility, businesses can significantly increase their conversion rates and improve the average order value, leading to better sales performance. Tap Another significant contender in the eCommerce payment processing industry is Tap. It is highly respected for delivering a smooth and safe purchasing process for customers visiting your online store. With its ability to accommodate various payment options, Tap is an outstanding selection for global eCommerce enterprises. Tabby Introducing payment solutions like "Buy Now, Pay Later" with Tabby can attract a wider audience, including those hesitant about upfront payments. This solution easily integrates into your website and checkout system, enabling customers to buy products and pay for them in convenient installments. The option of "purchase now, pay later" is especially attractive to customers who may not have the complete amount of money right away but are still enthusiastic about making a purchase. By providing this flexibility, you can draw in more customers and greatly increase your sales performance. Leverage advanced tools for market research There are some advanced tools that can help you understand the market so that you can build foolproof business strategies. Junglescout.com Before launching new products, use Junglescout.com. This platform helps brands identify trends, understand competition, and determine the potential of products in the online marketplace. eFunder.ai eFunder.ai is a leading digital financial platform specifically created to assist eCommerce enterprises that are small or medium-sized to assist them with instant cash and consistent cash flow proportionate to their receivables. Its distinguishing feature lies in its ability to offer financing and working capital solutions, supplying funds to eCommerce businesses. With this financial support, businesses can make investments in expansion and inventory without the need to wait for revenue accumulation. This helps boost the sales of eCommerce websites In addition, eFunder.ai offers advanced payment gateway functionalities, ensuring smooth integration with your online business platform. This characteristic ensures safe and effective transactions, simplifying the payment procedure and enhancing the financial liquidity of your company. Engage customers with high-quality content Customer engagement cannot be ignored in developing businesses. The more you interact with clients the more trust you build for your brand or company. Educational Webinars & Live Demos: Hosting webinars and using platforms like eFunder.ai to create and distribute valuable content can drive significant engagement. User Stories & Testimonials: Share stories of real users. Potential customers often trust peer reviews and testimonials more than brand advertisements. Email Marketing: Collaborate with platforms Mailchimp or Elastic Email that integrate seamlessly with Stripe or Tap, ensuring a cohesive retargeting strategy across all touchpoints. Conclusion To enhance your online sales performance on independent eCommerce websites, it is recommended that you incorporate sophisticated tools and functionalities like Stripe, Tap, eFunder.ai, and Tabby. These tools offer financing choices, deferred payment plans, and advanced payment gateway capabilities that cater to a wide range of customers, enhance conversion rates, and elevate the overall shopping experience. By staying at the forefront of these state-of-the-art technologies, you can guarantee the success of your eCommerce business in a progressively competitive marketplace. About eFunder.ai eFunder.ai is the most promising digital financing solutions partner for SMEs. With us, enterprises enjoy financial freedom because we get them instant working capital and can clear all payments. By partnering with us, you focus utterly on your business expansion and other essential tasks. Leave all financial hassles on us and your business can sail through the market successfully.

How to Set up a Seller’s Noon Account

The prevalence of technology has seamlessly incorporated electronic commerce into our daily routines, utilizing the internet as a gateway to virtual marketplaces. This provides us with the advantages of ease and accessibility, an extensive array of merchandise, and cost-effective pricing. A notable example exemplifying this occurrence is Noon, a recognized Middle Eastern eCommerce brand. When delving into the realm of internet selling, the first undertaking is to establish your Seller Noon account. In this instructional manual, we will act as your guide on this venture by furnishing explicit guidance on how to form your own Noon account and commence selling online. With the same, it is essential to understand that there are certain requirements for sellers to fulfil before setting up an account on Noon which are as follows: The seller’s business should be a locally owner business venture. Further, non-locals with an active local partner or a business owned or managed by a non-local family member with a local husband/wife are also allowed to register as a seller on Noon. Small to medium business owners with annual revenue of less than 350,000 AED are allowed to register. The seller should have an active trade license with any sort of ‘trade’ stated on the documents. The seller should have an active commercial bank account. If you fit in the above categories then follow the next steps to start setting up your seller account on Noon. Step-1: Open the Noon website and Register To begin, it is important to take the initial step of launching your internet browser on the appropriate partner account, click here in order to register as a seller on Noon. Upon arrival at the Noon homepage for partner registration, users will immediately notice a prominent button labeled ‘Sign Up’ or ‘Register’. Select the method that aligns with your preferences and proceed by clicking on it. Step-2: Complete Your Information Regardless of the method you select to sign up, you will be required to provide certain personal information in order to establish your Noon account. Typically, this entails supplying the following details and documents: Name Email address Phone number Trading License/Commercial Registration Residence Visa (for Non-Nationals) Emirates ID VAT Certificate or Non-VAT declaration Bank Details in the form of a cancelled cheque/bank statement/letter on the bank’s letterhead Tax Card (only required for Egypt-based sellers) Step-3: Verification To ensure the precision of your contact details, Noon may request that you authenticate your email address or phone number. In the event that you provided your email, kindly review your inbox for a verification message sent by Noon. Proceed to click on the link enclosed within the email in order to validate your email address. Alternatively, in the event that you have selected your phone number, please remain vigilant for a verification code sent via SMS. Proceed to input the received code into the designated box to complete the verification procedure. Step-4: Contact your relationship manager In order to enhance the individualization of your selling encounter, Noon would be provided a relationship manager who would guide you through your selling experience and onboarding requirements. Once, the same is done, you can start selling online with Noon and discover the world of online selling in one place. Conclusion Creating a Noon account opens the door to a myriad of retail selling options and convenience. With an interface that is easy to navigate, transactions that are secure, and an extensive customer base. By following the instructions provided in this manual, you will be on track to experiencing the advantages of online selling on Noon. Set up your account now! About eFunder.ai If you're managing an online retail enterprise and require financial support to boost your expansion efforts, please do not hesitate to reach out to eFunder.ai by completing our inquiry form. We help a business get access to funds that are essential for their business growth.

A Step-by-Step guide to starting your own restaurant on Talabat

IntroductionCommencing your culinary venture via Talabat is a thrilling pursuit that guarantees promising prospects. Talabat has established itself as the preferred avenue for food delivery and dining services, catering to a vast audience and fostering expansion opportunities.In this guide, we will go through a step-by-step process to walk you through the procedure of starting your restaurant on Talabat.Step 1: Business PlanIn order to initiate your restaurant venture, it is imperative to develop a sturdy business plan as the foundation. This comprises defining your restaurant's concept, target clientele, culinary offerings, pricing tactics, and unique selling propositions compared to competitors. A comprehensive blueprint of this nature not only brings clarity to your vision but also proves vital in securing financial assistance.Step 2: Necessary Obligations to fulfillAcquaint yourself with Talabat's criteria and benchmarks that necessitate fulfillment to enlist your restaurant on its platform. It is of utmost importance to comply with lawful and operational preconditions in order to avoid any hindrances during the initial phase. This constitutes the second step of the procedure.Step 3: Examination of CostingIn order to launch your restaurant, it is essential to carefully examine the initial costs involved in the process. These expenses include but are not limited to rent, equipment, employee salaries and benefits, licensing fees, marketing expenditures, and other associated costs. Conducting a thorough assessment of these expenses will provide you with an accurate estimation of the total funds required for starting your restaurant.Step 4: EnrolmentIn order to establish a reputable presence on Talabat, it is advised to follow below Steps of the process. The initial step involves enrolling yourself and your restaurant onto the Talabat platform and subsequently initiating the registration procedure. It is essential that all vital information regarding your restaurant such as its name, location, menu items, captivating images, and contact details are provided accurately during the registration process. Go to the Talabat Partner website https://ae.partner.talabat.com/s/ and click on the " Get Started " button. Fill out the online form with your restaurant's information, including its name, address, phone number, and website. Upload a copy of your restaurant's trade license and other required documents. Create a password for your account. Click on the "Submit" button to complete your registration.Once your registration is approved, you will be able to log in to your Talabat Partner account and start adding your food items to the platform. To do this: Go to the "Menu" section of your account and click on the "Add New Item" button. Enter the name, description, and price of your food item. Upload a photo of your food item. Select the categories that your food item belongs to. Click on the "Save" button to add your food item to the menu. You can also use your Talabat Partner account to manage your orders, track your sales, and view your analytics.Additional tips for registering on a Talabat restaurant account: • Make sure that your restaurant's information is accurate and complete.• Upload high-quality photos of your food items.• Select the right categories for your food items.• Set competitive prices for your food items.• Offer special promotions and discounts to attract customers.Once your Talabat restaurant account is up and running, you can start selling food items to customers in your area. Talabat will take a commission on each order that you receive, but this is a great way to reach a wider audience and boost your sales. Step 5: Enhance visibilityThe sixth step involves enhancing your restaurant's visibility. Allow eFunder to address your financial requirements while you focus on advertising your establishment. Avail yourself of Talabat's marketing resources and techniques to attract customers. Utilize various social media channels to engage with your audience, introduce tempting promotions, and highlight the distinctive features of your restaurant in order to stand out in a highly competitive market.Step 6: Build a customer baseIn order to build a loyal customer base and improve the reputation of your restaurant, it is crucial to prioritize delivering exceptional service as soon as orders start coming in through Talabat. Maintaining consistency in terms of quality, timely deliveries, and creating pleasant customer experiences are all key factors that contribute towards achieving this goal.Step 7: ExpandStep eight of the business plan involves repaying the borrowed funds from eFunder and broadening your restaurant's scope. It is crucial to pay back the loan promptly as it establishes your business's trustworthiness and sets the stage for potential partnerships.Step 8: Partner with eFunderStep 8 entails establishing a collaborative alliance with eFunder to obtain financing for your restaurant. They specialize in providing expeditious financial assistance by using unsettled invoices. This particular stage is crucial for small and medium enterprises seeking to mitigate the economic burden associated with delayed customer payments. To conclude, pursuing the Talabat route for your restaurant business presents considerable opportunities. Nevertheless, aspiring business owners often encounter obstacles in obtaining sufficient funds for a seamless launch. eFunder specializes in expeditiously disbursing funds against pending invoices, affording a customized solution designed to aid SMEs seeking financial backing for growth purposes. FAQ Why choose Talabat for starting a restaurant?Talabat offers a vast user base and growth potential in the food industry. How important is a business plan for launching a restaurant on Talabat?A business plan is vital for clarity and securing financial support, outlining your concept, target audience, menu, pricing, and uniqueness. What criteria must you meet to list your restaurant on Talabat?Comply with Talabat's legal and operational requirements to avoid initial obstacles. How does eFunder.ai assist restaurant owners financially on Talabat?eFunder.ai provides quick financial help using unpaid invoices, easing cash flow challenges. How can you enhance your restaurant's visibility and reputation on Talabat?Focus on marketing, utilize Talabat's resources, engage on social media, offer promotions, and ensure consistent high-quality service.About eFunder.aiIf you're managing an online retail enterprise and require financial support to boost your expansion efforts, please do not hesitate to reach out to us by completing our inquiry form. If you are aware of anyone else who could benefit from our assistance, kindly direct them to us through an email sent to sales@efunder.ai, and as a gesture of our appreciation, you will be eligible to receive an AED 500 referral reward.

Maximizing Revenue Vs Profits Vs Cashflows

Efficient management of revenue, profits, and cash flows in the business realm can be likened to a highly intricate financial choreography. It is incumbent upon entrepreneurs to comprehend the nuances, disparities, and recommended methods for handling these fundamental components. The purpose of this blog is to elucidate on the concepts of revenue, profits, and cash flows but before the same let us understand the basic nuances of the same. Understanding revenue Revenue can be viewed as the echoing sounds that reverberate throughout an enterprise. It represents the total accumulation of earnings generated by merchandise or services, hence a powerful monetary force that establishes the foundation for a synchronized performance. Nevertheless, it is important to note that revenue only reflects the inflow prior to expenses being acknowledged. Understanding profits Profits, as per standard business belief, are the remaining income derived by deducting all costs involved in the production process such as materials, salaries of employees, taxes and other miscellaneous expenses from the total revenue generated. A careful examination of this measure can offer significant understanding into your organization's distribution of resources and overall financial progress. Understanding cashflow Cash flows exhibit the transfer of funds into and out of your enterprise during a specified time frame. This encompasses revenue, expenses, financial investments, and loan reimbursements. Observing cash flows facilitates comprehension of your firm's solvency and capacity to manage financial responsibilities. Striking a balance between revenue, profits, and cash flow Achieving equilibrium among revenue, profits, and cash flows is imperative for businesses. Although augmenting revenue is a desirable objective, placing exclusive emphasis on the top line might result in disregarding expenses and impacting overall profitability. Similarly, reducing costs excessively could jeopardize the quality of products or services provided by the company. In addition, steady cash flows play a vital role in carrying out day-to-day operations and coping with unforeseen financial challenges. It is highly recommended to follow specific established protocols for your enterprise, to ensure success while striking the balance between revenue, profits, and cash flow, which are as follows: An essential step involves gaining a thorough understanding of the financial landscape through scrutinizing financial records, closely monitoring expenditures, and examining trends in cash flow on a regular basis. By undertaking this measure, you can ascertain that your business sustains its financial stability. It is advisable to formulate a comprehensive pricing plan that considers the interests of prospective clients, while also factoring in costs and ensuring lucrative profit margins. It would be prudent to remain flexible and receptive to modifying prices in response to shifting market trends. Effective cost control is an indispensable component that propels triumph in the domain of organizational management. To attain this objective, it becomes imperative to recognize the fundamental areas where expenditures can be minimized without jeopardizing the benchmarks of quality. This objective can be accomplished by implementing diverse tactics such as assessing alternatives for cutting costs, bargaining more favorable conditions with vendors, and maximizing resource utilization. Anticipate upcoming cash inflows and outflows through an analysis of previous financial records and evaluation of current industry patterns. Employing this approach enhances readiness for possible obstacles and encourages cautious judgment. Expertly handling working capital is a pivotal corporate tactic that can be achieved through various avenues, including enhancing inventory management, extending payment periods, and expediting the collection of receivables. Upholding fiscal equilibrium and augmenting profitability mandates meticulous monitoring of working capital. The achievement of financial stability is crucial for the survival of any business in the face of unexpected expenses or economic instability. Therefore, it is essential to establish a financial cushion that can be utilized during challenging times to ensure the sustainability of your enterprise. This short but informative guide has shed some light on cash flow, revenue, or profit. Whatever could be your business objective, you need to optimize your business strategies accordingly and work toward the success. About eFunder.ai eFunder.ai is dedicated to delivering digital financing solutions specifically designed to enhance and expand the operations of SMEs. Utilizing the latest in integrated technology, we ensure a smooth and user-friendly experience for our clients. At eFunder.ai, we prioritize transparency, offering platforms that are not only robust but also adaptable and scalable. For further insights into our advancements or to explore digital lending opportunities, reach out to us at sales@efunder.ai.

How Data Analytics and Transparency can Leverage Growth?

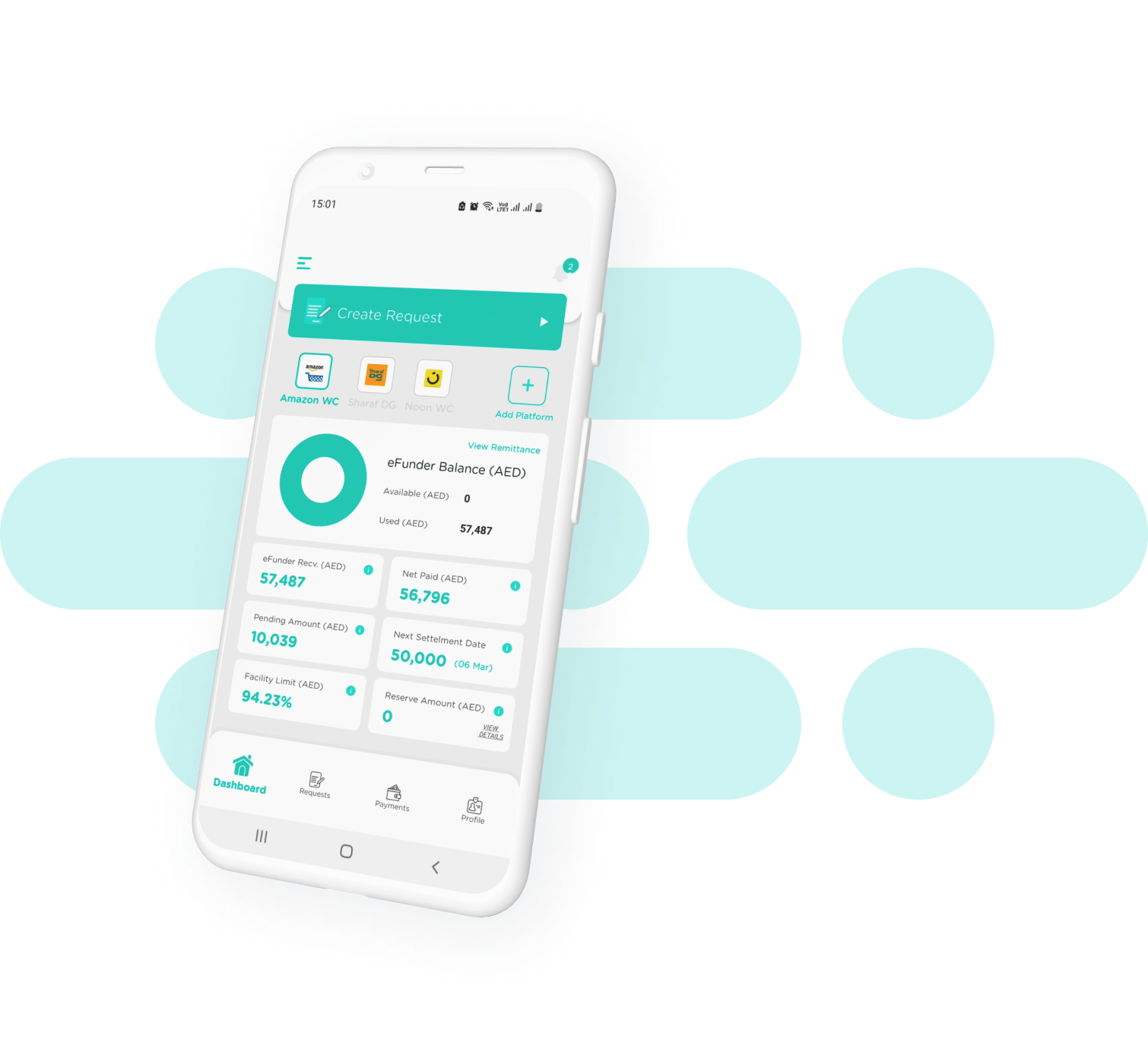

In the current age of digital advancement, enterprises that fall under the category of small and medium-sized businesses (SMBs) are exploring novel ways to grow their business and ensure its longevity. Business owners and entrepreneurs who aspire for sustainable expansion can rely on various inventive methodologies that utilize data analytics and transparency to revamp how businesses thrive, develop, and shape their future results. In this article, we will delve deeper into the aspect of how data analytics and transparency can leverage growth for various sorts of businesses. Understanding Data Analytics Data analytics is not merely a trendy term but a strategic methodology that endows enterprises with the ability to make well-informed decisions, refine operations and unveil concealed opportunities. Fundamentally, data analytics entails an organized analysis of unprocessed data to expose patterns, trends, and revelations that can facilitate strategic planning. It converts the act of decision-making into an empirical science thereby enabling businesses to react promptly and precisely to fluctuations in the market and customer conduct. The Types of Data That Foster Business Growth It is imperative for informed growth strategies that businesses utilize the copious amounts of data generated daily. Several essential types of data that facilitate business expansion are: Customer-behaviour data: Analysing customer behavior data can prove to be a beneficial factor in enhancing products and devising targeted marketing strategies. Understanding how customers engage with a business's offerings can provide valuable insights, which enable effective improvements and precise targeting efforts. Market trends data: Utilizing market trend information is imperative for businesses to adjust their offerings based on fluctuations in customer demand. This adaptability is necessary for sustaining the pertinence of your business. Operational Data: This type of data analytics is all about operational deficiencies that are streamlined in a business to attain better cost savings with optimum productivity. Financial data: Financial analytics holds immense value in guiding a business towards the allocation of budget to make prompt and prudent investment decisions while keeping in mind the potential risks of the same. Transparency and eFunder.ai: A transformative partnership By providing online sellers with real-time and transparent access to receivables data, eFunder establishes a mutually beneficial partnership that facilitates business expansion. Here are some of the reasons why eFunder.ai fosters transparency with data analytics: Trusted financing partner: As an esteemed financial institution, eFunder.ai has gained the recognition of a dependable financing partner that prioritizes transparency and informed decision-making. It has shown its commitment to different organizations by fostering long-lasting connections with clients. Paperless efficiency: eFunder's as a financial institution optimizes its operational efficiency with the implementation of paperless procedures and the incorporation of data analytics in its financial operations. Prompt onboarding: The eFunder.ai platform boasts a beneficial onboarding system that expeditiously facilitates a swift incorporation process. This well-organized system deducts all unnecessary bureaucratic procedures that allow businesses to promptly get on their journey toward expansion. Empowering business owners to scale with confidence Small business owners and individuals who undertake entrepreneurial ventures are frequently confronted with obstacles when it comes to sustaining steady progress. Nevertheless, eFunder.ai emerges as a significant strategic partnership by harnessing cutting-edge data analytics and transparent methodologies which enable the facilitation of expandable business operations. Instant cash: The expeditious provision of funds through same-day payments can provide prompt financial resources, addressing concerns regarding the availability of cash and maintaining operational stability. Consistent cash flow: Sustained liquidity is a vital necessity for enterprises to ensure stable cash flow and capitalize on expansion prospects without any hindrance. Such an objective can be accomplished by utilizing eFunder. Harnessing the power of data and transparency for growth The goal of eFunder.ai is based upon the convergence of transparency and data analytics to empower businesses. Through the provision of immediate access to cash and reliable cash flow linked with receivables, eFunder.ai aids growth-oriented initiatives by transforming challenges into opportunities. About eFunder eFunder.ai, an eminent digital financing platform exclusively committed to providing SMBs with quick access to funds and maintaining a stable cash flow by securing their receivables. The noteworthy factor behind eFunder's triumph is its impeccable integration of data analytics and transparency, two fundamental aspects that have the capability of bringing a revolution in how businesses expand and succeed in today's cut-throat environment. If you are an eCommerce business seeking financial support to boost your growth, we invite you to fill out our form and contact us at sales@efunder.ai. Know others who could benefit from our services? Refer them to us, and as a token of our gratitude, you'll receive an AED 500 bonus for each successful referral.

What are the requirements to get funding from eFunder.ai?